AI-Powered Refund Eligibility Analysis

End-to-End Amended Return Support in Partnership with Yoo Hyun Tax Corporation

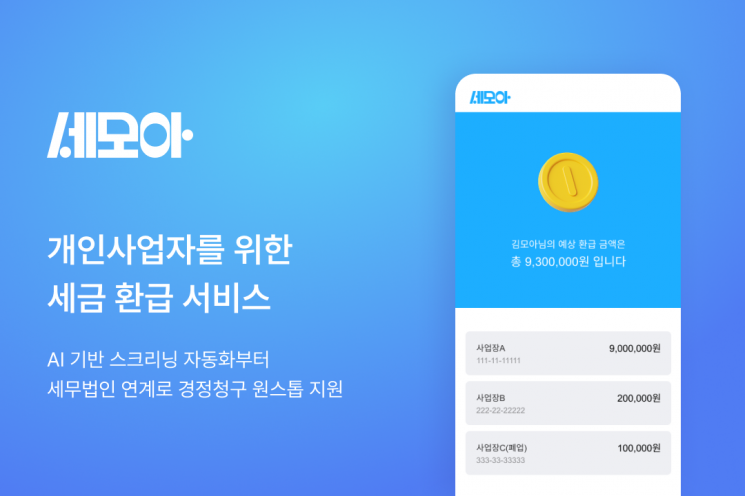

Finobus Lab announced on January 12 that it has officially launched 'Semoa', a tax refund service for sole proprietors.

Founded in 2020, Finobus Lab explained that it has introduced 'Semoa' to simplify the complex tax filing and refund process for sole proprietors, leveraging its data analysis capabilities and work automation expertise accumulated through operating fintech services.

Semoa features an artificial intelligence (AI)-based automated screening technology that comprehensively analyzes the applicant's business type, tax credit items, and previous filing history. For those with a high likelihood of receiving a refund, the service connects them with a professional tax firm to provide end-to-end support, from filing to amended returns.

To this end, Finobus Lab has prepared its service operation system in collaboration with Yoo Hyun Tax Corporation, which has experience and expertise in handling more than 50 billion won in cumulative refunds for numerous sole proprietor clients.

Sole proprietors who wish to check their estimated refund amount can do so by entering the representative's personal information registered with the National Tax Service and completing simple authentication via Hometax and the Korea Workers' Compensation & Welfare Service on the official Semoa website.

Jang Jongwook, CEO of Finobus Lab, said, "By combining my experience as a certified public accountant at a major accounting firm with technology, we have created a service that is not just a simple refund calculator, but one that can be used efficiently in the field." He added, "Our goal is to provide high-quality tax services by using AI to handle repetitive and standardized tasks, while focusing expert resources on areas that require professional verification."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)