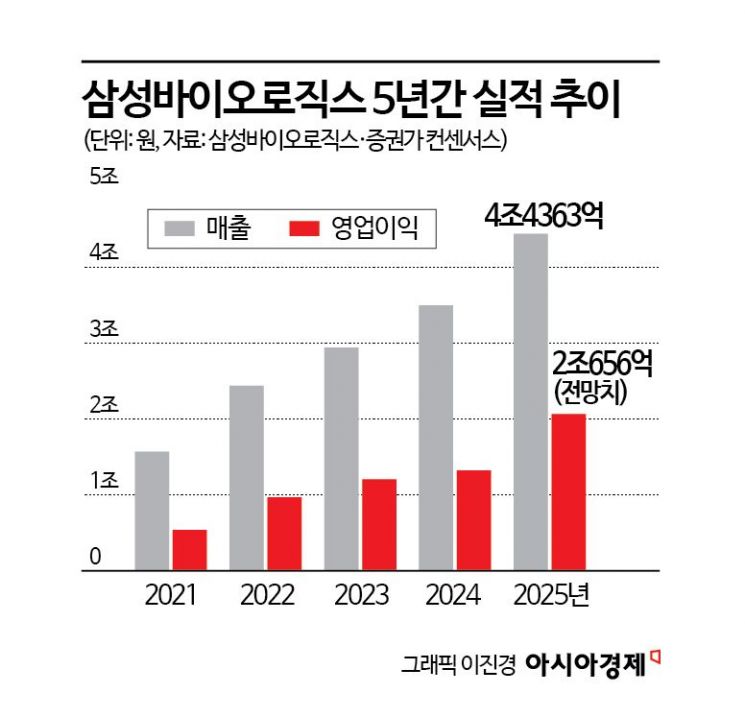

Securities Consensus:

Revenue of 4.3 Trillion Won,

Operating Profit of 2 Trillion Won

Samsung Biologics is rapidly approaching the milestone of 2 trillion won in annual operating profit.

According to industry sources on January 9, the consensus (market forecast) for Samsung Biologics' performance last year is 4.4363 trillion won in sales and 2.0656 trillion won in operating profit. Samsung Biologics is scheduled to announce its provisional fourth-quarter results on January 21, and it is highly likely to achieve an operating profit of 2 trillion won for the first time in its history.

The "2 trillion won operating profit era" carries significant symbolic weight. Since its establishment in 2011, Samsung Biologics has grown by aggressively expanding its manufacturing plants. It surpassed 1 trillion won in consolidated operating profit in 2023, just 12 years after its founding, and raised this figure to 1.3201 trillion won in 2024. Samsung Biologics achieved trillion-won-level operating profit faster than any other Samsung Group affiliate, and now, it is expected to exceed 2 trillion won in operating profit in just two years.

What securities analysts are focusing on is not just the company's external growth, but its solid "high-growth, high-profitability" structure. NH Investment & Securities evaluated, "Samsung Biologics will further leverage the fixed cost effect based on its large-scale production capacity, and by improving process efficiency, will once again demonstrate the industry's top-level profitability among global contract development and manufacturing organizations (CDMOs)." The fixed cost leverage effect refers to the phenomenon where, due to high fixed costs, the rate of change in operating profit is much greater than the rate of change in sales. Many predict that last year's sales will increase by around 30% compared to the previous year, operating profit will rise by 50-60%, and the operating profit margin (OPM) will remain in the mid-to-high 40% range.

Kiwoom Securities forecasts that the operating profit margin will reach around 46%, and highlights as an investment point that "the structure in which higher plant utilization rates lower the fixed cost burden and improve profitability should be interpreted not as a 'temporary boom,' but as the 'establishment of a stable model.'"

From this year, growth drivers are expected to become even clearer. With the revenue contribution from Plant 5 in full swing and the continued full operation of Plant 4, as well as the addition of a production base in the United States, Samsung Biologics is logically expected to structurally strengthen its global customer responsiveness and order competitiveness. In December last year, Samsung Biologics signed a contract with GSK to acquire a biopharmaceutical manufacturing facility in Rockville, Maryland, USA, for 280 million dollars (approximately 406.8 billion won). Through the acquisition of a 60,000-liter drug substance (DS) production infrastructure and the transfer of about 500 local employees, the company secured "operational stability." NH Investment & Securities projects this year's sales at 5.3825 trillion won and operating profit at 2.4095 trillion won (operating profit margin of 45%), assessing that the "CDMO industry leader premium" can be maintained.

Policy variables are also frequently cited in the medium- to long-term investment narrative. If the trend toward a "China-free supply chain" gains momentum in line with the U.S. Biosecurity Act, it is expected that global pharmaceutical companies will become more conservative in selecting manufacturing partners, allowing Samsung Biologics to benefit indirectly.

Based on these expectations, target stock prices are also on an upward trend. The target price range suggested by securities firms is generally between 2.1 million and 2.3 million won. As of January 8, Samsung Biologics closed at 1,885,000 won, up 6.68% from the previous day. Analysts assess that this is a price range where the "global CDMO industry leader premium" can be justified.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.