Average Daily Trading Volume Expected to Approach 40 Trillion Won This Year

KOSPI’s Daily Trading Volume Surpasses 20 Trillion Won for the First Time in 5 Years

Standby Funds Reach 91 Trillion Won, Fueling the Market Rally

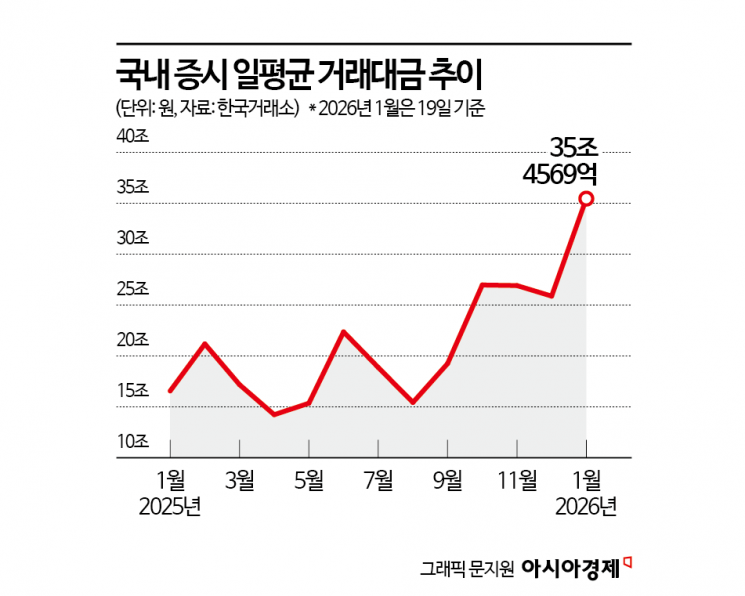

The KOSPI has continued its upward momentum since the start of the year, breaking through the 4,900-point mark after recording gains for every trading day so far. Only 95 points now separate it from the 5,000-point milestone. This record-breaking rally in the KOSPI has also led to a significant increase in domestic stock market trading volume. There are forecasts that this year’s average daily trading volume could approach 40 trillion won.

According to the Korea Exchange on January 20, the previous day the KOSPI closed at 4,904.66, up 63.92 points (1.32%) from the previous session, surpassing the 4,900-point level. The index has now posted gains for 12 consecutive trading days, breaking through the 4,800-point mark on the 16th and then reaching the 4,900-point level just one day later, drawing ever closer to the 5,000-point milestone.

As the stock market has continued to set new records since the beginning of the year, trading volume has also surged. According to data compiled by the Korea Exchange, the average daily trading volume for the domestic stock market this month stands at 35.4569 trillion won, nearly 10 trillion won higher than last month’s 25.8779 trillion won. Notably, the average daily trading volume for the KOSPI has exceeded 20 trillion won for the first time in five years. This month, the KOSPI’s average daily trading volume reached 24.5231 trillion won, up by about 10 trillion won from last month’s 14.4168 trillion won. The last time the KOSPI’s monthly average daily trading volume exceeded 20 trillion won was in January 2021, when it reached 26.4778 trillion won-marking a five-year high.

In the securities industry, there are projections that the average daily trading volume for the domestic stock market could approach 40 trillion won this year. Shinhan Investment & Securities has revised its estimate for this year’s average daily trading volume upward to 39 trillion won. Lim Heeyeon, a researcher at Shinhan Investment & Securities, stated, “Reflecting the increase in turnover, we have raised our estimate for the 2026 average daily trading volume to 39 trillion won, an 18.2% increase from our previous projection. Last year, quarterly turnover rates rose from 220% to 229%, 248%, and then 269%. Taking this into account, we have adjusted this year’s turnover assumption to 265%.”

With the stock market on a continuous rally, capital inflows into the market have also persisted. According to the Korea Financial Investment Association, investor deposits stood at 91.2181 trillion won as of January 16. This figure has increased by more than 3 trillion won since the beginning of the year. On January 8, investor deposits reached an all-time high of 92.8537 trillion won. Investor deposits refer to funds that investors have deposited with securities firms in preparation for purchasing stocks, and are considered ready capital poised to enter the market.

Ample liquidity is expected to continue supporting the stock market’s upward trend. Han Jiyeong, a researcher at Kiwoom Securities, commented, “With client deposits exceeding 90 trillion won, liquidity conditions within the stock market are helping to sustain the domestic market’s rally.”

Kim Jiyeong, a researcher at Kiwoom Securities, analyzed, “The liquidity effect resulting from the easing of global monetary policy, which began last year, will continue to invigorate both domestic and international stock markets for the time being. Currently, money market fund (MMF) balances remain high, providing ample potential liquidity, and global liquidity continues to trend upward.” She added, “Additionally, in Korea, there are valid expectations for new capital inflows into the stock market due to the growth of equity-type exchange-traded funds (ETFs), which are higher than in the past. Furthermore, these factors are expected to serve as a buffer mechanism supporting the downside of market volatility.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.