AI Utilization as the Top Priority

Talent Acquisition Also Under Consideration

Chief tax and finance officers at companies worldwide have identified the utilization of artificial intelligence (AI) data as their top priority. They also anticipate that efficiency could increase by up to 30% over the next two years.

On January 15, EY Korea, a global accounting and consulting firm, announced the results of its "2025 EY Tax and Finance Operations (TFO) Survey." The survey was conducted with 1,600 chief financial officers (CFOs) and tax and finance executives across 22 industries in 30 countries.

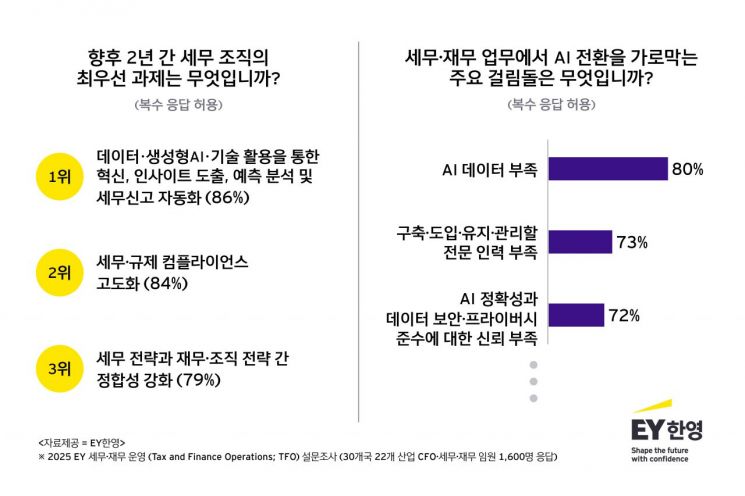

According to the survey, 86% of global tax and finance executives cited innovation, insight generation, predictive analytics, and tax filing automation using data and generative AI technologies as the most critical priorities their organizations will face over the next two years. This was followed by the advancement of tax and regulatory compliance (84%) and strengthening alignment between tax strategy and financial and organizational strategies (79%) as other key priorities.

Respondents predicted that the adoption of AI would increase the efficiency of tax and finance functions by 30% within the next two years. They also expected that 23% of the budget secured through these efficiency gains could be reallocated to strategic, high-value-added work.

However, clear constraints at the implementation stage were also identified. Forty-four percent of respondents pointed to a lack of internal capabilities to consistently execute data, AI, and technology strategies as the biggest obstacle to innovation in tax functions. In fact, more than half (51%) of tax and finance organizations remain at an early stage of data management maturity, making it difficult to adopt and utilize AI. Similarly, 75% of organizations are still at an early stage in adopting generative AI.

Major barriers to AI transformation in tax and finance operations included: insufficient data suitable for AI application (80%), a lack of specialized personnel to build, implement, maintain, and manage AI (73%), and a lack of trust in AI accuracy and compliance with data security and privacy (72%). Only 21% of respondents said that building solutions for tax functions was "very easy." Seventy-eight percent of respondents anticipated that collaboration with external experts possessing AI capabilities would provide substantial benefits for advancing tax functions over the next two years.

Changes are also emerging in organizational operations. Currently, tax professionals spend 53% of their working hours on simple, repetitive tasks, but they hope to reduce this to 21%-less than half-and devote more than twice as much time to high-value-added work.

Accordingly, companies reported that they are outsourcing 69% of simple and repetitive tasks and shifting internal personnel to focus on strategic, high-value-added work. Eighty-five percent of responding companies assessed that these changes are delivering tangible results.

Securing AI-focused talent has also emerged as a priority for tax and finance teams. Seventy-three percent of respondents are prioritizing the recruitment of data scientists and tax technology specialists, while 89% said they are investing in upskilling and reskilling existing staff. In addition, 83% reported that they are actively leveraging external professional expertise.

Meanwhile, alongside the AI transformation, responding to changes in the geopolitical, trade, and regulatory environments has also become a major priority. Eighty-one percent of companies said they plan to pursue significant changes in overall business operations, including supply chain restructuring, within the next two years. This represents a 20 percentage point increase from the previous year.

Furthermore, the most significant legislative and regulatory change identified was the global minimum tax (81%), far surpassing country-specific tax reforms (8%), electronic invoicing (5%), and tariffs (4%). On the other hand, while 85% of respondents expected an increased tax burden due to the implementation of the global minimum tax, only 21% said they were "very well prepared" to meet reporting obligations.

Ko Kyungtae, Head of Tax at EY Korea, emphasized, "Going forward, there will be a demand for new types of talent that combine technological and data literacy, judgment, critical and innovative thinking, and tax expertise. Organizations will be restructured around teams that can turn innovation into execution."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)