A Look at the Card Benefits from the Three Third-Phase Providers

Shinhan Focuses on Daily Discounts, Expanding Coverage to All Activities

IBK Pursues Digital Partnerships and Expands PX Discounts

Hana, as a First-Time Operator, Stands Out with Tr

All benefits for the third phase of the “Nara Sarang Card,” a debit card exclusively for military personnel, have now been released. From this year through up to 2033, Shinhan Bank, Hana Bank, and IBK Industrial Bank of Korea-selected as operators for the next eight years-are entering full competition to attract service members by offering unprecedented benefits. For the banks, the generous discounts mean annual losses of tens of billions of won. However, they see this as a crucial opportunity to secure potential customers among young people in their teens, twenties, and thirties, who may become long-term clients as they start their careers and families. As a result, all three banks are fully committed to the project.

Shinhan Focuses on Everyday Discounts, IBK Expands PX Benefits, Hana Offers Unique Perks

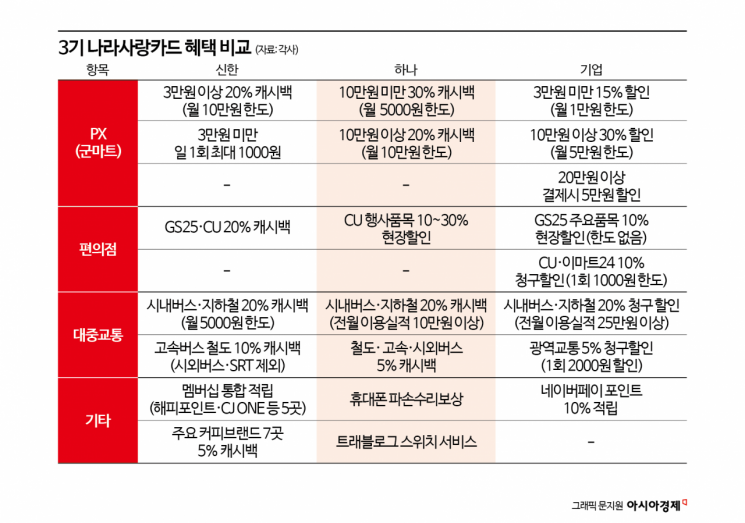

On January 9, the details of the benefits provided by Shinhan, Hana, and IBK Industrial Bank of Korea revealed that the third phase of the card program features expanded military mart (PX) benefits and broader discount categories for service members. The scope of benefits has also diversified, extending beyond simple discounts to include insurance, overseas travel, and collaborations with digital service providers.

Shinhan Bank, drawing on its experience as the sole operator during the first phase (2007-2015), has expanded its discount coverage to encompass all aspects of daily life. In addition to PX, the bank offers the widest range of discounts across major brands frequently used by young people, such as public transportation, convenience stores, cafes, bookstores, delivery services, and shopping. The concept is to ensure discounts are available wherever young people typically spend in their daily lives.

At PX stores, a 20% discount is applied daily regardless of the payment amount. Especially considering the spending patterns of service members, who often make small and repeated purchases, Shinhan allows a 20% discount on transactions under 30,000 won per purchase, up to a monthly limit of 30,000 won. This sets Shinhan apart from IBK, which offers a 15% discount on transactions under 30,000 won with a monthly cap of 10,000 won, and Hana, which provides a 30% discount on transactions under 100,000 won with a monthly cap of 5,000 won.

Shinhan also boasts the largest number of integrated membership partnerships-five in total-including GS POP, Happy Point, CJ ONE, Amorepacific, and LG Electronics. By collaborating with brands that young people frequently use and prefer, the bank aims to deliver tangible benefits.

IBK Industrial Bank of Korea, which has maintained business continuity by being selected for both the second and third phases, has significantly expanded PX benefits this time. At PX stores on military bases nationwide, both a basic and a special discount are applied simultaneously based on the payment amount, for a total discount of up to 50%. For example, if a service member spends 200,000 won at a PX, they receive a 50,000 won basic discount and a 50,000 won special discount, totaling 100,000 won off. Notably, if the previous month’s spending exceeds 250,000 won, the “All-in-One” service increases the discount amount or frequency for each category, enhancing the perceived benefits. The structure is designed so that the greater the spending, the larger the benefit.

IBK’s digital collaboration with Naver Pay is also noteworthy. If the previous month’s spending is at least 250,000 won, registering the Nara Sarang Card with Naver Pay earns 10% of the payment amount as points. Additionally, Naver and the Naver Pay application allow pre-registration for the card even before the Military Manpower Administration’s examination.

Hana Bank, participating as an operator for the first time, has lowered the usage threshold for major daily discounts such as public transportation, fast food, and coffee, applying a minimum previous month’s spending requirement of just 100,000 won to reduce the burden on users. PX usage and discounts at Coupang and Naver Plus Store are available even without any previous month’s spending. Hana also leverages its partnership with Travelog, allowing the Nara Sarang Card to be linked to foreign currency Hana Money payments through the “Travelog Switch Service.” When traveling abroad, cardholders can switch the payment setting to foreign currency Hana Money, enjoying benefits such as waived overseas merchant and ATM withdrawal fees.

Hana also offers unique benefits such as compensation for mobile phone damage repairs. When the card is issued, the “Nara Sarang Touch Card” (a watch-type NFC payment card) is provided free of charge to support convenient payments.

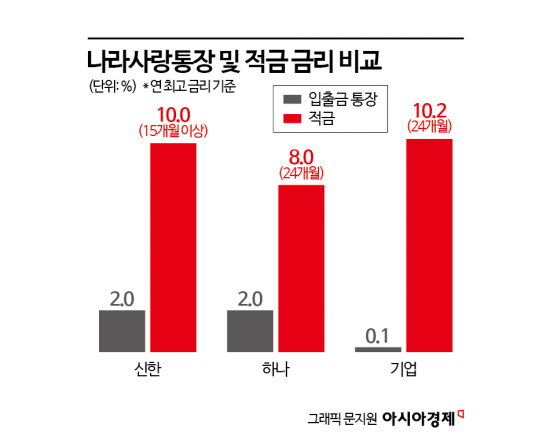

2% Annual Interest Just for Depositing Funds, Up to 10% for Installment Savings

The Nara Sarang savings account and installment savings products linked to the card have also been designed with generous benefits.

The “Nara Sarang Account,” a deposit account offered by Shinhan Bank and IBK Industrial Bank of Korea, provides an annual interest rate of up to 2.0% when military salaries are deposited. This is significantly higher than the standard annual interest rate of 0.1% for regular deposit accounts. The “Jangbyeong Naeil Junbi Installment Savings” offers interest rates of 8.0% to 10.2% for terms ranging from 15 to 24 months.

A financial industry official commented, “Until the project ends in 2033, service members will be able to retain the benefits of the Nara Sarang Card even after discharge. Although banks may not expect immediate profits, they see this as an unmissable opportunity to secure potential customers and attract low-interest, low-cost deposits.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.