Hanwha Asset Management announced on January 19 that the 'PLUS Tesla Weekly Covered Call Bond Mixed' Exchange Traded Fund (ETF) will pay a dividend of 212 KRW per share for January.

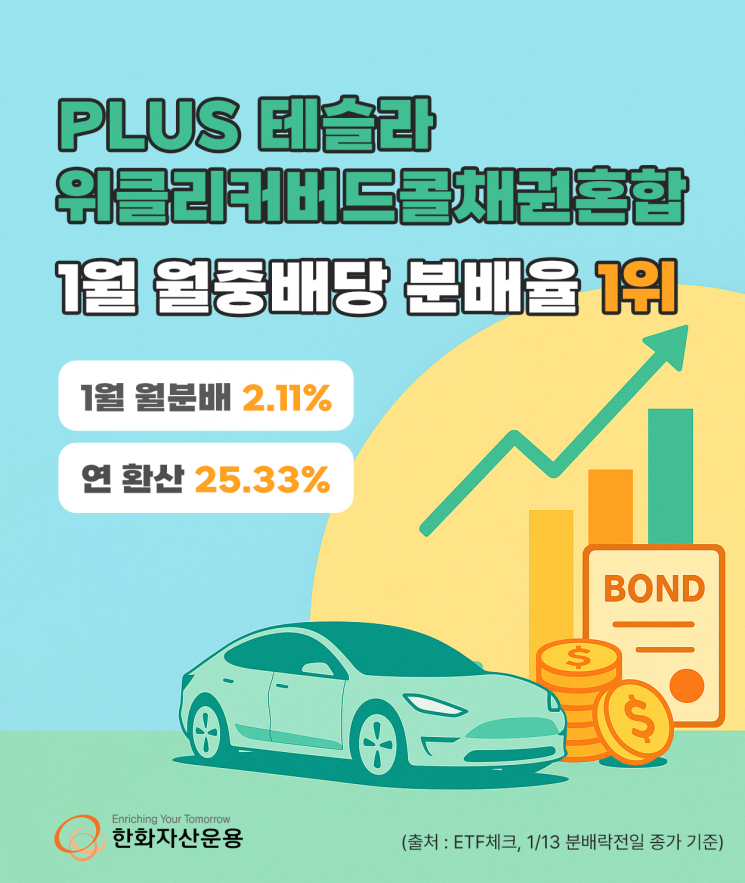

The distribution rate is 2.11% per month and 25.33% annualized, based on the closing price on the day before the ex-dividend date (January 13). According to KOSCOM ETF CHECK, this is the highest distribution rate among domestically listed ETFs that paid a 'mid-month dividend' in January.

The PLUS Tesla Weekly Covered Call Bond Mixed ETF utilizes a covered call strategy to pay dividends on the 19th of each month, making it a 'mid-month dividend' ETF. It generates distribution income by selling weekly Tesla call options at a fixed 50% allocation and using the premiums received as the source of the dividend.

The ETF invests 30% in Tesla and 70% in 3-year Korean government bonds. The government bonds help offset some of Tesla's high volatility, and, as they are classified as 'safe assets' under retirement pension regulations, the ETF can be invested in up to 100% within pension savings, defined contribution/individual retirement pensions (DC/IRP), and ISAs (Individual Savings Accounts).

Although this is an overseas investment ETF, it is noteworthy that investors can fully benefit from tax deferral on dividends within the aforementioned tax-advantaged accounts. Unlike dividends from U.S. stocks, which are typically subject to withholding tax, 'call option sale premiums' are not subject to withholding tax.

Given Tesla's high volatility, the option premiums are relatively higher compared to options on the U.S. Big Tech M7 and the Nasdaq Index. According to Hanwha Asset Management's backtesting results, the probability that the weekly return exceeds 3% when Tesla's stock price rises is about 74%. By utilizing relatively high-priced at-the-money (ATM) options and limiting the sale allocation to 50%, the ETF is designed to capture high levels of premium while still participating as much as possible in Tesla's upward price movements.

Tesla is being revalued thanks to the rapid growth of the artificial intelligence (AI) and robotics industries. At the recently held world's largest information technology (IT) and electronics trade show, CES 2026, the advancement of 'software-defined vehicles (SDV)' and 'autonomous driving technology'-areas where Tesla holds a leading position-emerged as key topics. Analysts say that Tesla's vast accumulated data and technological prowess will further solidify its dominance in these fields. Furthermore, with the commercialization of Tesla's humanoid robots and Full Self-Driving (FSD) becoming more tangible, the momentum for further stock price increases is expected to remain strong.

Kim Jeongseop, Head of the ETF Business Division at Hanwha Asset Management, explained, "Tesla is a stock with high price volatility, but when utilizing a covered call strategy, this volatility actually becomes an excellent source of distribution income through high option premiums."

He added, "We will continue to manage the product in a stable manner so that investors can benefit from Tesla's growth potential while reducing volatility through bond mixing and receive a predictable level of monthly dividends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.