Focus on Mid- and Small-Sized Deals Over Mega-Deals at the Start of the Year

At the start of the new year, the global pharmaceutical and biotechnology M&A and technology transaction markets, which serve as indicators for industry trends, have been dominated by obesity and artificial intelligence (AI). Rather than pursuing mega-deals, there is a clear trend toward reducing market risks through mid- and small-sized deals.

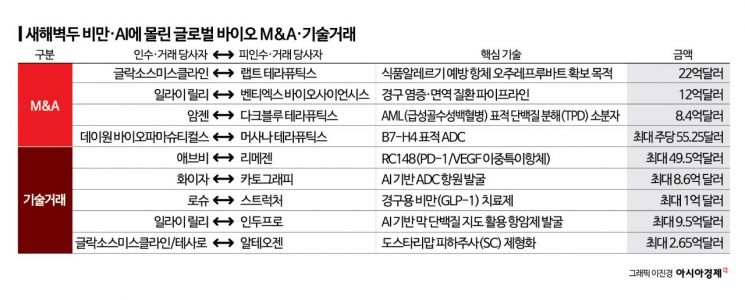

According to the industry on January 21, the average deal value of the five major global pharmaceutical and biotechnology M&A deals so far this year was approximately $1.92 billion (about 2.8412 trillion won), while the average value of the five major technology transactions was about $955 million (about 1.4132 trillion won). Instead of pursuing large-scale mergers worth over 10 trillion won that would overhaul entire organizations, companies are adopting a 'bolt-on' strategy-acquiring biotech firms with strengths in specific disease areas or technologies, or entering into major technology deals to fill gaps in their existing portfolios through mid- and small-sized M&A.

The main focus of these deals has been on obesity and AI. In the field of obesity treatments, issues of supply, pricing, and accessibility are intertwined, and the market is quickly shifting toward oral medications, combination therapies, and next-generation mechanisms. In this phase, major pharmaceutical companies are not simply expanding their obesity treatment pipelines; instead, they are diversifying their growth drivers by targeting inflammation, cardiovascular, and metabolic complications associated with obesity. As competition intensifies, relying on a single blockbuster (a new drug with sales exceeding 1 trillion won) becomes increasingly risky.

A representative example is Eli Lilly's acquisition of the biotech company Versanis for approximately $1.2 billion (about 1.7757 trillion won). Versanis has an oral pipeline in autoimmune and inflammatory diseases such as inflammatory bowel disease (IBD). By expanding its portfolio to include cardiovascular and metabolic inflammatory diseases associated with obesity, Eli Lilly has secured a way to reduce growth volatility.

Roche has also entered into a licensing agreement with Structure, a developer of oral obesity treatments, for oral GLP-1 (glucagon-like peptide-1) therapies, thereby adding oral obesity treatments to its pipeline. Oral obesity treatments have the potential to greatly expand the market if successful, but there are many variables related to clinical development, formulation, and safety. As a result, more deals are being structured to limit upfront payments and distribute compensation based on milestone achievements, rather than shouldering large initial costs, in order to mitigate risk.

AI is also emerging as a central focus of investment in the biotechnology industry. AI is now moving beyond assisting with patient selection and protocol optimization in clinical trials to playing a role in the design phase of new drug development, including generating antibody candidates. Major pharmaceutical companies are going beyond simple collaborations with AI firms and increasingly acquiring AI engines, data, and workflow systems outright.

Pfizer has decided to utilize AI to more precisely select targets and drug candidates. Pfizer has entered into a collaboration agreement with AI biotech Cartography worth up to $865 million (about 1.28 trillion won). The core of this deal is to identify 'tumor-selective antigens' that can be expanded into antibody-drug conjugates (ADCs) and other applications, rather than focusing solely on clinical trial design. The risk in antibody and ADC development is that targeting antigens expressed in normal tissues can increase toxicity. Major pharmaceutical companies are now using large-scale data platforms and AI to more precisely identify antigens that are highly expressed only in tumors. A similar example is Eli Lilly's collaboration agreement with Indupro, worth up to $950 million (about 1.4 trillion won), which involves using Indupro's AI platform to identify target combinations and link the results to multispecific antibody programs, thereby advancing antibody design.

Meanwhile, the first domestic technology transaction of the year came from Alteogen. The company signed an exclusive licensing agreement with Tesaro, a subsidiary of GlaxoSmithKline (GSK), for the development and commercialization of a subcutaneous (SC) formulation of dostarlimab (an immuno-oncology drug) using ALT-B4, which incorporates Hybrozyme technology. The deal includes an upfront payment of $20 million (about 2.95 billion won), and Alteogen could receive up to $285 million (about 42.17 billion won) in milestone payments upon achieving key development milestones.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.