Overcoming Seasonal Slump on the Back of MLCC Boom

Strong Outlook for Packaging Performance Including FC-BGA and Glass Substrates

Riding the wave of artificial intelligence (AI) proliferation, Samsung Electro-Mechanics has signaled a surprise earnings result, breaking the traditional off-season pattern. The company’s high-value-added strategy, spanning from semiconductor components such as multilayer ceramic capacitors (MLCCs) and flip-chip ball grid arrays (FC-BGAs) to automotive electronics, is credited for this performance.

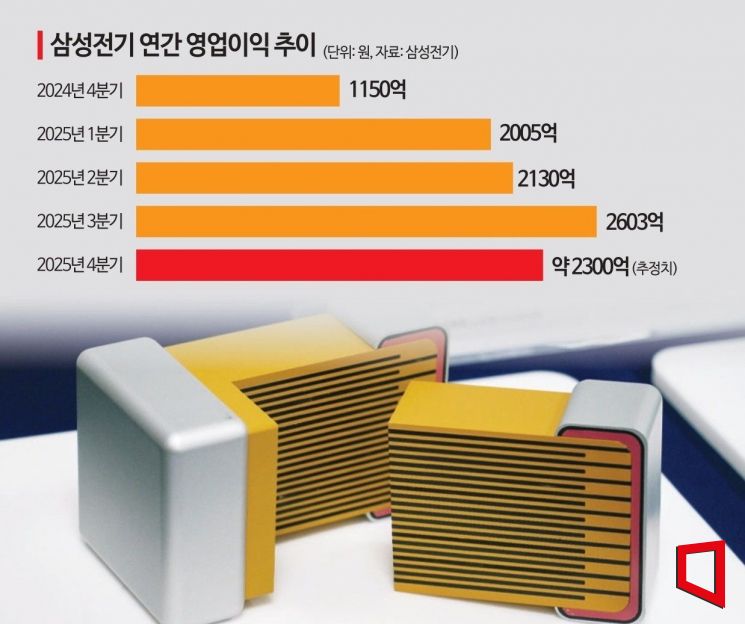

According to industry sources on January 23, Samsung Electro-Mechanics will announce its fourth-quarter results later today. Although the fourth quarter is typically considered a seasonal off-peak period, the company is expected to have posted operating profit nearly double that of previous years. According to the earnings consensus compiled by financial information provider FnGuide, sales are projected at 2.8405 trillion won, with operating profit at 228.4 billion won. Compared to the same period last year, this represents an increase of 14.0% in sales and 98.5% in operating profit.

The Component Solution Division, which is responsible for the flagship MLCC products, is expected to have contributed about 70% of the operating profit. As AI adoption has accelerated, Samsung Electro-Mechanics has expanded its supply of MLCCs-often called the “rice of the electronics industry”-from smartphones to AI servers and finished vehicles. The company is particularly strong in MLCCs for AI servers and advanced driver-assistance systems (ADAS), which require sophisticated technology. Since the number of MLCCs used per server in AI servers is about ten times higher than in general servers, the AI server market is experiencing the steepest growth. The spread of autonomous driving has also significantly increased the volume of automotive MLCCs, leading to a supplier-dominated market structure.

Reflecting brokerage forecasts, last year’s annual results are expected to show sales of 11.2527 trillion won and operating profit of 902.2 billion won. With the expansion of MLCC demand, there is a possibility that the company will make a surprise return to the “1 trillion won club.”

Samsung Electro-Mechanics’ MLCC production facilities are operating at an average utilization rate of 99%, effectively running at full capacity. The Tianjin plant in China focuses on automotive MLCCs, while the Philippines plant specializes in MLCCs for AI servers. In the first quarter of this year, the company will begin expanding its MLCC mass production line in the Philippines. Although Murata of Japan leads the overall market share, Samsung Electro-Mechanics is competing for leadership in key markets such as AI servers, which is cited as a reason for continued investment expansion.

The Package Solution Division, responsible for semiconductor package substrates, is also estimated to have recorded operating profit of around 40 billion won. This is attributed to rising demand for advanced FC-BGAs amid increased AI investment by major technology companies. Samsung Electro-Mechanics counts AMD and Apple among its major substrate customers and is reportedly achieving visible results in securing new customers and increasing volumes, particularly among North American tech giants.

FC-BGA is another product category significantly impacted by the spread of AI. Just a few years ago, more than half of FC-BGA supply was for PCs, but with changing AI demand, sales for data centers are expected to surge. At CES 2026 earlier this month, Samsung Electro-Mechanics President Jang Deokhyun expressed confidence that FC-BGA production lines would be running at full capacity starting in the second half of this year.

The successful supply track record of FC-BGA is also expected to positively influence the glass substrate market, which is considered a “game changer” for next-generation semiconductor packaging. Samsung Electro-Mechanics plans to begin mass production and supply of glass substrates starting next year. The industry believes that samples have already been supplied to AMD and Broadcom. Apple, which is developing application-specific integrated circuits (ASICs) with Broadcom, is also reportedly considering adopting glass substrates.

An industry insider commented, “As demand structures are being reorganized around AI servers and automotive electronics, the very foundation of Samsung Electro-Mechanics has changed,” adding, “This is a sign that the company is entering a phase of mid- to long-term growth, beyond short-term earnings improvement.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)