Manufacturing Sales Outlook BSI at 93, Below Baseline for Seven Consecutive Quarters

Shipbuilding and Biohealth Hold Steady, Steel and Textiles Falter

A recent survey found that manufacturing sales in the first quarter of this year are expected to decrease compared to the previous quarter. Manufacturing companies cited volatility in the financial markets, such as exchange rates and interest rates, as their biggest concern in current business operations.

The Korea Institute for Industrial Economics and Trade announced on the 18th that its Business Survey Index (BSI) survey of 1,500 domestic manufacturing companies, conducted from December 8 to 19 last year, showed the BSI for first-quarter sales outlook at 93, falling below the baseline of 100.

The BSI uses 100 to indicate "no change from the previous quarter." The closer the figure is to 200, the more positive responses there are; the closer to 0, the more negative responses dominate.

The quarterly sales outlook BSI has remained below the baseline for seven consecutive quarters since the third quarter of 2024. In addition to sales, other key indicators for the first quarter-such as business conditions (91), exports (95), facility investment (96), employment (98), and funding conditions (88)-also failed to reach 100.

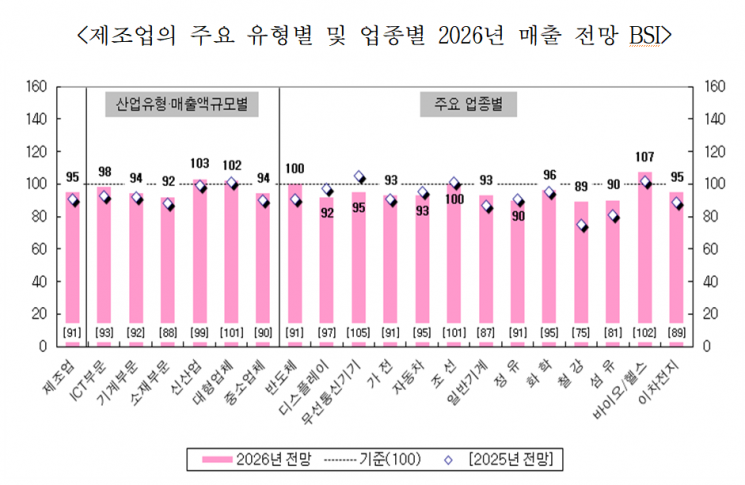

By industry, shipbuilding posted the highest figure at 99, followed by biohealth and chemicals (both at 98), and semiconductors and displays (both at 97), which were close to the baseline. However, sales were expected to decline across all industries. Sectors such as steel (86), which is affected by high U.S. tariffs, textiles (84), refining (87), and home appliances (88) are expected to face even greater difficulties in the first quarter.

The wireless communication device sector, which had been forecast to increase in the previous quarter at 101, dropped by 11 points to 91 in just one quarter.

The annual manufacturing sales outlook BSI for this year was 95, remaining below the baseline, but it improved by 4 points compared to last year (91). By sector, biohealth was projected to see sales growth at 107, while semiconductors and shipbuilding both stood at 100, right at the baseline. In terms of industry type and sales scale, new industries (103) and large companies (102) had a positive sales outlook.

In a special survey, manufacturing companies most frequently cited "increased volatility in the financial market (exchange rates and interest rates)" (43%) as the factor most affecting current business operations. This response rate increased significantly compared to the previous quarter (23%).

As for the expected effects of adopting AI technology, "support for automation (management and inspection)" (39.9%) and "support for management decision-making" (35.9%) were the most common responses, while 37.1% answered, "I am not sure at this time." To promote the adoption of AI technology, "sharing of industry-specific use cases (information)" (50.3%) and "support for adoption costs and tax benefits" (48.3%) were cited as key measures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.