The Korea Financial Investment Association announced on January 13 that it has released the "February 2026 Bond Market Index," noting that bond market sentiment has deteriorated compared to the previous month due to the continued high exchange rate and expectations for a rising stock market.

According to the association, a survey of bond market experts conducted from February 2 to 7 showed that the overall Bond Market Sentiment Index (BMSI) stood at 96.8, down 3.1 points from the previous month’s 99.9. The association analyzed that investment sentiment in the bond market has weakened as the high exchange rate persists and more respondents expect the KOSPI index to rise.

Regarding the outlook for the base interest rate, 96% of respondents predicted that the Bank of Korea’s Monetary Policy Board, scheduled for the 15th, would keep the base rate unchanged. This is the same level as the previous survey, with expectations for a rate freeze maintained due to the ongoing high exchange rate and instability in the real estate market.

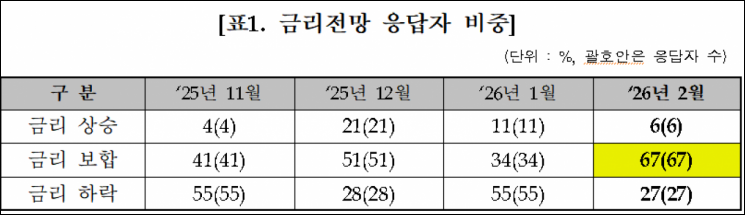

The BMSI reflecting market interest rate expectations dropped sharply to 121.0 from 144.0 in the previous month. The association explained that this was the result of weakened expectations for a rate cut, citing increased government bond issuance and heightened geopolitical risks this year as the background. The proportion of respondents expecting interest rates to rise was 6%, down 5 percentage points from the previous month. The share of those expecting rates to fall was 27%, a decrease of 28 percentage points from the previous month.

The inflation-related BMSI fell to 94.0 from 101.0 in the previous month. Despite a decline in international oil prices, concerns about rising import prices due to the continued high exchange rate were reflected, leading to a 15% rate of respondents expecting inflation, up 3 percentage points from the previous month. In contrast, the proportion of respondents expecting inflation to fall was 9%, down 4 percentage points.

The exchange rate-related BMSI dropped sharply to 82.0 from 108.0 in the previous month. Although the won-dollar exchange rate fell to the 1,420 won range at the end of the year, more respondents expected the exchange rate to rise in February due to factors such as bargain hunting and the weak yen. The proportion of respondents expecting the exchange rate to rise was 28%, up 7 percentage points from the previous month, while those expecting it to fall dropped by 19 percentage points to 10%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)