Recovering Illicit Gains from Illegal Medical Institutions with New Collection Techniques

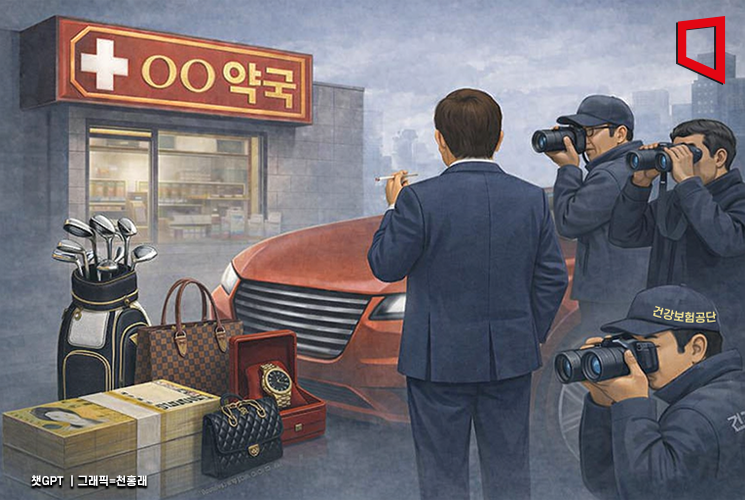

# Individual A, who is not a licensed pharmacist, was caught illegally establishing and operating a pharmacy (known as a "front pharmacy") by borrowing someone else's license, resulting in 7 billion won in unpaid dues. For the past seven years, A refused to answer reminder calls from the National Health Insurance Service (NHIS), thoroughly concealed their residence, and evaded compulsory collection efforts. After analyzing A's income and surrounding environment and conducting surveillance, the NHIS discovered that A was engaging in economic activities under another person's name and living a luxurious lifestyle, driving a foreign luxury car worth about 100 million won. The NHIS conducted a surprise search of A's residence, seizing cash and high-end home appliances, and ultimately secured A's agreement to make a lump-sum payment of 100 million won and monthly installments of 3 million won for the outstanding dues.

On January 23, the NHIS announced that last year it had conducted comprehensive collection activities targeting high-value and habitual delinquent payers, such as those involved in unauthorized hospitals and front pharmacies who deliberately conceal assets. As a result, a total of 19.1 billion won was collected.

Illegally established institutions focus solely on generating profit rather than protecting public health, negatively impacting the health insurance system. However, collection conditions are becoming increasingly challenging as delinquent payers cleverly conceal assets or use false addresses. To counter this, the NHIS operates a permanent "Special Task Force for the Collection of Illegally Established Institutions," responding to increasingly sophisticated concealment tactics.

In particular, the NHIS has introduced new collection methods, establishing a foundation for recovering approximately 1 billion won in unpaid dues. These methods include: ▲ seizing dormant bank accounts and court-held guarantee deposits that financial consumers have not claimed; ▲ seizing claims for medical expenses paid by private auto insurance companies; and ▲ swiftly seizing medical devices such as X-ray equipment from closed, illegally established medical institutions. By newly identifying claims that were previously difficult to access, the NHIS has expanded the scope of asset recovery and minimized blind spots in the retrieval of concealed assets.

Additionally, when assets are transferred to family members or acquaintances, the NHIS actively files civil lawsuits, such as actions to void fraudulent transfers, to recover hidden assets. Thanks to these efforts, the cumulative collection rate has risen from 8.3% at the end of 2024 to 8.8% at the end of 2025.

Going forward, the NHIS plans to intensify pressure on high-value delinquent payers by utilizing every available means, including public disclosure of personal information, providing credit information, and imposing travel bans. In particular, the agency aims to further advance its big data-based tracking system to fundamentally block the concealment of assets.

An NHIS official stated, "We will track down and collect all hidden assets to the very end," and urged, "Voluntary reports from the public are extremely helpful, so please check the list published on our website and actively provide information."

Meanwhile, the maximum reward for reporting concealed assets was raised from 2 billion won to 3 billion won as of last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.