Bank of Korea Releases Preliminary Real GDP Figures for 2025 and Q4

South Korea's 2024 Economic Growth Rate at 1.0%... Q4 Contracts by 0.3%

Construction Sector Significantly Restrains Annual Growth, While Exports and Consumption Rise

Last year, South Korea's economic growth rate barely reached 1%. Weak construction investment significantly constrained overall growth, resulting in the lowest growth rate in five years since the COVID-19 pandemic. However, exports continued to increase, led by semiconductors, and consumption also showed signs of recovery due to improved sentiment and policy effects, which aligned with the annual forecasts of major institutions. In the fourth quarter of last year, the economy contracted by 0.3% as both sluggish construction investment and a slowdown in exports weighed on growth.

Hampered by Weak Construction, 'Barely 1%'... Lowest Growth Rate Since COVID-19

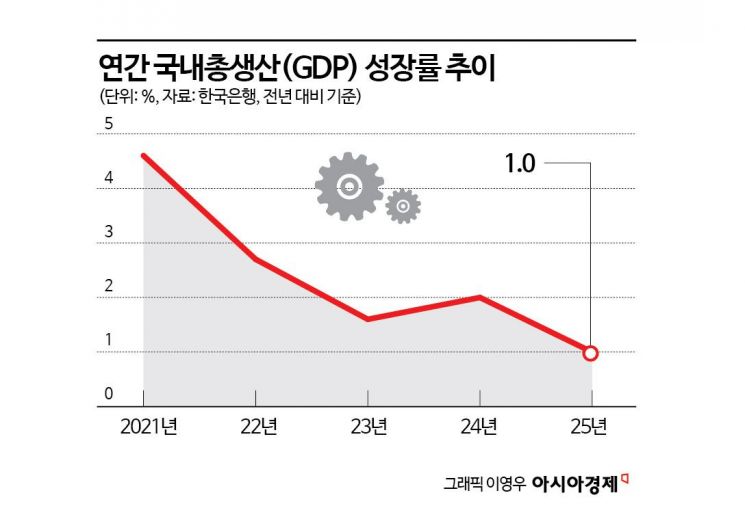

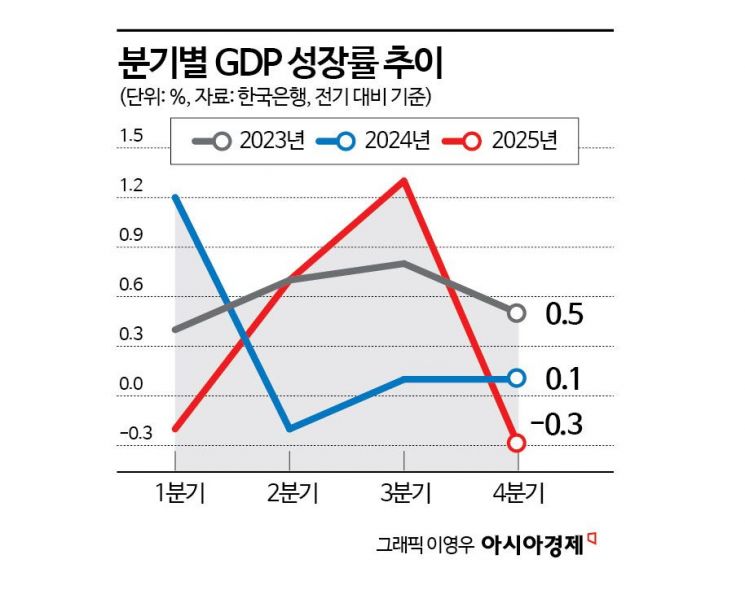

On January 22, the Bank of Korea announced that last year's real gross domestic product (GDP) growth rate (preliminary figure) was 1.0% compared to the previous year. This is in line with the 1.0% forecast presented by both the government and the Bank of Korea. After contracting by 0.2% in the first quarter due to the aftermath of emergency martial law, the growth rate rebounded quickly to 0.7% in the second quarter and 1.3% in the third quarter, but a lack of momentum in the fourth quarter (-0.3%) meant that the economy managed to achieve only 1% growth. Persistent weakness in construction investment since 2021 has been a major drag, causing last year's growth rate to be halved compared to the previous year (2024), when it was 2.0%.

Last year's growth rate was the lowest in five years, since 2020 (-0.7%), when the economy contracted annually due to the impact of COVID-19. South Korea's economic growth rate had declined for three consecutive years: 4.6% in 2021, 2.7% in 2022, and 1.6% in 2023. It rebounded to 2.0% in 2024, but fell back again last year.

Although the slump in construction investment dragged down the growth rate, increased exports and consumption helped cushion the decline. The growth rate of private consumption rose from 1.1% in 2024 to 1.3% last year. Government consumption also saw a significant increase, rising from 2.1% to 2.8%. Facility investment increased from 1.7% to 2.0%. In contrast, construction investment plummeted from -3.3% to -9.9% during the same period. Lee Dongwon, Director General of Economic Statistics Department 2 at the Bank of Korea, commented, "If construction, which significantly constrained growth, had been neutral to growth, the annual growth rate would have been 2.4%."

Exports increased by 4.1% compared to the previous year, but the growth rate slowed compared to 2024 (6.8%). Meanwhile, imports rose from 2.5% to 3.8%. By sector, the construction industry saw its contraction deepen from -3.8% in 2024 to -9.6% last year, while the growth rate in manufacturing slowed from 4.3% to 2.0%. In contrast, the service sector saw its growth rate rise from 1.6% to 1.7%.

Last year, the private sector's contribution to growth was 0.4 percentage points, significantly lower than the previous year's 1.5 percentage points. The government's contribution remained the same as the previous year at 0.5 percentage points. The contribution from net exports (exports minus imports) was 0.3 percentage points, lower than domestic demand (0.6 percentage points). Within domestic demand, private consumption (0.6 percentage points) and government consumption (0.5 percentage points) led growth. In contrast, the contribution of construction investment fell from -0.5 percentage points to -1.4 percentage points, having the most negative impact on the growth rate.

Fourth Quarter Growth Rate Hits Three-Year Low... Base Effect from Third Quarter Growth and Weak Construction Investment

In the fourth quarter of last year, GDP declined by 0.3% compared to the previous quarter, marking the lowest level in three years. This figure is 0.5 percentage points below the Bank of Korea's November forecast (0.2%). The result was due to a base effect from strong growth in the previous quarter, combined with weaker-than-expected construction investment. Director Lee explained, "GDP in the third quarter was 1.3%, which annualizes to 5.4%. This is quite high compared to last year's annual growth rate of 1.0%. We expected the base effect from the third quarter to significantly lower the fourth quarter growth rate, but in addition, construction investment underperformed expectations, which contributed to the lower-than-forecast result."

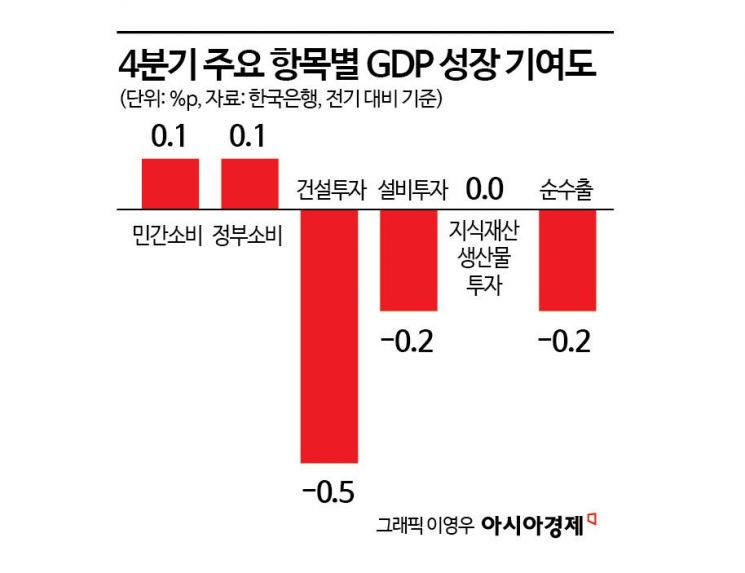

In terms of domestic demand, construction investment remained weak, but consumption showed a modest increase. Private consumption rose by 0.3% quarter-on-quarter, as spending on goods such as passenger cars decreased but service consumption, including medical services, increased. Government consumption increased by 0.6%, mainly due to higher health insurance benefits. Construction investment fell by 3.9% during the same period as both building and civil engineering works declined. Facility investment also dropped by 1.8% as transportation equipment, including automobiles, decreased. Director Lee added, "We did not expect construction investment to turn positive in the third quarter compared to the previous quarter, and thought that this trend would continue in the fourth quarter, leading to a faster easing of the slump. However, this did not materialize, partly due to persistently high construction costs."

Exports decreased by 2.1%, mainly due to declines in automobiles, machinery, and equipment. Imports also fell by 1.7% as imports of natural gas and automobiles decreased.

By industry, agriculture, forestry, and fisheries grew by 4.6% quarter-on-quarter, mainly due to crop production, while manufacturing declined by 1.5%. The electricity, gas, and water supply sector fell by 9.2%, mainly due to the electricity sector, and construction declined by 5.0%. The service sector increased by 0.6% as retail, accommodation, and food services decreased, but finance, insurance, and medical services increased.

In the fourth quarter of last year, real gross domestic income (GDI) increased by 0.8%, outpacing real GDP growth.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.