Bank of Korea Releases Systemic Risk Survey Results

Seventy-five economic experts have identified the exchange rate as the greatest risk factor for South Korea's economy.

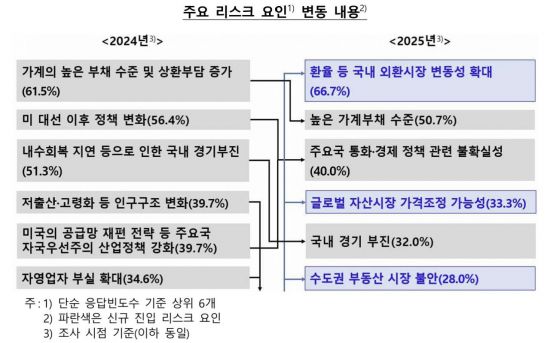

According to the "Systemic Risk Survey Results" released by the Bank of Korea on January 23, 75 domestic and international financial and economic experts cited "increased volatility in the domestic foreign exchange market, including the exchange rate" as the most significant internal risk factor for the domestic financial system, based on simple response frequency (66.7%).

This was followed by "high levels of household debt" at 50.7%, and uncertainty related to major countries' monetary and economic policies at 40%. Experts were asked to list the top five risk factors for Korea in order of importance.

When tallying the risk factors chosen as the top priority, internal factors such as "increased volatility in the domestic foreign exchange market, including the exchange rate" (26.7%) and "high levels of household debt" (16%) were more prevalent than external factors.

The Bank of Korea stated, "Compared to the 2024 survey, concerns over increased volatility in the foreign exchange and asset markets are more pronounced than structural vulnerabilities such as household debt and aging. The frequency of responses citing household debt as the greatest risk factor has been declining since the second half of 2023."

It is also notable that "increased volatility in the domestic foreign exchange market, including the exchange rate," "the possibility of a global asset market price adjustment" (33.3%), and "instability in the real estate market in the Seoul metropolitan area" (28%) have newly emerged as major risk factors.

In contrast, "changes in demographic structure such as low birth rates and aging" and "increased insolvency among the self-employed" were ranked relatively lower.

The increased volatility in the domestic foreign exchange market, including the exchange rate, is considered likely to materialize as a short-term risk within one year, while the high level of household debt is seen as a medium-term risk likely to materialize within one to three years.

The likelihood of a short-term shock that could undermine the stability of the financial system within one year has decreased compared to the previous survey. The proportion of respondents who answered "low" or "very low" was 41.3%, down from 43.6% in the 2024 survey. However, the proportion of those who answered "very high" or "high" also decreased from 15.4% to 12%.

The likelihood of a medium-term shock occurring within one to three years also declined compared to the previous survey.

Confidence in the stability of South Korea's financial system over the next three years has improved compared to the previous survey. The proportion of respondents who rated financial system stability as "very low" or "low" fell slightly from 5.1% to 4.0%, while those who rated it as "very high" or "high" rose from 50% to 54.7%.

The economic experts who participated in the survey called for enhanced risk management to prepare for both domestic and external uncertainties, as well as strengthening the credibility and predictability of policies to improve financial system stability.

They emphasized, "It is necessary to strengthen stabilization and monitoring of the foreign exchange and asset markets, and for policy authorities to communicate clearly and transparently." They added, "To manage household debt stably, a consistent policy mix should be implemented, and institutional improvements are needed to address structural vulnerabilities by borrower and sector. There is also a need to pursue orderly restructuring of marginal companies."

Meanwhile, this survey was conducted by the Bank of Korea from November to December last year, targeting a total of 87 domestic and international financial and economic experts from financial institutions, research institutes, universities, and overseas investment banks. Of these, 75 participated in the survey.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)