KOSPI Rises Every Trading Day This Year

Closes Above 4,600... Up 9.7% Year-to-Date

Potential to Surpass 5,000 in the First Quarter

Earnings Upgrades Drive Index Higher

The KOSPI has continued its upward streak since the beginning of the year. With about 375 points remaining to reach the "Five-Thousand-Pi" milestone, expectations for the index to hit the 5,000 mark are rising. In the market, there are projections that the KOSPI could surpass the 5,000 level as early as the first quarter.

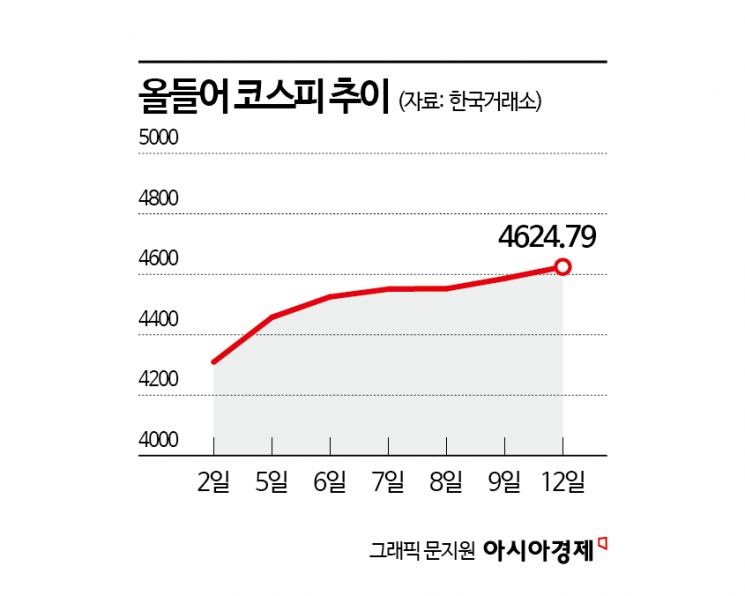

According to the Korea Exchange on January 13, the previous day, the KOSPI closed at 4,624.79, up 0.84% from the previous session, marking the first time it has finished above the 4,600 mark on a closing basis. The index has set new all-time highs every day this year, recording gains in every trading session so far. Starting the year in the 4,200 range, the KOSPI reached the 4,600 level in just seven trading days. It has risen 9.74% so far this month.

As the KOSPI continues to hit record highs day after day, a breakthrough of the 5,000 mark now seems within reach. Market forecasts suggest that the index could surpass 5,000 as early as the first quarter. Lee Kyungmin, Head of FICC Research at Daishin Securities, said, "We expect the KOSPI to reach 5,000 within the first half of the year, and it could even happen in the first quarter. The semiconductor earnings upgrade, led by Samsung Electronics and SK Hynix, has been much faster than initially anticipated, and the forward earnings per share (EPS) upgrade is also progressing at a rapid pace, bringing forward the timing of the 5,000 breakthrough attempt. While there may be short-term fluctuations, the upward trend is likely to continue until the index reaches the 5,000 range."

At the current pace, breaking through the 5,000 mark within this month is not out of the question. Heo Jaehwan, a researcher at Eugene Investment & Securities, noted, "The KOSPI has risen 14% in just three weeks since December 18, which is similar to the 19.9% surge seen in October last year. At this rate, reaching 5,000 points within January is not impossible. This is due to the sharp upward revision in semiconductor earnings, and except for the recovery phases following the dot-com bubble burst and the global financial crisis, such a pace of semiconductor earnings upgrades is unprecedented." He added, "With the increase in semiconductor earnings, the KOSPI's operating profit for this year is estimated to exceed 460 trillion won. Based on the correlation between operating profit and the average daily KOSPI level, the appropriate upper bound for the KOSPI is now revised upward to between the high 4,000s and 5,360 points."

Although the index has surged in the short term, the upward revisions in earnings have kept valuation pressures in check. Kim Jungwon, a researcher at Hyundai Motor Securities, said, "The KOSPI's rise has been driven not by an expansion of the price-to-earnings ratio (PER), but by a clear upward revision in 12-month forward EPS centered on semiconductors. This has created a structure in which improved earnings are lifting the index level." He continued, "The KOSPI's 12-month forward PER has remained stable at around 11 times, so despite the index's rise, valuation pressure is limited compared to the past."

Byun Junho, a researcher at IBK Investment & Securities, also commented, "The strong upward revision in semiconductor earnings forecasts continues, with Samsung Electronics and SK Hynix in particular driving the overall earnings upgrades for the KOSPI. This strong earnings upgrade is resulting in reduced valuation pressure on the KOSPI."

The upward trend for the KOSPI is expected to continue at least through the first half of the year. Lee added, "While we are keeping an open mind about various possibilities in the second half, we basically expect the economy to recover somewhat and oil prices to rise. If inflationary pressures increase, it will be difficult to maintain the same upward momentum as in the first half. The direction of the stock market will depend on oil prices, inflation levels, and monetary policy stance. Even in the best-case scenario, momentum will be significantly weaker than in the first half, and if a consensus (average forecast of securities firms) on interest rate hikes starts to be reflected in the market, we must also consider the possibility of increased volatility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.