The Korea Corporate Governance Forum has criticized Hanwha's spin-off, stating that although the company claims it aims to enhance corporate value, the interests of ordinary shareholders have not been sufficiently considered.

On January 19, the forum explained its position in a commentary titled "Five Questions for Vice Chairman Kim Dongkwan, President Kim Dongwon, and Executive Vice President Kim Dongseon."

On January 14, Hanwha announced a spin-off, creating a surviving holding company focused on defense, shipbuilding, energy, and finance, and a new holding company encompassing machinery and distribution. The stock price surged in response. In the eight trading days before the announcement, Hanwha's trading volume increased, and the share price rose by 26%. After the disclosure, the stock jumped an additional 22% over three trading days.

However, the forum stated, "This spin-off, from its intention and purpose, does not adhere to the spirit of the revised Commercial Act, which requires directors to protect the interests of all shareholders and treat all shareholders equitably." The forum further pointed out, "Instead, the decision was made from the perspective of Vice Chairman Kim Dongkwan, the eldest son of Chairman Kim Seungyeon; President Kim Dongwon, the second son; and Executive Vice President Kim Dongseon, the third son, excluding ordinary shareholders."

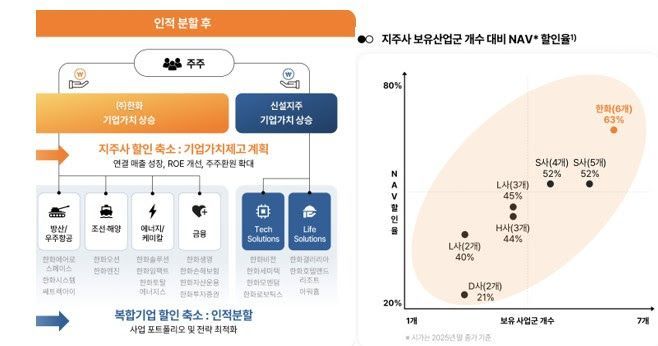

The forum identified the biggest issue with the spin-off as the board's failure to select an "obviously better alternative." It argued that alternatives, such as separating the holding company into eight business groups-defense and aerospace, shipbuilding and marine, energy and chemicals, finance, tech solutions, life solutions, construction, and global-should have been thoroughly considered.

Furthermore, the forum stated, "From the perspective of ordinary shareholders, not Executive Vice President Kim Dongseon who is striking out on his own, establishing only one new holding company fundamentally limits the enhancement of corporate value." It added, "Ordinary shareholders will find it hard to accept that things will improve after a simple spin-off compared to the current situation."

The forum also called for a clear declaration of the Majority of Minority (MoM) principle at the extraordinary shareholders' meeting scheduled for June 15, 2026, to approve the spin-off. It explained that this aligns with the intent of the "Guidelines for Directors' Conduct in Corporate Restructuring" issued by the Ministry of Justice in December 2025.

The forum continued, "If the three brothers are genuinely interested in enhancing the value for ordinary shareholders, we recommend a survey led by a special committee to gather the opinions of ordinary shareholders regarding the spin-off." It emphasized, "These details should be specifically disclosed in the company's public announcements."

The forum also criticized Hanwha's dividend policy, urging the company to improve its low dividend payout ratio and dividend yield. Hanwha has proposed a minimum dividend of 1,000 won for 2025. However, based on the current share price, the dividend yield is only about 0.8%. The forum noted, "The company has repeatedly stressed during conference calls that, on a standalone basis, the dividend is not low, but ordinary shareholders will assess dividends and shareholder returns on a consolidated basis."

The forum further stressed the need to restructure the board of directors. It stated, "Currently, the four independent directors of Hanwha and the surviving entity have no business experience." The forum suggested, "The board should be restructured to focus on independent individuals with expertise in management and capital markets, and the reduction of the discount to net asset value (NAV) should be used as a performance metric for directors."

The forum also raised concerns about the spin-off ratio set at 76 to 24. "Almost all shareholders will want to sell shares in the new entity and use the proceeds to buy shares in the surviving entity," it said, warning, "Ordinary shareholders will suffer from structural coercion."

The forum concluded, "If the three brothers are sincere about enhancing corporate and shareholder value, they should not exploit information asymmetry. They must protect the interests of all shareholders and treat everyone equitably, in line with the revised Commercial Act." The forum added, "Hanwha must answer whether it intends to transparently disclose measures to restore the interests of ordinary shareholders harmed during the Hanwha Energy succession process, as well as the master plan for restructuring after the spin-off."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)