Related Stocks Surge After New Atlas Unveiled at CES

Rising Interest in Equity Value Impact Ahead of Boston Dynamics’ IPO

The stock prices of Hyundai Motor Group affiliates have been on a strong upward trend, driven by the humanoid robot "Atlas" developed by its U.S. robotics subsidiary, Boston Dynamics (BD). As BD is emerging as a leading player in the future humanoid market and remains unlisted, market attention is focused on how BD's equity value will be reflected in the group’s stock prices when it eventually goes public through an IPO.

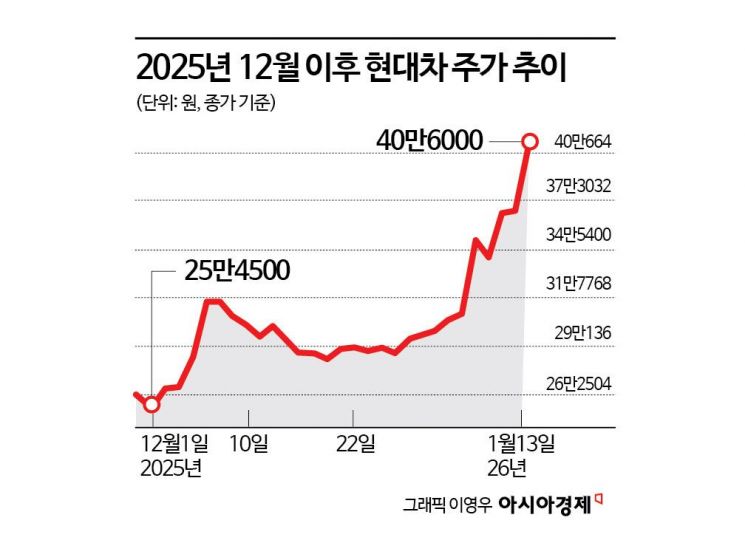

According to the Korea Exchange on January 14, Hyundai Motor closed at 406,000 won the previous day, up 10.63% from the previous session. Other Hyundai Motor Group affiliates also saw significant gains: Hyundai Mobis (14.47%), Hyundai AutoEver (8.91%), Hyundai Glovis (5.54%), and Kia (5.18%) all closed higher. Since December last year, Hyundai Motor’s stock price has risen by 59.53%.

"'Equity Value Reassessment' and 'Core Business Synergy' Should Be Considered Separately"

This rally accelerated after Hyundai Motor Group unveiled the next-generation model of "Atlas" and presented its physical AI (artificial intelligence) roadmap-connecting robotics, autonomous driving, and smart factories-at CES 2026, the world’s largest electronics and IT exhibition held last week.

Hyundai Motor Group announced a strategy to mass-produce 30,000 units of Atlas annually and to accelerate the industrial application of physical AI by deploying the robot through a Robotics-as-a-Service (RaaS) subscription model in manufacturing sites.

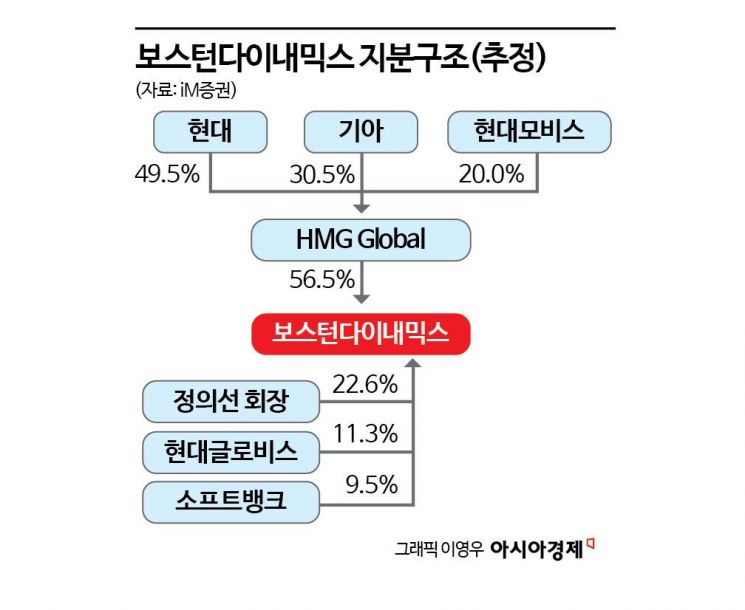

Lee Sangsoo, a researcher at iM Securities, stated, "The catalyst for the stock price surge was the unveiling of BD's Atlas at CES, the synergy with group companies, and the equity value of BD held by Hyundai Motor Group." According to the investment banking (IB) industry, following a paid-in capital increase in the second half of last year, BD’s major shareholders are: HMG Global (56.5% stake), Hyundai Motor Group Chairman Chung Euisun (22.6%), Hyundai Glovis (11.25%), and SoftBank (9.5%). HMG Global is a special purpose company (SPC) established by Hyundai Motor, Kia, and Hyundai Mobis to invest in BD.

Securities analysts advise that the "potential for equity value reassessment" and "core business synergy" should be evaluated independently. If BD proceeds with an IPO, the impact on each affiliate’s stock price will depend on whether the value is directly linked to the group companies or remains as a long-term asset. If the equity value connection is weak, only proven monetization within the value chain-such as parts, software, and logistics-can serve as a driver for further stock price increases.

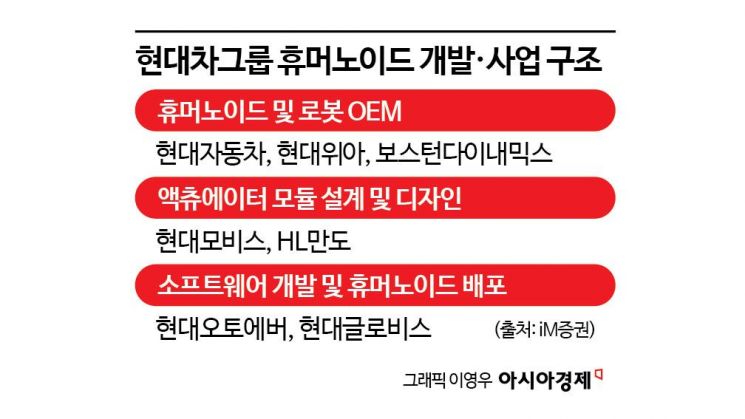

According to the humanoid business structure outlined at CES, BD will focus on robot design and technology development, while Hyundai Motor and Kia will handle manufacturing site application and technology validation. Hyundai Mobis will supply key components such as actuators, Hyundai AutoEver will be responsible for system integration and robot control, and Hyundai Glovis will optimize the supply chain within the value chain.

'Largest Stakeholder Is SPC', 'Direct Stake Belongs to Glovis'...Will Ownership Structure Determine Beneficiaries?

However, there are widely varying forecasts regarding BD's IPO valuation. BD’s revenue in 2024 reached 111.6 billion won, continuing its growth since 2021, but it posted a net loss of 441.1 billion won. Cumulative results through the third quarter of last year were similar, with revenue of 105 billion won and a net loss of 354 billion won.

Kim Guyoun, a researcher at Daishin Securities, commented, "Like other robotics companies, BD's sales revenue is limited, and investments for technological advancement and mass production are heavily reflected in its results." He added, "If BD is valued using the price-to-sales ratio (PSR) of five domestic humanoid companies-ranging from 24 to 302 times-it would yield a corporate value of at least 3.4 trillion won to as much as 42 trillion won." He further analyzed, "The combined equity value held by the four listed Hyundai Motor Group affiliates would be between 2 trillion and 28 trillion won, representing 1% to 16% of their combined market capitalization of 172 trillion won."

The extent to which BD’s value is already reflected in the stock prices should also be considered. Researcher Lee Sangsoo said, "BD is likely targeting a corporate value of 12 trillion to 56 trillion won," and added, "Depending on the steps taken before initiating IPO preparations, the valuation could rise further." He continued, "At this CES, BD announced plans for mass production, previously seen as a weakness compared to competitors. Many of the factors that led to BD’s valuation discount have now been resolved, and it is likely that the IPO valuation will be closer to the upper end of the expected range."

SoftBank's 'Put Option' in June Draws Attention...Who Will Sell Existing Shares?

Potential changes to Hyundai Motor Group’s governance structure are another variable. Kim Yongmin, a researcher at Yuanta Securities, noted, "If an IPO of BD leads to the sale of existing shares (by current shareholders), the need to secure inheritance tax for Honorary Chairman Chung Mongkoo’s major group holdings would become a key premise for governance restructuring." He added, "This could be interpreted as the starting signal for a long-term restructuring of Hyundai Motor Group’s governance."

A key date to watch is June this year, when SoftBank may exercise its put option (right to sell shares). Through the exercise of this option, SoftBank can sell its remaining 10% stake to existing shareholders or a third party. While it could hold the stake until the IPO, many in the industry believe continued ownership is unlikely, as SoftBank has not participated in BD’s capital increases over the past five years.

Researcher Kim Yongmin stated, "Hyundai Motor Group will likely secure 100% control before proceeding with the IPO. The estimated fair value of BD refers to its market capitalization after listing, but there is a neutral view on whether the BD stake held by HMG Global will be directly reflected in the market capitalization of Hyundai Motor, Kia, and Hyundai Mobis. The indirect majority ownership through an SPC has very low liquidity potential."

He added, "The stake directly held by Chairman Chung Euisun is also unlikely to be sold in the short term immediately after the IPO. Direct sales of shares by the group’s owner are among the biggest factors that dampen investor sentiment in the capital market." He continued, "In this scenario, what remains is the direct stake held by Hyundai Glovis. However, the synergy with the robotics business for Hyundai Glovis is more limited compared to the three SPC companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)