Top Mortgage and Jeonse Loan Rates at Major Banks Surpass 6%

Household Loan Restrictions Eased in the New Year, but High Interest Rates Weigh on Genuine Borrowers

Bank of Korea Signals End of Rate Cuts, Increasing Housing Cost Burden for Non-Homeowners

Although major commercial banks have begun easing restrictions on household loans in the new year, the interest burden on genuine borrowers has increased, with mortgage loan rates (ju-dam-dae) nearing the 7% range. As the upper end of jeonse loan rates has surpassed 6%, the housing cost burden for ordinary citizens is accelerating further. Meanwhile, the Bank of Korea has signaled the end of its rate-cutting cycle, leading to forecasts that homeownership will become even more difficult for non-homeowners from low- and middle-income groups.

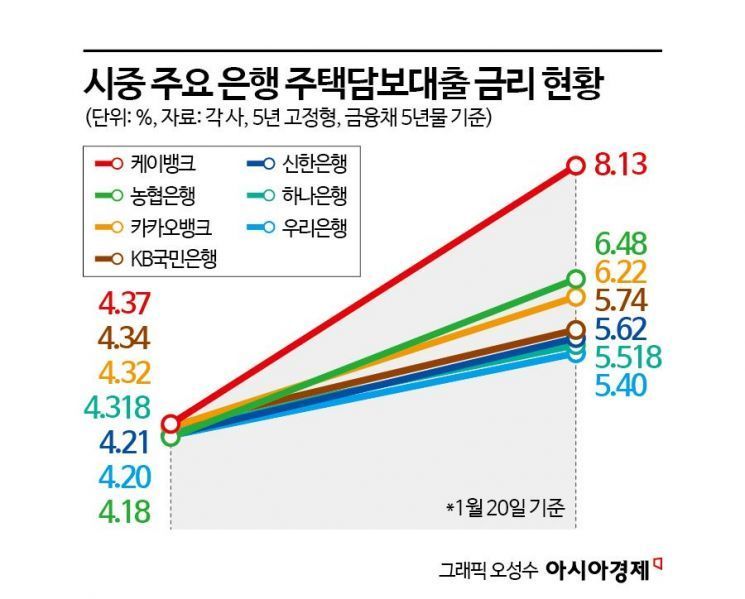

According to the financial sector on January 20, the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) are currently offering five-year fixed-rate mortgage loans at 4.20% to 6.48%. The lower end of the rates has risen to the 4% range and has continued to climb. Compared to five years ago, when rates ranged from about 2.50% to 4.00%, both the upper and lower ends have increased by around 2 percentage points. At some internet banks, the upper end of mortgage loan rates has reached as high as 7% to 8%.

Jeonse loan rates have also risen across the board. The five major commercial banks are offering jeonse loans at 3.02% to 5.67%, with the upper end approaching 6%. At internet banks, the upper end of jeonse loan rates has exceeded 6%.

The rise in bank lending rates is due to an increase in market rates, which serve as the basis for calculating loan rates. The five-year bank bond (AAA), which is used as a benchmark for loan rates, stood at 3.649% as of January 19, marking the highest level in one year and seven months since June 11, 2024 (3.506%). The COFIX (Cost of Funds Index), which serves as the benchmark for variable-rate mortgage loans, has also risen for four consecutive months, putting further upward pressure on mortgage rates. According to the Korea Federation of Banks, the new COFIX rate for December 2025 was 2.89%, up 0.08 percentage points from the previous month. The COFIX rate has been climbing for four consecutive months, rising from 2.52% in September 2025 to 2.57% in October and 2.81% in November.

In addition to the interest burden, the two rounds of real estate measures have significantly reduced the mortgage loan limits, making it even harder to buy a home. Under the June 27, 2025 measures, the mortgage loan limit for home purchases in the Seoul metropolitan area and regulated areas was uniformly capped at 600 million won. The October 15, 2025 measures further reduced the loan limits: homes priced between 1.5 billion and 2.5 billion won are now limited to 400 million won, and those above 2.5 billion won are capped at 200 million won. With the median price of apartments in Seoul exceeding 1.5 billion won, it is now considered virtually impossible to purchase a home through loans.

With expectations that mortgage rates will rise further, there are growing concerns that the dream of homeownership will become even more unattainable for non-homeowners. On January 15, the Bank of Korea kept its base rate unchanged at 2.5% per annum and removed the phrase "possibility of a rate cut" from its monetary policy statement, which it had previously included. The market has interpreted this as effectively signaling the end of the rate-cutting cycle, thereby increasing upward pressure on mortgage rates.

An official from the financial sector commented, "In the Bank of Korea's final monetary policy statement last year, the term 'rate-cutting stance' was changed to 'possibility of a rate cut,' but this time, even the phrase 'possibility of a rate cut' has been removed. The bond market is interpreting this as the end of the rate-cutting cycle," adding, "The volatility in bond yields reflects the process of finding an appropriate interest rate level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.