Publication of "The Age of Icebreaking: Realities and Opportunities of the Arctic Economy Seen on the Ground" Report

"Cooperation Model Should Be Prepared Through a 'Team Korea' Consortium Combining Technology and Operational Capabilities"

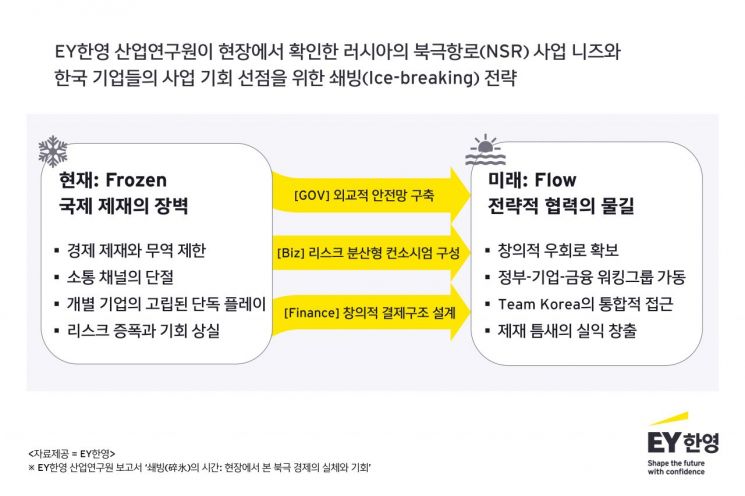

As Russia accelerates the development of the Northern Sea Route (NSR) as a key hub in its national strategy, an analysis suggests that Korean companies should preemptively capture the market with a "Team Korea" strategy that combines technological prowess and operational capabilities.

On January 20, EY Korea, a global accounting and consulting firm, announced the publication of its report "The Age of Icebreaking: Realities and Opportunities of the Arctic Economy Seen on the Ground," based on interviews with key local stakeholders in Russia. The report is notable for its in-depth interviews with the Russian Arctic Circle Initiative (ACCNI), state-owned enterprise Rosatom, and other policy leaders, analyzing future business structures and public-private cooperation models.

Russia Interested in Countries and Companies Capable of Long-Term Partnerships

According to the report, Russia views the Arctic as a future strategic stronghold where logistics, energy, and resource security intersect. In terms of logistics, Russia aims to secure a route up to 30% faster than the Suez Canal. On the energy front, it is pursuing the establishment of small modular reactor (SMR) and hydrogen production bases. Additionally, Russia plans to utilize the Arctic as a stable supply source for key minerals used in secondary batteries, such as lithium and nickel.

However, Russia faces structural limitations in securing advanced technology, raising large-scale capital, and operating complex projects. As a result, Russia regards Korea not merely as an investor but as a comprehensive partner capable of providing both advanced technology and sophisticated operational systems. In particular, Russia strongly anticipates Korea's participation in areas such as icebreaker and battery process technology, port optimization, and the entrusted operation of railways and hospitals, among other systems.

To attract foreign investment, Russia is strengthening institutional incentives such as tax reductions and tariff benefits through Advanced Special Economic Zones (ASEZ), as well as measures to prevent asset freezes and guarantee ownership rights.

"Consortium in the Form of 'Team Korea' Is Essential"

The EY Korea industry research institute recommended that domestic companies seek cooperation opportunities centered on three core agendas: logistics, resources, and infrastructure. The report forecasted significant potential for collaboration between Korea's shipbuilding and construction sectors in areas such as the construction of small and specialized vessels for integrated logistics systems connecting inland rivers and the Arctic Ocean, the establishment of battery value chains, and railway infrastructure projects.

Given the complex nature of Arctic projects involving multiple industries, the report emphasized that forming a consortium in the form of "Team Korea"-combining construction, manufacturing, finance, and consulting firms-is essential, rather than individual company approaches. It also added that, at the government level, institutional foundations to mitigate risks are needed, such as launching public-private cooperation working groups and enacting special laws to support the Northern Sea Route.

Kwon Youngdae, head of industry research at EY Korea, stated, "To resume business with Russia, which is currently tightly closed, it is more important than ever to design flexible and creative business structures that share mutual benefits between the two countries, and to secure continuous communication channels for such discussions." He added, "Through integrated capabilities that unite the public and private sectors, we must secure first-mover market leadership and institutional benefits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.