Government and Banking Sector Launch Full-Scale Inclusive Financial Transformation

Significant Expansion of Low-Interest Loans for Youth and Vulnerable Groups

Banks to Expand Supply of Sae-Hope Hallssi Loans

Five Major Financial Groups to I

The government has decided to actively pursue a "grand transition to inclusive finance," significantly strengthening support for financially marginalized groups. The government will introduce a variety of low-interest loan products for young people and socially disadvantaged individuals, while banks will expand customized loan products for low-income earners, such as the Saehope Hallssi Loan, to actively help those in financial distress recover. The five major financial holding companies plan to inject a total of 70 trillion won into expanding inclusive finance over the next five years.

Significant Expansion of Low-Interest Loans for Youth and Vulnerable Groups

The Financial Services Commission held the first meeting on the "Grand Transition to Inclusive Finance" at the Suwon Low-Income Financial Integration Support Center in Gyeonggi Province on the morning of January 8. The meeting was attended by officials from the Financial Services Commission, the five major financial holding companies, and experts in inclusive finance, who discussed the future direction of inclusive finance that the government and private sector should jointly pursue.

Lee Okwon, Chairman of the Financial Services Commission, stated, "Since the launch of the new administration, the foundation for overcoming the livelihood crisis has been laid through the New Leap Fund and credit amnesty, among other measures. Now is the time to promote a grand transition to inclusive finance for more fundamental solutions to issues such as financial exclusion, long-term delinquencies, and aggressive debt collection."

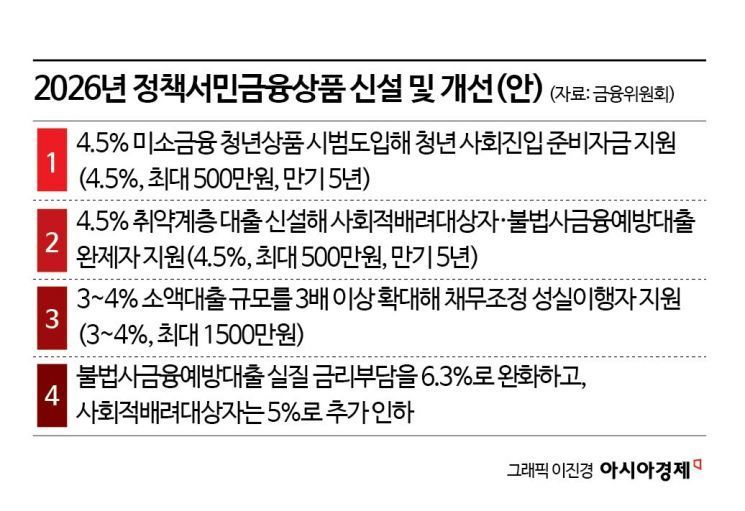

To this end, the government will work with the private sector to expand the supply of funds for low-income individuals. This year, a variety of policy-based financial products for low-income groups will be introduced to support the financially marginalized. First, a youth product under Smile Microfinance will be launched for certain young people, such as high school graduates and the unemployed. Unemployed youth who need funds to enter society will be eligible, and they can borrow up to 5 million won at an annual interest rate of 4.5% for purposes such as academy fees and startup preparation funds.

New livelihood loans for financially vulnerable groups will also be introduced. Eligible recipients include those with an annual income of 35 million won or less, individuals in the bottom 20% of personal credit scores, and those who have fully repaid illegal private loan prevention loans. These individuals can borrow up to 5 million won at an annual interest rate of 4.5%.

The size of loans for diligent debt restructuring repayment clients, provided by the Credit Counseling & Recovery Service, will be significantly expanded from the current 120 billion won per year to 420 billion won per year starting this year. Diligent debt restructuring repayment clients will be eligible to borrow up to 15 million won at an annual interest rate of 3-4%. In addition, the actual interest burden of illegal private loan prevention loans will be reduced from the current 15.9% to 6.3% in the future, and for socially disadvantaged individuals, it will be further reduced to 5%.

On the morning of the 8th, Eunghwok Lee, Chairman of the Financial Services Commission, held the 1st Inclusive Finance Grand Transition Meeting at the Suwon Low-Income Financial Integration Support Center in Gyeonggi Province. He discussed the direction of inclusive finance that the government and the private sector should jointly pursue in the future with representatives from the government and related organizations, leaders of the five major financial holding companies, and private experts in inclusive finance. Financial Services Commission

On the morning of the 8th, Eunghwok Lee, Chairman of the Financial Services Commission, held the 1st Inclusive Finance Grand Transition Meeting at the Suwon Low-Income Financial Integration Support Center in Gyeonggi Province. He discussed the direction of inclusive finance that the government and the private sector should jointly pursue in the future with representatives from the government and related organizations, leaders of the five major financial holding companies, and private experts in inclusive finance. Financial Services Commission

Expansion of Saehope Hallssi Loan Supply in the Banking Sector

The banking sector will gradually expand the supply of Saehope Hallssi Loans, a representative customized loan product for low-income earners, and will review changes to eligibility requirements and loan limits. Saehope Hallssi Loans are available to people with an annual income of 40 million won or less, or those in the bottom 20% of personal credit scores with an annual income of 50 million won or less, allowing them to borrow up to 35 million won per year at an interest rate of 10.5% or less. The banking sector plans to increase the size of Saehope Hallssi Loans from 4 trillion won as of last year to 6 trillion won by 2028.

To reduce the debt burden on vulnerable groups, the eligibility for liquidation-type debt restructuring support will also be expanded. Previously, only those with principal debt of 15 million won or less were eligible, but the standard will be raised to 50 million won, significantly easing the debt burden for vulnerable groups with insufficient repayment capacity.

To reduce the burden of debt collection on low-income earners, the system for purchased debt collection businesses will also be improved. Previously, financial companies or lending businesses meeting certain requirements could engage in debt collection simply by registering with the authorities, but going forward, a licensing system will be introduced. Licensing requirements will be strengthened to prevent the proliferation of small-scale lending businesses engaging in excessive debt collection. In addition, purchased debt collection businesses will be required to register all acquired claims with the Korea Credit Information Services within six months, and penalties will be imposed for non-compliance.

In line with government policy, the five major financial holding companies have decided to invest a total of 70 trillion won in inclusive finance over the next five years. KB Financial Group will support a total of 17 trillion won in inclusive finance over five years. KB Kookmin Bank will support refinancing of loans from secondary financial institutions and lending businesses, and will ease the financial burden on individuals using high-interest loans due to low credit by lowering interest rates.

Shinhan Financial Group, which will support 15 trillion won, will implement inclusive finance through three major "Value-Up" programs: "Bring-Up," which supports the conversion of savings bank customers to low-interest bank loans; "Help-Up," which significantly lowers interest rates for low-credit individuals using high-interest loans; and "Virtuous Cycle," which supports principal repayment by refunding part of the interest to small business owners.

Hana Financial Group also plans to invest a total of 16 trillion won. At the end of last year, it launched the Youth Saehope Hallssi Loan, which offers a preferential interest rate 1.9 percentage points lower than the standard rate, and it will continue to promote new inclusive finance businesses such as Seoul-type refinancing loans for sole proprietors and cashback on interest for Sunshine Loans.

Woori Financial Group announced a plan to promote inclusive finance totaling 7 trillion won over five years. Additional measures to strengthen inclusive finance include introducing a 7% cap on interest rates for unsecured loans, launching an emergency living expense loan for the financially marginalized (100 billion won), introducing refinancing loans from secondary financial institutions to banks (200 billion won), and suspending collection on overdue loans of more than six years and less than 10 million won.

NongHyup Financial Group will also supply inclusive finance totaling 15 trillion won. Key initiatives include expanding loans for small business owners and self-employed individuals, strengthening financial support for low-income and vulnerable groups, and preferential interest rates for farmers.

The Financial Services Commission plans to continue holding meetings on the grand transition to inclusive finance and actively implement the tasks discussed. Chairman Lee stated, "We will form task force meetings with various experts and stakeholders to develop detailed measures for inclusive finance. The improvement measures developed will be announced at the monthly meetings on the grand transition to inclusive finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)