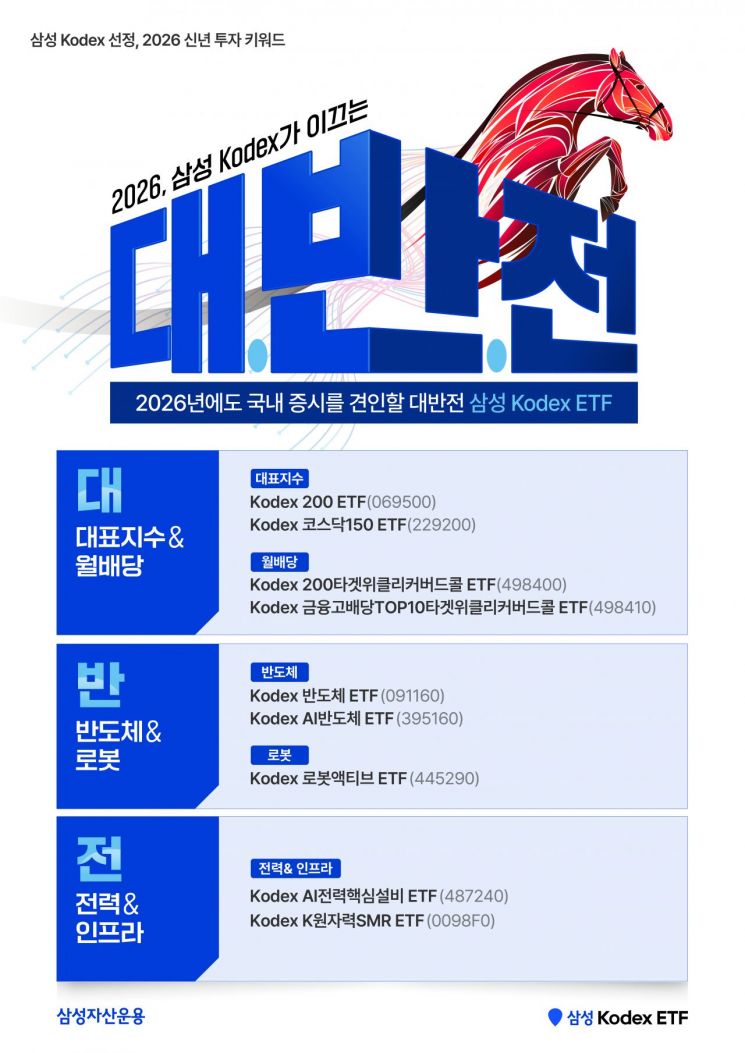

Samsung Asset Management, which opened the market by listing Korea’s first ETF in 2002, has unveiled its 2026 investment keywords “Dae·Ban·Jeon” (meaning “Great·Reversal·Turnaround”) as the era of 300 trillion won in total ETF net assets begins, aiming to drive the next leap in the domestic stock market.

On January 7, Samsung Asset Management identified the following ETFs as promising for this year: representative index & monthly dividend, semiconductors & robots, and power & infrastructure.

Last year, the KOSPI surged by 75.6%, achieving its best performance since 1999. Samsung Asset Management explained that it has carefully selected investment keywords that can once again deliver a dramatic portfolio turnaround, as seen last year.

With the KOSPI surpassing 4,500, the domestic stock market is gaining momentum and moving toward the 5,000 mark, supported by the government’s value-up policy and improved semiconductor performance. Accordingly, KODEX 200, the representative index that forms the backbone of the Korean economy, and KODEX KOSDAQ150, which is expected to be re-evaluated thanks to the government’s revitalization measures, were highlighted as top recommended products.

Additionally, “monthly dividends” can be a useful tool for managing volatility by generating stable cash flow and providing breathing room after sharp rallies. KODEX 200 Target Weekly Covered Call, which invests in the main domestic index and pays monthly distributions, and KODEX Financial High Dividend TOP10 Target Weekly Covered Call, which captures the high dividend appeal of financial stocks, were cited as stable options even in a rising market.

“Semiconductors” are the sector investors should pay the most attention to this year. The sharp rise in memory chip prices, driven by soaring AI demand, is spreading across the foundry and equipment industries, fueling continued momentum for semiconductor stocks. In this context, KODEX Semiconductor, which captures the essence of Korea’s semiconductor industry, and KODEX AI Semiconductor, which focuses on semiconductors while also benefiting from the global AI industry’s growth, were recommended.

This year also marks the beginning of “humanoid robots” being actively deployed in industrial sites. With interest in domestic small and medium-sized companies possessing core component technologies and completed robot solutions at its peak, Samsung Asset Management advised investors to pay attention to KODEX Robot Active.

Investment in “power & infrastructure” is also expected to strengthen. The construction of data centers and the replacement cycle for aging power equipment are coinciding, ensuring continued benefits for domestic power facility companies. In particular, Korean companies with unrivaled competitiveness in the power transmission and distribution sector, such as transformers, have emerged as key partners for global power infrastructure investments, especially in the United States. As a result, KODEX AI Power Core Equipment and KODEX K-Nuclear SMR, reflecting Korea’s status as a nuclear powerhouse, were identified as core weapons to drive a dramatic turnaround in portfolio returns.

For investors looking to actively invest in the domestic stock market, Samsung Asset Management recommended three leveraged KODEX ETFs. These include KODEX Leverage, which tracks twice the daily return of the KOSPI 200, KODEX KOSDAQ150 Leverage, which tracks twice the daily return of the KOSDAQ 150, and KODEX Semiconductor Leverage, which tracks twice the daily return of the semiconductor index.

Kim Dohyung, Head of ETF Consulting at Samsung Asset Management, said, “This year, the stock market will see strong differentiation by industry and individual stocks based on technological innovation and performance. I hope individual investors, who may find it difficult to analyze and forecast individual stocks in detail, can enjoy the ‘Dae·Ban·Jeon’ in returns.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)