China Imposes Export Controls on Dual-Use Goods to Japan

Blow to Industrial Supply Chains Linking China, Japan, and Korea

Domestic Permanent Magnet Manufacturers Hit First

Core Components for Industrial Motors in EVs and Robots

Limited

As China begins to impose export controls on dual-use materials containing rare earth elements against Japan, it has been found that Korean permanent magnet component companies are the first to be affected. Since permanent magnets are essential materials used in electric vehicles and industrial equipment, there is analysis suggesting that industries such as automotive manufacturing are now within the sphere of influence of the China-Japan conflict.

According to foreign media outlets including The Wall Street Journal (WSJ) on January 8 (local time), China has started to restrict exports to Japan of dual-use materials that could potentially be diverted for military purposes. These reports indicate that rare earth elements and items related to rare earth magnets may be included in the scope of these measures. Industry sources believe that seven major rare earth elements, including samarium (Sm), dysprosium (Dy), and terbium (Tb), are subject to these restrictions.

The Korean industrial sector expects that permanent magnet manufacturers will be the first to take a hit from these measures, due to the supply chain structure that connects Korea, China, and Japan. Currently, Korean permanent magnet producers import rare earth elements from China, which are then processed in Japan into intermediate products such as magnet powders or alloys, and subsequently used to manufacture finished permanent magnets in Korea. Although this only concerns part of the raw materials, if China tightens export controls to Japan, bottlenecks could occur at the Japanese processing stage, and the impact could ripple through to Korean component manufacturers.

An industry insider commented, "While it is not an immediate threat to finished vehicle production, secondary and tertiary suppliers who must procure permanent magnet raw materials directly will inevitably face increased sourcing burdens." He added, "We experienced similar difficulties last year when China strengthened rare earth export controls against the United States."

Permanent magnets are a key component that generate rotational force by forming a magnetic field inside electric vehicle motors. Because they efficiently convert electric energy into mechanical energy, they are widely used not only in electric vehicles but also in industrial equipment, robots, conveyors, elevators, and across the broader industrial sector. This is why there are concerns that disruptions in the supply of permanent magnets could affect overall production schedules in Korea's manufacturing industry.

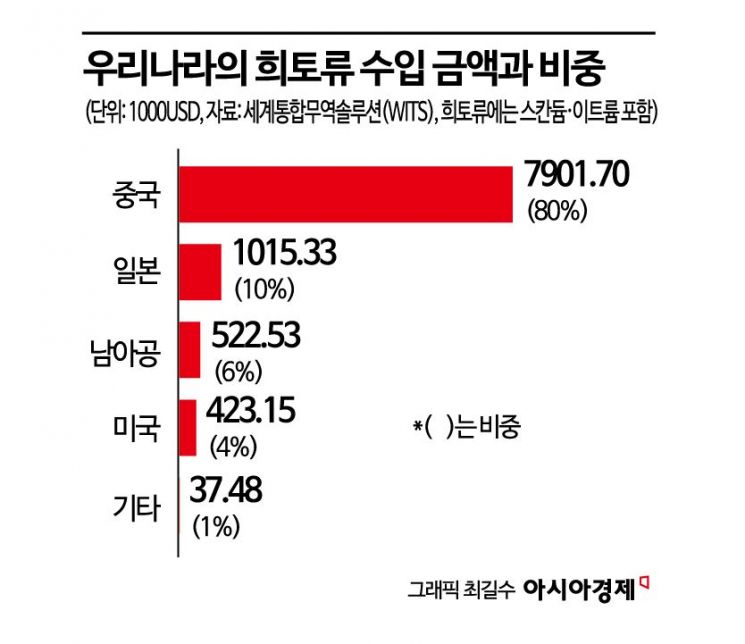

According to the World Integrated Trade Solution (WITS) by the World Bank, as of 2024, Japan accounted for 10% of Korea's rare earth imports, second only to China (80%). Although the proportion itself is not large, given Japan's structural role in processing and supplying Chinese rare earth elements, this has a considerable impact on Korean industry.

However, regarding China's export controls on rare earth elements to Japan, the semiconductor and battery industries do not expect any immediate direct impact. In the semiconductor sector, rare earth elements are used in some laser and optical components for manufacturing equipment, as well as in certain motors that power the equipment. There are concerns, particularly among Japanese equipment manufacturers, about potential delays in parts procurement or equipment delivery. The industry believes that since there are inventories and alternative sourcing options, the possibility of immediate production stoppages is low, but these factors could indirectly burden equipment installation and maintenance schedules.

The battery industry is also largely unaffected by these rare earth restrictions. This is because the core materials that make up battery cells-such as cathode and anode materials, electrolytes, electrolyte additives, and separators-do not have direct chemical links to rare earth elements. Furthermore, since Japan's export restrictions in 2019, the battery industry has made significant progress in diversifying its supply chain and localizing materials. For example, the proportion of electrolyte additives imported from Japan, which was extremely high, reached 99% in 2023, but by November 2025, this figure is expected to drop to about 51%.

A battery industry official stated, "Most anode materials and separators are overwhelmingly imported from China. Even for electrolyte additives, which are still heavily sourced from Japan, Japanese companies can transfer technology to Chinese chemical companies and import them at lower costs, then supply them to Korea. However, if Japan chooses to do so, it could always produce them domestically."

Experts point out that this issue has made it inevitable to restructure supply chains for strategic components such as permanent magnets over the medium to long term. While supply chain diversification for battery materials has made significant progress since Japan's export restrictions in 2019, dependence on China and Japan for permanent magnets remains high, leaving structural vulnerabilities. There is growing consensus that a comprehensive supply chain strategy is needed, covering not only raw material procurement but also processing and intermediate product stages.

In Korea, companies such as POSCO International are making efforts to diversify material sources. Last year, POSCO International signed permanent magnet supply contracts worth a total of 1.16 trillion won with automakers in the United States and Europe. By sourcing rare earth raw materials from the United States, Australia, and Vietnam instead of China, the Korean industry views this as a "symbolic case of establishing a rare earth supply chain independent of China."

Cho Chul, a research fellow at the Korea Institute for Industrial Economics and Trade, said, "If China uses rare earths as a means of sanctions, it could affect not just specific countries but the global industrial sector as a whole. Ultimately, we need to develop our own medium- and long-term solutions, and at the same time, respond jointly through cooperation not only with Korea but also with major countries such as the United States and Japan."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.