Achieved 100 Trillion Won in Net Assets for the First Time Among Korean Asset Managers Last October...

20 Trillion Won Growth in Just 86 Days

Rapid Expansion Driven by Flagship Domestic and Overseas Index Products and Covered Call ETFs

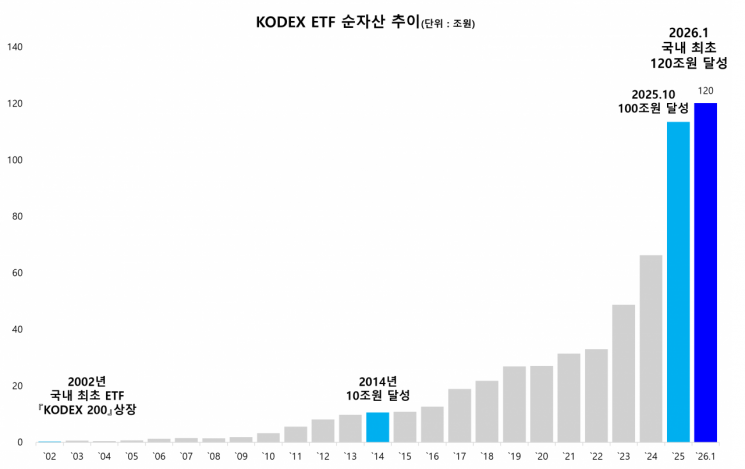

As the net asset value of the domestic Exchange Traded Fund (ETF) market has surpassed 300 trillion won, KODEX ETF from Samsung Asset Management, which has led the market’s growth, has become the first in the Korean asset management industry to exceed 120 trillion won in net assets.

Samsung Asset Management announced on the 12th that as of the 9th, the net asset value of KODEX ETF stood at 120.5343 trillion won. This marks an increase of more than 20 trillion won in just 86 days since it became the first in Korea to surpass 100 trillion won in net assets in October last year.

This achievement is attributed to the balanced growth of products that encompass a wide range of assets and themes, rather than being concentrated in specific product groups. Since October 15, when the 100 trillion won milestone was crossed, seven products have seen their net assets increase by more than 1 trillion won, and 44 products have grown by more than 100 billion won. Driven by favorable conditions in the domestic stock market, domestic equity-type ETFs led the growth with a net asset increase of 10.3 trillion won. Additionally, overseas equity-type products grew by 4.4 trillion won during the pension season, and covered call products increased by 1.9 trillion won.

Funds flowed into flagship domestic index-based products such as KODEX 200 (2.4 trillion won), KODEX 200TR (1.2 trillion won), and KODEX 200 Target Weekly Covered Call (900 billion won). At the same time, overseas flagship index products such as KODEX US S&P500 (1.7 trillion won) and KODEX US NASDAQ100 (1.4 trillion won) also ranked high in net asset growth.

There was also strong demand from individual investors. During the same period, 18 products recorded net purchases by individuals of more than 100 billion won. Among these, KODEX US S&P500 (985.4 billion won), KODEX 200 (974.9 billion won), and KODEX US NASDAQ100 (779.8 billion won) were the top products in terms of net individual purchases.

Lim Taehyuk, Head of ETF Management Division at Samsung Asset Management, said, "After surpassing 100 trillion won in ETF net assets last October, the additional accumulation of 20 trillion won was made possible by the support and aspirations of Korean investors aiming for KOSPI 5000," adding, "We will continue our efforts for the growth of all investors who are with KODEX ETF."

Samsung Asset Management is currently holding a celebratory event to mark the milestone of 300 trillion won in domestic ETF net assets. Participants can join by capturing an image of the event page and posting it on their personal social media (Instagram, Facebook, blogs, etc.). Running until the 23rd, the event will award a 10,000 won Daiso gift certificate to 300 participants selected by lottery.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)