KT&G Expected to Surpass 6 Trillion Won in Annual Sales for the First Time

Strong Growth in Overseas Conventional Cigarettes and Electronic Cigarettes Drives Expansion

Shareholder Returns and Nicotine Pouches Set Stage for Structural Revaluation

KT&G's annual sales are expected to surpass 6 trillion won for the first time in its history. While the domestic cigarette market has entered a mature phase and overall demand continues to decline, KT&G is accelerating its transformation from a traditional tobacco company into a global nicotine platform enterprise. This is being driven by rapid growth in its overseas tobacco business, a recovery in its next-generation product (NGP) segment, the expansion of new businesses such as nicotine pouches, and the simultaneous implementation of an unprecedented shareholder return policy. This growth trend is expected to continue this year, positioning the "6 trillion won in sales" not as a one-off event but as the starting point for structural growth.

Overseas Tobacco: 'Qualitative Growth' Strategy Drives Performance... Electronic Cigarettes Move Beyond Recovery to Growth Trajectory

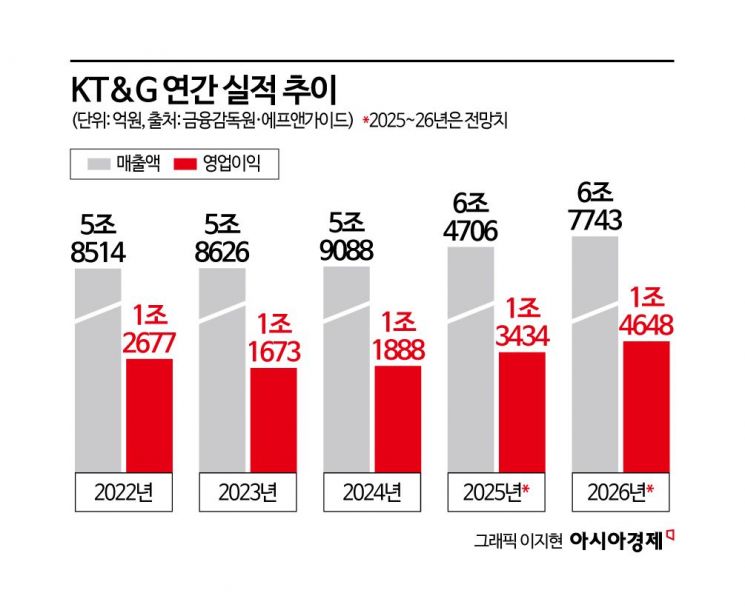

According to market research firm FnGuide on January 9, KT&G's consolidated sales for last year are projected at 6.4706 trillion won, with operating profit estimated at 1.3434 trillion won. These figures represent increases of 9.5% and 13.0%, respectively, compared to the previous year.

The key driver of KT&G's improved performance last year was its overseas combustible cigarette business. In the past, the company relied on promotional discounts and low-price policies to boost volume, but it has recently shifted its strategy by reducing discounts and increasing the proportion of high-margin products. This has established a qualitative growth structure in which both average selling price (ASP) and sales volume increase simultaneously.

In particular, the pace of growth has accelerated in the Commonwealth of Independent States (CIS), the Middle East, and Southeast Asia, as local production has expanded and distribution networks have stabilized. The impact of the expanded Kazakhstan plant has been fully reflected since last year, and a new plant in Indonesia is scheduled to begin operations this year. The expansion of overseas production bases is expected to lead to both reduced logistics costs and favorable currency effects, directly improving profitability.

Market analysts expect KT&G's overseas combustible cigarette sales to grow by more than 30% this year, with growth of around 20% projected for next year as well. This is the backdrop for KT&G's overall tobacco sales increasing, even as domestic cigarette demand declines.

NGP (Heated Tobacco Products) has also become a pillar of structural growth. Growth was hampered until 2024 due to supply disruptions of devices in Vietnam, but most of these issues have been resolved since last year, and sales have normalized.

In Korea, KT&G's premium device lineup, including 'Lil Hybrid' and 'Able,' has gained traction, while overseas, the company is preparing to launch new global platforms and enter new markets such as Russia. The securities industry expects KT&G's global NGP sales contribution to rise to a new level by 2026.

Nicotine Pouches: A Strategic Move Targeting the 'Post-Cigarette' Era

KT&G's growth momentum is expected to continue this year. According to FnGuide, KT&G's sales in 2026 are projected to reach 6.7743 trillion won, with operating profit expanding to 1.4648 trillion won. This growth is expected to be driven by the high growth of overseas combustible cigarettes and NGP, the next-generation nicotine portfolio represented by nicotine pouches, and shareholder returns totaling around 3 trillion won, all operating in tandem.

Bang Kyungman, President of KT&G, and Billy Gifford, CEO of Altria, signed a comprehensive memorandum of understanding in September last year to establish a strategic partnership in the global nicotine and non-nicotine market, and are taking a commemorative photo.

Bang Kyungman, President of KT&G, and Billy Gifford, CEO of Altria, signed a comprehensive memorandum of understanding in September last year to establish a strategic partnership in the global nicotine and non-nicotine market, and are taking a commemorative photo. [Photo by KT&G]

First, in September last year, KT&G partnered with Altria to jointly acquire Another Snus Factory Stockholm AB (ASF), a Swedish nicotine pouch company. This marked KT&G's full-scale entry into the rapidly growing nicotine pouch market, centered in Northern Europe.

ASF owns the 'LOOP' brand, which holds the top market share in Iceland and ranks second or third in Sweden and Norway. Starting from the first quarter of this year, ASF's performance will be reflected in KT&G's equity-method earnings. KT&G plans to leverage its existing strong distribution networks in the Middle East and Asia-Pacific to expand the reach of its nicotine pouch products.

This strategy extends the approach that enabled KT&G to quickly establish itself in the overseas electronic cigarette market through a global NGP partnership with Philip Morris International (PMI), now applying it to the nicotine pouch sector. Market observers are paying close attention to the potential for nicotine pouches to become the next-generation nicotine product, following electronic cigarettes.

Shareholder Returns: Transforming the Image of 'Conservative KT&G'

Another significant change at KT&G is the full-scale implementation of its shareholder return policy. The company previously announced plans to return a total of 3.7 trillion won to shareholders between 2024 and 2027. This aggressive plan includes 1.3 trillion won in share buybacks, 2.4 trillion won in dividends, and the cancellation of treasury shares.

Additionally, KT&G has opened the door to further returns by selling non-core real estate and financial assets, completely overturning its previous image as a company that simply accumulates cash. As overseas plant expansions near completion, annual capital expenditures (CAPEX) are expected to decrease to the 200 billion won range from this year onward, which will directly fund increased dividends and share buybacks. The securities industry believes that KT&G's cash generation capability, combined with its return policy, could trigger a full-fledged revaluation of the company's valuation.

Furthermore, the potential for an increase in tobacco taxes is also viewed as a positive factor for KT&G's mid- to long-term growth. The last tobacco tax hike occurred in January 2015, and there has been no change in the tax rate for more than 10 years. This is why the possibility of a tax increase around 2026 is being discussed.

Past cases show that while demand may contract in the short term, price hikes have led to improved margins and positive stock performance in the mid- to long-term. If a tobacco tax increase does materialize, it could once again boost KT&G's earnings strength and share price momentum.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.