$425 Billion Last Year, Up 30% from Previous Year

Five Leading AI Companies Take $84 Billion

U.S. Share Hits Record High at 64%

The global venture investment market succeeded in rebounding last year. The expansion in investment was driven by the artificial intelligence (AI) sector and large-scale rounds exceeding 100 million dollars (approximately 145.3 billion won). However, analysts point out that the overall recovery was limited, as funding was concentrated among a small number of top-tier companies and in the United States market.

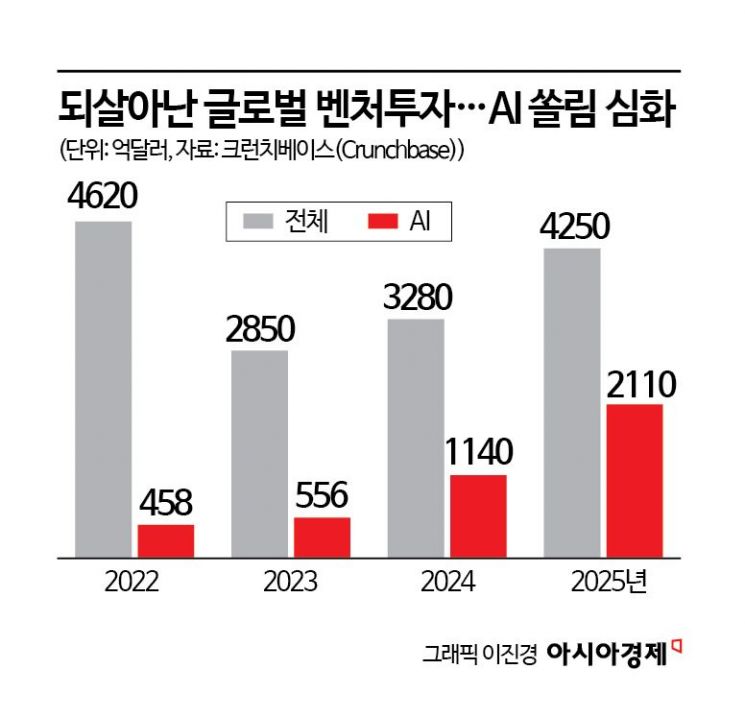

According to global market research firm Crunchbase on January 9, the total annual global venture investment in 2025 was tallied at 425 billion dollars (about 616 trillion won). This represents a 30% increase compared to 328 billion dollars (about 477 trillion won) in 2024, making it the third-largest amount since the record boom years of 2021-2022.

Last year, quantitative growth was clearly led by the AI sector. Investments related to AI surged 85% year-on-year to 211 billion dollars, up from 114 billion dollars the previous year. This figure approaches half of all venture capital invested last year. Notably, funding was concentrated among leading AI companies. Just five companies-OpenAI, Scale AI, Anthropic, Project Prometheus, and xAI-raised a combined total of 84 billion dollars last year. In other words, these five companies absorbed one-fifth of all global venture investment. OpenAI, in particular, set a record for the largest single round ever by securing 40 billion dollars from SoftBank.

By industry, aside from AI, the healthcare and biotechnology sector formed the second-largest market with 71.7 billion dollars. The financial services sector also grew, raising 52 billion dollars compared to 41 billion dollars the previous year, ranking third. Crunchbase also reported increased capital inflows year-on-year in other sectors, including aerospace, robotics, virtual assets, and defense.

Concentration by region and round size became even more pronounced. Last year, companies based in the United States attracted 274 billion dollars in investment, accounting for 64% of the total. This is 8 percentage points higher than the previous year’s 56%. Compared to the early 2020s, when the share hovered around 47%, the U.S. dominance has become even more apparent. Polarization by investment size also intensified. About 60% of total investment in 2025 was concentrated in 629 companies that secured large-scale investments of 100 million dollars or more, while 68 companies that raised rounds of 500 million dollars (approximately 726.5 billion won) or more took in over one-third of global capital.

Despite this polarization, signs of recovery emerged in the exit (investment recovery) market. Last year, the global merger and acquisition (M&A) market reached its second-largest scale ever, with transaction values in the United States surpassing the levels seen during the venture boom of 2021. Crunchbase analyzed, “Investors are opening their wallets only for proven large-scale AI companies or sectors with clear productivity improvements,” adding, “The concentration of capital is intensifying.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.