Financial authorities have filed criminal complaints against controlling shareholders of listed companies who engaged in price manipulation to prevent forced sales, as well as securities firm employees who used undisclosed information about tender offers to gain unfair profits. In addition, a total of 3.7 billion won in fines was imposed on secondary and tertiary recipients of undisclosed information who participated in trading based on this information.

The Securities and Futures Commission announced on January 21 that it held its second regular meeting and decided to file criminal complaints and impose fines in two separate cases of unfair trading: price manipulation by controlling shareholders and the use of undisclosed tender offer information by a securities firm employee. The two cases are independent of each other.

First, the commission filed criminal complaints against three individuals, including a controlling shareholder, for violating the Capital Markets Act’s prohibition on price manipulation. They had placed orders to manipulate prices in order to defend against a decline in the stock price.

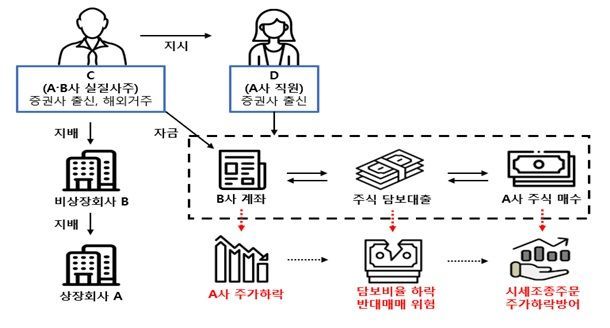

According to the investigation, individual C is the de facto controlling shareholder of listed company A and its largest shareholder, unlisted company B. Company B had secured about 20 billion won in loans by pledging 70-80% of its holdings in company A as collateral. When the share price of company A fell and the risk of forced sales of the collateralized shares increased, C instructed employee D of company A to engage in price manipulation using company B’s account.

From February 2023 to June 2024, C submitted a total of 2,152 price-manipulating orders involving 298,447 shares on two occasions, artificially defending against a decline in the share price. As a result, C was found to have gained approximately 29.4 billion won in unfair profits. Financial authorities emphasized that even price stabilization activities intended to prevent a decline in share price, without actually raising it, clearly constitute price manipulation.

Additionally, the commission decided on strong sanctions against employees of NH Investment & Securities who used undisclosed information about planned tender offers.

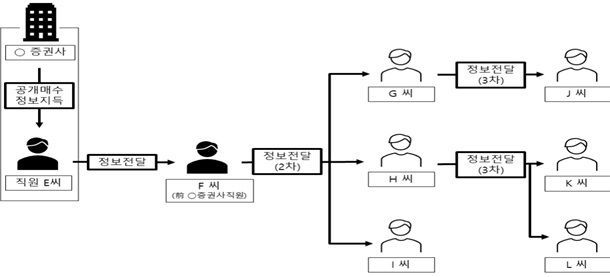

According to the investigation, employee E of NH Investment & Securities, which has a high market share in the domestic tender offer market, obtained undisclosed information about planned tender offers for three listed companies in the course of work and used this information to purchase shares. E then passed this information to F, a former colleague at the same securities firm. Through this process, unfair profits of about 370 million won were generated.

The information leak spread further. Secondary recipients who received the information from F, as well as tertiary recipients who received it from the secondary recipients, also participated in trading, resulting in an additional 2.9 billion won in unfair profits.

The commission filed criminal complaints against E and F for violating the Capital Markets Act’s prohibition on the use of undisclosed material information. In addition, secondary and tertiary recipients were fined a total of 3.7 billion won for engaging in market-disrupting activities based on the use of such information.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)