Fair Trade Commission imposes 272 billion won fine on four major banks for LTV collusion

Commission finds banks shared LTV information, restricted competition in mortgage lending

Banks: "Difficult to accept, no harm to consumer interests"

"Banks

The Korea Fair Trade Commission has imposed a large-scale fine on the four major banks for collusion regarding the loan-to-value (LTV) ratio. The banks have stated that they find it difficult to accept the commission's decision and are prepared to pursue administrative litigation.

Fair Trade Commission imposes 272 billion won fine on four major banks for LTV collusion

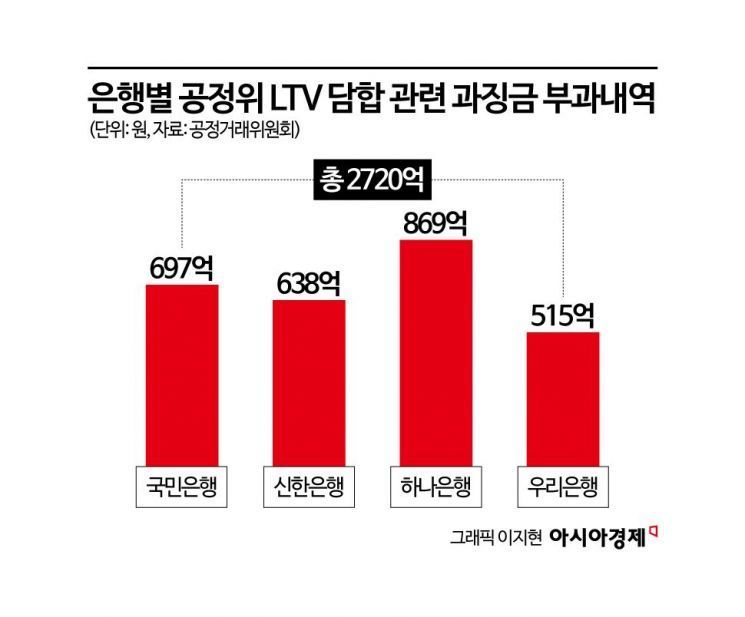

On January 21, the Korea Fair Trade Commission announced that it had decided to impose a fine of approximately 272 billion won on the four major banks-KB Kookmin, Shinhan, Hana, and Woori Bank-after finding that they shared LTV information and used it to restrict competition in the real estate secured loan market.

The commission concluded, after a full board meeting, that from March 2022 to March 2024, these four banks exchanged information related to real estate secured loans for households and businesses, including LTV ratios, and adjusted their LTV ratios to ensure there was no significant difference from other banks.

The commission determined that this series of actions involved exchanging information on transaction terms or payment conditions, which substantially restricted competition. It found this to be a violation of Article 40(1) Item 9 of the Monopoly Regulation and Fair Trade Act and Article 44(2) Item 3 of the Enforcement Decree of the same law.

The fines for each bank are as follows: KB Kookmin Bank, 69.7 billion won; Shinhan Bank, 63.8 billion won; Hana Bank, 86.9 billion won; and Woori Bank, 51.5 billion won. The relevant sales amount, which serves as the basis for the fines, is estimated at approximately 6.8 trillion won for all four major commercial banks combined.

Banks say, "Difficult to accept, no harm to consumer interests"

The banks involved have strongly objected to the Fair Trade Commission's decision. A representative from one of the four major banks stated, "It is difficult to accept the commission's decision. The key issue is not simply the exchange of information but whether consumer interests were harmed, and we do not see it that way."

Another bank official remarked, "In practice, we referred to the information to review the appropriateness of pricing, so we are perplexed by the conclusion that customer interests were harmed. In addition to LTV, there are numerous meetings led by the government where information is exchanged, so we also question how this case is different from those."

The four major banks have already each contracted with law firms and are reviewing administrative litigation. Another banking sector representative said, "We are currently having various discussions through our law firms, but since it is difficult to accept the outcome, administrative litigation is a natural next step. However, since we have not yet received the official resolution from the commission, we will decide on further procedures after receiving it."

The Fair Trade Commission also expects that the banks will proceed with administrative litigation. A commission official stated, "Most institutions that have received a fine decision have filed administrative lawsuits, and we expect the banks will not be much different, so we will respond accordingly." Legal experts believe that if administrative litigation begins, it could proceed through the first trial, appeal, and the Supreme Court, potentially taking several years for a final conclusion.

In the financial sector, there are concerns about the deterioration of financial soundness, as the banks are facing another large-scale fine from the Fair Trade Commission following the massive fines previously imposed by the Financial Supervisory Service for the misselling of Hong Kong H Index (Hang Seng China Enterprises Index, HSCEI) equity-linked securities (ELS). There are also concerns that worsening financial soundness could hinder major financial policies promoted by the government, such as productive finance, inclusive finance, and enhanced shareholder returns.

The Financial Supervisory Service has notified KB Kookmin, Shinhan, Hana, NH Nonghyup, and Standard Chartered Bank Korea of fines and penalties totaling about 2 trillion won for the misselling of Hong Kong ELS. Although discussions are underway to reduce the fines through the sanctions review committee, it is expected that the banks will still face at least several hundred billion won in fines.

The imposition of large-scale fines increases the burden of risk-weighted assets (RWA) for banks, negatively affecting their capital soundness. As RWA increases, banks' financial capacity declines, creating pressure on corporate lending, productive finance, and expanded shareholder returns, which are key financial policies of the Lee Jaemyung administration. A banking sector official explained, "Not only the LTV fine but also the Hong Kong ELS fine and various government contributions will inevitably impact productive finance policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.