Export Volume Stagnant for Five Years

Imports More Than Double

Impact of Expanded Local Production and Increased B2B Food Service Imports

Riding the wave of the K-food craze, frozen dumplings, which had established themselves as a leading export product, have entered a period of stagnation over the past five years. While export volumes have remained flat, imports have surged rapidly, narrowing the trade surplus. As a result, there is growing sentiment that the growth model for frozen dumplings, one of the flagship K-food items, has reached a turning point.

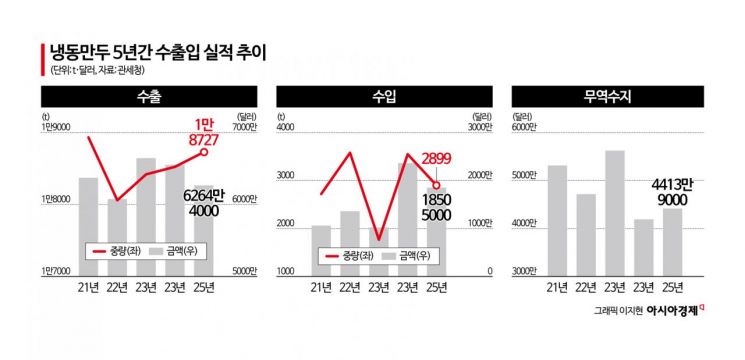

According to export-import statistics from the Korea Customs Service on January 22, the export value of frozen dumplings last year was recorded at 62.64 million dollars. This is a slight decrease compared to 63.71 million dollars in 2021. Export volume also remained in the 18,000-ton range over the past five years, from 18,932 tons in 2021 to 18,727 tons in 2025.

In contrast, imports showed a clear upward trend. Last year, the import value of frozen dumplings reached 18.5 million dollars, a significant increase from 10.59 million dollars in 2021. Notably, in 2024, the import value soared to 23.6 million dollars, marking the highest level in the past five years.

Due to the increase in imports, the size of the trade surplus has also shrunk. The trade surplus for frozen dumplings peaked at 56.21 million dollars in 2023, then fell to 41.9 million dollars in 2024, and remained at 44.14 million dollars in 2025.

The trend is similar in terms of weight. While export volumes have shown little change, import volumes more than doubled from 1,767 tons in 2023 to 3,547 tons in 2024, and remained high at 2,899 tons in 2025.

Industry experts believe that the stagnation in frozen dumpling exports cannot be attributed solely to a slowdown in demand. They analyze that the statistics reflect the substantial increase in local production by major domestic food companies in North America and Asia.

For example, CJ CheilJedang has expanded local production and distribution in the United States, led by its dumpling brand 'Bibigo.' As a significant portion of Bibigo dumplings sold in the North American market are now produced locally, the volume previously exported from Korea has naturally decreased. Similarly, Pulmuone has been operating frozen food production bases primarily on the U.S. West Coast, strengthening its localization strategy.

An industry insider stated, "Based on export statistics alone, it may appear stagnant, but in reality, companies have relocated production bases to reduce tariff and logistics burdens. Frozen dumplings are shifting from being a 'Korean export product' to a 'globally locally produced item.'"

Within the industry, there is a consensus that frozen dumplings, after rapidly spreading in overseas Korean and Asian markets, have now entered a phase of slower growth. With the initial expansion in exports having run its course, further volume growth is now limited.

Conversely, the rapid increase in imports is attributed to changing demand in food service, catering, and B2B (business-to-business) channels. Chinese, Vietnamese, and Thai frozen dumplings are lower in price and can be supplied in standardized formats, leading to increased adoption by franchise restaurants and catering companies.

In fact, in the domestic food distribution market, as labor and production costs rise, there is a growing trend to prioritize price competitiveness over country of origin. As a result, there are numerous cases where domestically manufactured products are being replaced by imports.

It is also notable that while export volumes have remained virtually unchanged for several years, export values have fluctuated year by year. This suggests that exchange rates and price adjustments have had a greater impact than volume growth. Factors such as global fluctuations in grain and meat prices, sharp changes in exchange rates, and adjustments in local distribution margins all interact, creating a structure where dollar-based performance can vary even with the same export volume.

Industry experts believe that as frozen dumplings have already reached the stage of mass-market acceptance in the global market, a simple volume expansion strategy has reached its limit. This is why major companies such as CJ CheilJedang, Pulmuone, and Daesang are focusing on developing premium lines, vegan and plant-based dumplings, and recipes tailored to local tastes.

Another industry insider emphasized, "Frozen dumplings have already moved from the 'expansion phase' to the 'maintenance phase' in the global market. Without premiumization or differentiation, it will become increasingly difficult for frozen dumplings to retain their reputation as a leading export product."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)