The government has taken strong action to block illegal foreign exchange transactions, such as failing to bring dollars earned from exports into the country. Authorities have determined that widespread illegal foreign exchange transactions in the trade sector are one of the causes of the sharp rise in the won-dollar exchange rate. As a result, they plan to operate a year-round, continuous intensive inspection system to ensure the soundness of foreign exchange transactions in the trade industry.

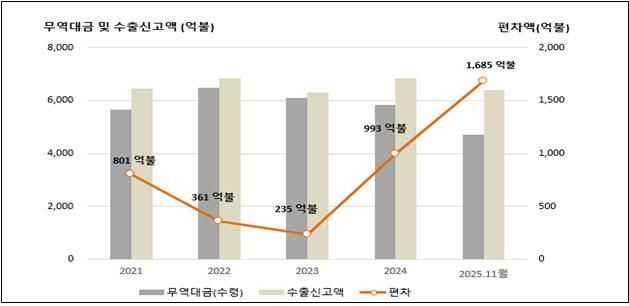

According to the Korea Customs Service on January 13, payments for imports and exports in trade transactions can be settled through letters of credit or bills of exchange, or discrepancies may arise due to differences between the time of export/import declaration and the time of settlement. The agency explained that such discrepancies alone cannot be taken as definitive evidence of illegal activity. However, the gap between trade payments processed by banks and the amounts reported to customs for imports and exports last year reached 290 billion dollars (427 trillion won), the highest in the past five years. This supports the view that companies are not bringing export earnings in dollars into the country, resulting in a lack of smooth foreign exchange circulation.

Furthermore, last year, the Korea Customs Service found that 97% of the companies inspected for foreign exchange compliance in the trade sector had engaged in illegal foreign exchange transactions. The total amount of confirmed illegal foreign exchange transactions reached 2.2049 trillion won.

Lee Jongwook, Deputy Commissioner of the Korea Customs Service, is briefing on the "Year-round Intensive Inspection Plan for Illegal Foreign Exchange Transactions Undermining Exchange Rate Stability" at the Government Sejong Complex on the 13th. Photo by Korea Customs Service

Lee Jongwook, Deputy Commissioner of the Korea Customs Service, is briefing on the "Year-round Intensive Inspection Plan for Illegal Foreign Exchange Transactions Undermining Exchange Rate Stability" at the Government Sejong Complex on the 13th. Photo by Korea Customs Service

For example, Company A, a multimodal transport service provider operating overseas subsidiaries and branches, did not repatriate service fees (external receivables) earned from providing freight transport services to foreign clients. Instead, the company kept the funds at its overseas branch and used the retained cash to settle debts with another overseas partner when such obligations arose, without reporting this to the foreign exchange authorities. Under the Foreign Exchange Transactions Act, there is a general obligation to report payments made without going through an authorized foreign exchange institution, but the company failed to comply with this requirement.

Company B, after signing a supply contract to deliver IC chips to a domestic client, established a paper company in Singapore. The company then manipulated export prices by inserting unrelated import/export trades into the process, exporting IC chips at artificially low prices and allowing the domestic client to import them at normal prices. This generated illicit gains, which were then used to create a slush fund in dollars overseas. The company was caught during a foreign exchange inspection for these activities.

Yearly Export Declaration Amount and Trade Payment (Export) Deviation Trends. Provided by Korea Customs Service

Yearly Export Declaration Amount and Trade Payment (Export) Deviation Trends. Provided by Korea Customs Service

To block such illegal foreign exchange transactions, the Korea Customs Service will operate a "Task Force for Crackdown on Illegal Trade and Foreign Exchange Transactions in Response to High Exchange Rates" until exchange rate stability is achieved. The agency will focus year-round, continuous inspections on three key types of illegal trade and foreign exchange activities: failure to collect trade payments in violation of the law, irregular trade settlements exploiting alternative means such as virtual assets, and the overseas flight of foreign currency assets through the misuse of trade.

In particular, the agency will conduct foreign exchange inspections on 1,138 groups of companies engaged in trade of a certain scale, where there is a relatively large gap between the amounts reported to customs for imports/exports and the trade payments processed through banks. By company size, the inspection targets include 62 large enterprises (6%), 424 medium-sized enterprises (37%), and 652 small businesses (57%).

Lee Myunggu, Commissioner of the Korea Customs Service, stated, "Supporting exchange rate stability is one of the Korea Customs Service's core tasks this year. By mobilizing all our foreign exchange and customs investigation capabilities to block acts that undermine exchange rate stability, such as the illegal failure to collect export proceeds, we will establish order in the national economy and foreign exchange transactions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)