Construction Costs Hit Record Highs with Cement and Labor Prices Soaring...

New Busan Apartment Sale Prices Set to Surge

Perception Spreads That "Today's Sale Prices Are the Lowest"

Buyers Turning to Prime Unsold Units

In an interview regarding the 2026 real estate outlook, a real estate expert stated, "Waiting for sale prices to drop has become meaningless. Unless raw material costs and labor expenses are brought under control, newly built apartments will inevitably be more expensive than they are now."

Although the year has changed, the upward trend in pre-sale apartment prices shows no signs of stopping. In fact, with the implementation of various building regulations and the accumulation of construction cost increases taking effect from this year, there is a prevailing expectation that the price ceiling for new apartments in the Busan area will be broken once again. As a result, the perception that "prices are the lowest right now" is spreading in the market, and unsold units in well-located pre-sale complexes are rapidly emerging as new investment destinations.

◆ "Everything except salaries has gone up"... Unstoppable rise in construction costs

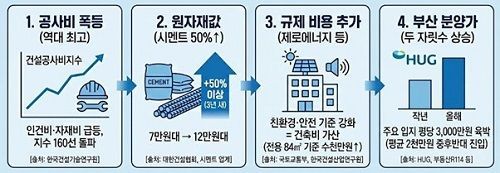

The main driver behind the increase in sale prices is, without a doubt, construction costs. According to the Korea Construction Association and related industries, the prices of key raw materials such as cement and steel bars have soared by more than 30 to 50 percent over the past three years. On top of this, rising labor costs due to minimum wage increases and higher transportation costs for ready-mixed concrete have pushed construction companies' operating costs to record highs.

Especially from this year, the expansion of mandatory "Zero Energy Building Certification" and the introduction of stricter safety and eco-friendly standards, such as the post-verification system for inter-floor noise, are being fully implemented. These factors are directly adding to construction costs, serving as key contributors to the rising prices of new pre-sale complexes. In fact, according to statistics from the Housing and Urban Guarantee Corporation (HUG), the average sale price of private apartments in Busan has shown a sharp double-digit increase compared to a year ago.

◆ Busan pre-sale market: New supply prices are a 'burden'... Quick-moving buyers target 'these places'

With new pre-sale prices "soaring out of control," the dynamics of the Busan real estate market are changing. Both end-users and investors, who had been saving their subscription accounts, are now turning to high-quality unsold units with fixed sale prices, rather than applying for new subscriptions.

The complexes currently on sale are maintaining the prices set in 2025, making them far more competitive compared to recently launched or upcoming new complexes. Essentially, buyers are purchasing "future new apartments" at "past prices" that do not reflect the recent increases in material costs.

◆ "Location is money"... Clear preference for proven 'flatland station areas' like Dongnae and Myeongnyun

Experts advise thorough selection rather than unconditional buying. They unanimously agree that in the Busan real estate market, it is crucial to secure locations that meet both the "flatland" and "station area" criteria, which are considered unchanging rules. Due to Busan's topography, which features many mountains and hills, the scarcity value of flatland apartments continues to rise.

Amid this trend, the Oncheon-dong and Myeongnyun-dong areas in Dongnae-gu, which are traditional affluent neighborhoods and the most preferred residential areas, are once again drawing attention. These locations, with their well-established living infrastructure and prestigious school districts, are known for their strong price resilience even during market downturns.

A local real estate official commented, "With new pre-sale prices rising sharply, demand is flooding into prime complexes like 'Harrington Place Myeongnyun Station,' which are maintaining relatively reasonable prices. Securing flatland station area units in Dongnae, which offers abundant infrastructure and clear future value, is the smartest strategy to maximize asset value during future periods of rising sale prices."

In this era of skyrocketing construction costs, the saying "today is the cheapest" has become a harsh market reality rather than just a marketing slogan. For Busan residents considering home ownership, seizing the opportunity of the remaining "reasonable sale prices" is likely to be the key factor determining success in this year's financial planning.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)