Exports Reached $10.36 Billion from January to November Last Year

SMEs Accounted for 91% of Exporters

Concerns Grow Over "Cosmetics Concentration"

Need to Diversify Consumer Goods by Integrating K-Content

Last year, small and medium-sized enterprises (SMEs) achieved record-high export performance, led by cosmetics, fueling high expectations for this year as well. However, there are growing concerns that an excessive concentration on the cosmetics industry-driven by its low entry barriers-could further expose the vulnerabilities of the SME export structure. Experts point out the need for a strategic approach that not only sustains the growth of K-beauty but also seeks to identify the next key export items.

Foreign visitors are examining products at the 2025 Seoul International Cosmetics & Beauty Industry Expo and International Health Industry Expo held at COEX in Gangnam-gu, Seoul.

Foreign visitors are examining products at the 2025 Seoul International Cosmetics & Beauty Industry Expo and International Health Industry Expo held at COEX in Gangnam-gu, Seoul.

According to industry sources on January 13, exports by SMEs are expected to remain strong this year, with cosmetics continuing to lead the way. Last year, for the first time, cosmetics ranked among the top 10 export categories in Korea, and unless there are any unexpected developments, a similar trend is anticipated this year. Cosmetics exports reached a record high of 10.36 billion dollars from January to November last year. Notably, 91% of these exporting companies were mid-sized or small enterprises, cementing cosmetics as a key driver of SME exports. An official at the Korea Federation of SMEs explained, "Overall, this year's export performance is expected to be more positive than last year, with certain categories such as cosmetics and bio showing strong growth potential."

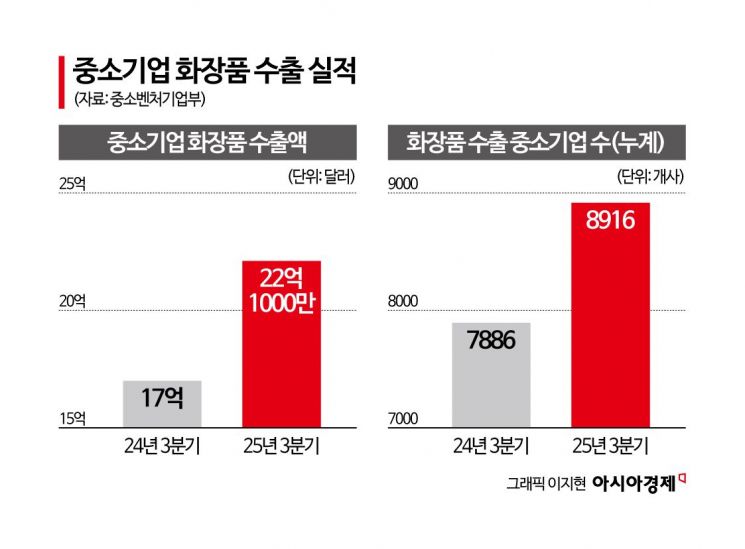

Amid these positive trends, voices both inside and outside the industry are cautioning against excessive concentration on cosmetics. The cosmetics sector has experienced rapid growth in a short period, as the national K-beauty brand has become firmly established, and SMEs have entered the market quickly, leveraging low manufacturing entry barriers and social networking service (SNS) marketing. The number of SME cosmetics exporters has steadily increased, reaching a record high of 8,922 companies in the third quarter of last year. Experts warn that such export concentration in the cosmetics market could create an industrial structure vulnerable to external shocks and intensify price and marketing competition to unsustainable levels.

No Minseon, a research fellow at the Korea Small Business Institute, stated, "Competition in the cosmetics market is already fierce, and leading global companies are also showing strong growth. If this concentration on a single category continues, the profit margins of SMEs could become increasingly fragile. While it is important to actively foster the K-beauty industry by leveraging our national brand, we must also be prepared to respond to market changes."

As a result, there is growing discussion about diversifying into "lifestyle consumer goods" by leveraging K-content such as music, dramas, and films. Just as cosmetics have expanded their competitiveness and recognition in the global market through K-pop, a variety of consumer goods incorporating K-content could also establish a strong export presence by connecting with overseas consumers. In particular, since storytelling is a key feature of content-based consumer goods, SMEs-despite their smaller scale and limited capital-are seen as having a relative advantage in developing differentiated strategies.

An official at the Korea Trade-Investment Promotion Agency (KOTRA) commented, "In the case of cosmetics, the favorable perception of Korean culture fostered by K-pop has translated into purchases, which has been a major driver of export growth. It is necessary to expand these achievements to other sectors-such as functional foods, pet food, clothing, small healthcare devices, and household goods-through proactive on-site marketing that links content with consumer goods, especially in the K-food plus category."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)