Shinhan Life Launches Industry’s First Tontine Annuity Insurance

ABL Life Introduces Product Offering Higher Refunds for Healthier Customers

US Dollar-Linked Products and Expanded Limits for Pet Insurance Released

The competition among insurance companies to launch new products in the new year is intensifying. From health insurance, which saw fierce competition between life and non-life insurers last year, to annuities, dementia, and pet insurance, companies are rolling out new products equipped with innovative riders and expanded coverage.

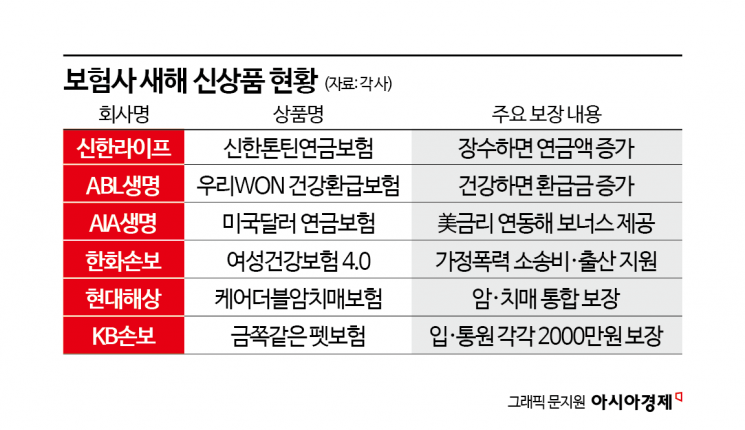

According to the financial sector on January 9, Shinhan Life introduced "Shinhan Tontine Annuity Insurance" as its first new product of the year. This is the first time a tontine annuity has been launched in Korea, with financial authorities and the insurance industry preparing for its introduction through insurance reform meetings last year.

The tontine annuity is a financial product designed by Lorenzo de Tonti, an Italian banker from the 17th century. The investment returns from the participants' contributions are distributed only to surviving members, and when a participant dies, their share is allocated to the remaining survivors. This product, which provides higher annuity payments the longer one lives, was developed in anticipation of increased demand in a super-aged society.

Shinhan Life has localized the tontine annuity for the Korean market. To address its drawbacks, the company has ensured that even if a policyholder dies before the annuity begins, they can receive the greater amount between the total premiums paid and a certain percentage of the accumulated reserves. For policies with a pre-annuity insurance period of 20 years or more that are maintained until the annuity start date, a bonus of up to 35% of the total basic premiums paid during that period is also provided at the start of the annuity.

ABL Life has launched a product that rewards healthier customers with higher payouts. The "(Non-Participating) Woori WON Health Refund Insurance" pays a health refund at the refund age based on the policyholder's age at enrollment, calculated as either the total premiums paid or the premiums paid minus any benefits already received. ABL Life has been granted nine months of exclusive usage rights by the Korea Life Insurance Association in recognition of the originality of this refund method. The product includes 10 types of riders, covering major illnesses such as cancer, cerebrovascular disease, and ischemic heart disease, as well as hospitalization and surgery benefits.

AIA Life has introduced the "(Non-Participating) AIA Global Power US Dollar Annuity Insurance," which pays a higher annuity as the value of the US dollar rises. This product is well-suited for the current high exchange rate era, with the won-dollar rate threatening the 1,500-won level. It also features a "US Interest Rate Linked Bonus" to maximize annuity payments. Through a won conversion service, policyholders can pay premiums and receive annuity or insurance benefits in either Korean won or US dollars without a separate currency exchange process.

KB Insurance has launched "KB Precious Pet Insurance" as its new product for the new year, signaling its intent to actively target the pet insurance market, which has been led by Meritz Fire & Marine Insurance and DB Insurance. Unlike existing pet insurance products that combine inpatient and outpatient medical expenses, this new product provides up to 20 million won each per year for inpatient and outpatient care, which is the highest level in the industry. In response to cancer being a leading cause of death among dogs and cats, the company has newly introduced coverage for "anti-cancer drug therapy," providing up to 300,000 won per session, up to six times per year.

Hanwha General Insurance has upgraded its flagship product, "Hanwha Signature Women's Health Insurance," to version 4.0 for the new year. The coverage has been expanded to include legal and economic burdens related to domestic violence and sexual violence. Maternity benefits have also been extended to cover the pregnancy stage, providing a one-time pregnancy support payment of 500,000 won upon pregnancy. The number of infertility treatment benefits has been increased, supporting up to eight procedures in total for artificial and in vitro fertilization. Additional benefits include higher childbirth support payments for families with more children, as well as coverage for postpartum care center costs and child care expenses during hospitalization.

Hyundai Marine & Fire Insurance has launched "Care Double Cancer Dementia Insurance," which provides integrated coverage for cancer and dementia, major diseases in a super-aged society. If the policyholder is first diagnosed with cancer, 100% of the cancer diagnosis coverage amount is paid, and if later diagnosed with severe dementia, an additional 200% of the dementia diagnosis coverage amount is provided. Conversely, if severe dementia is diagnosed first, 100% of the dementia diagnosis coverage amount is paid, and if cancer is diagnosed later, 200% of the cancer diagnosis coverage amount is provided. The product is designed to ensure sufficient coverage even if both diseases occur.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)