2026 Macroeconomic Outlook

"Gradual Recovery Expected for Domestic Economy"

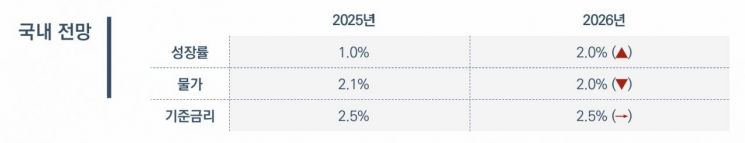

The Korea Capital Market Institute, a capital market think tank, has projected that South Korea's economic growth rate will reach 2.0% this year. The institute analyzed that, with exports driven by the IT and shipbuilding sectors and improvements in domestic demand, growth at the level of the potential growth rate can be expected. The base interest rate is expected to remain at 2.5% throughout the year.

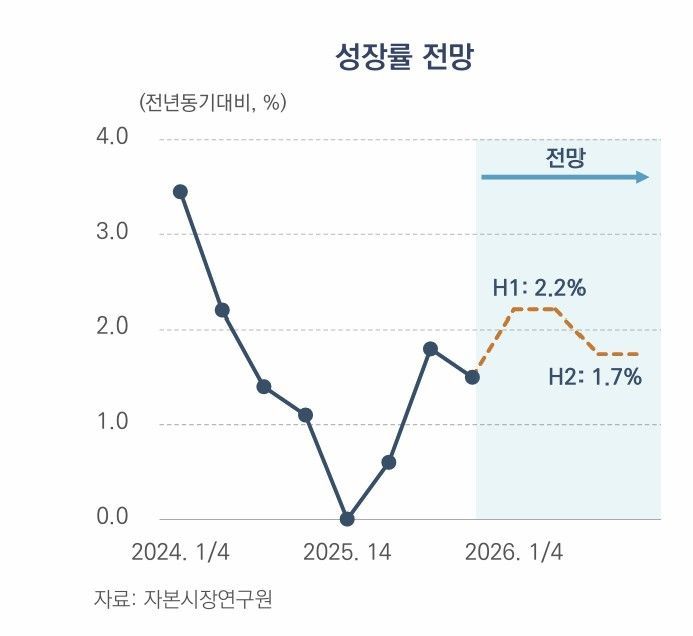

On January 27, the Korea Capital Market Institute held a seminar at the Yeouido Financial Investment Center under the theme "2026 Capital Market Outlook and Key Issues." Jang Boseong, Head of the Macroeconomic and Financial Division, who presented the "Macroeconomic Outlook," stated, "The domestic economy is expected to see a gradual recovery, with overall price stability being maintained." He added, "In 2026, the gross domestic product (GDP) is projected to grow by 2.0%." This is a clear improvement compared to last year's forecast of 1% growth. Specifically, growth is expected to be 2.2% in the first half and 1.7% in the second half of the year.

In terms of exports, the outlook suggests continued differentiation among major industries. While the IT and shipbuilding sectors are expected to perform well, the steel and petrochemical sectors are likely to face weaker external demand. For domestic demand, a modest recovery is anticipated as private consumption and construction investment improve. Jang explained, "Consumption conditions, such as income and consumer sentiment, are improving, and construction investment is expected to turn to growth due to existing order backlogs and the initiation of SOC projects."

The consumer price inflation rate is forecast at 2.0% for the year. Jang noted, "While service prices will act as an upward factor for inflation, the decline in international prices of key commodities such as crude oil is expected to keep inflation at a stable level." As private consumption improves, service prices are expected to rise at a somewhat higher rate, making a moderate increase inevitable. The price of personal services is estimated to continue rising at around 3%, similar to last year's level.

Additionally, the Korea Capital Market Institute expects the Bank of Korea to maintain the base interest rate at 2.5% this year. Jang stated, "Given economic conditions at the inflation target and potential growth rate levels, the base rate is likely to be managed at a neutral level," adding, "The average nominal neutral rate for 2026 is estimated to be around 2.5%." He explained, "The Bank of Korea will need to balance the need to sustain the economic recovery with financial stability and exchange rate risks," and predicted, "The rate will be maintained at the neutral level, with signals for possible adjustments after the second half of the year."

Key macroeconomic issues for this year include the long-term trend of the KRW-USD exchange rate and the trends in long-term interest rates in both the US and South Korea. Jang commented, "The recent rise in the exchange rate is the result of a combination of structural and cyclical factors," and added, "The downward pressure on the Korean won from cyclical factors is expected to gradually ease going forward." Factors such as the Bank of Japan's interest rate hikes, capital inflows related to World Government Bond Index (WGBI) inclusion, domestic economic recovery, and the potential slowdown in the US stock market rally are expected to have an impact.

He also stated, "The US long-term interest rate, based on the 10-year Treasury, is expected to fluctuate around the current level of 4%," and anticipated that "the domestic long-term interest rate (10-year) will also fluctuate at the current level." He continued, "If there is a sharp rise in interest rates and increased volatility, it is necessary to monitor the potential instability from private equity funds (bond leverage investments) and the possibility of a widening credit spread due to persistently high long-term rates."

Other upside and downside risk factors at home and abroad include, respectively: ▲ global AI investment expansion, improved current account conditions with China, an end to the war between Russia and Ukraine, and stronger consumer sentiment driven by a bullish stock market; and ▲ contraction of global AI investment, renewed uncertainty in US trade policy, heightened geopolitical risks, a deepening K-shaped recovery, and the transmission of negative effects.

Meanwhile, for the US economy, growth of 2.3% is expected this year, supported by increased investment in AI-related infrastructure and expanded tax benefits. In terms of monetary policy, the Federal Reserve is expected to consider both inflation and employment risks and implement additional easing at the level of a 0.25 percentage point cut.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.