Dunamu, the operator of digital asset exchange Upbit, announced on January 26 that a paper by its machine learning team was selected for the Demo Track at the international artificial intelligence conference 'Association for the Advancement of Artificial Intelligence (AAAI)' and was successfully demonstrated.

Celebrating its 40th anniversary this year, AAAI is a prestigious conference where artificial intelligence (AI) researchers from around the world present the latest technologies and research achievements. It is considered one of the world's top three AI conferences. The 2026 AAAI conference is being held at the Singapore Expo from January 20 to 27.

The Dunamu machine learning team's paper was selected for the highly competitive Demo Track. The Demo Track goes beyond theoretical presentations by requiring live demonstrations of working systems, assessing the practical effectiveness of the technology. This makes it particularly significant, as research results must be validated through real-world applications.

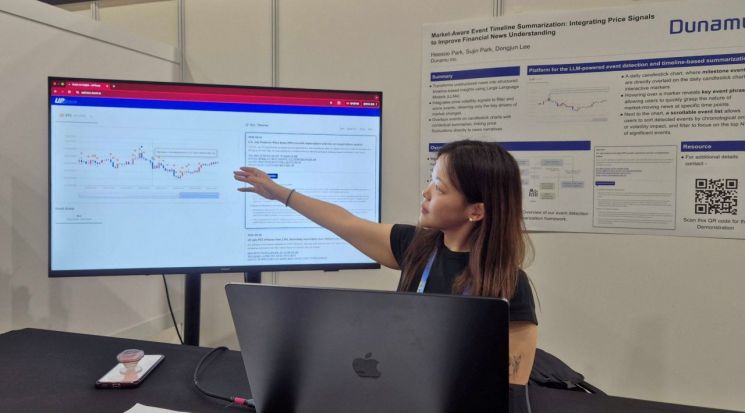

Park Heesoo, a researcher on Dunamu's machine learning team, presented the paper "Market-Aware Event Timeline Summarization: Integrating Price Signals to Improve Financial News Understanding" at the AAAI Demo Track and demonstrated Dunamu's proprietary system in person.

This research combines news data and fluctuation data from digital asset price charts to provide only the key news that caused price changes. Previously, it was difficult to identify the core news that actually influenced price movements amid the flood of information, and it was challenging to promptly determine the causes behind price fluctuations. To address this, Dunamu's machine learning team proposed a new modeling approach that integrates large language models (LLMs) with volatility indicators.

First, the system automatically extracts digital asset-related events from news feeds, then selects only those events that caused high price volatility. The LLM then summarizes each event and the background knowledge required to understand it, visualizing them in a timeline format alongside the chart. This helps investors intuitively understand the context behind chart movements.

Kim Daehyun, Chief Data Officer (CDO) of Dunamu, stated, "This AAAI presentation is significant not only because Dunamu's AI technology has received global academic recognition, but also because it has proven its practical value in resolving information asymmetry for investors. Going forward, we will continue to leverage AI technology to provide investors with more valuable information and contribute to greater market transparency."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)