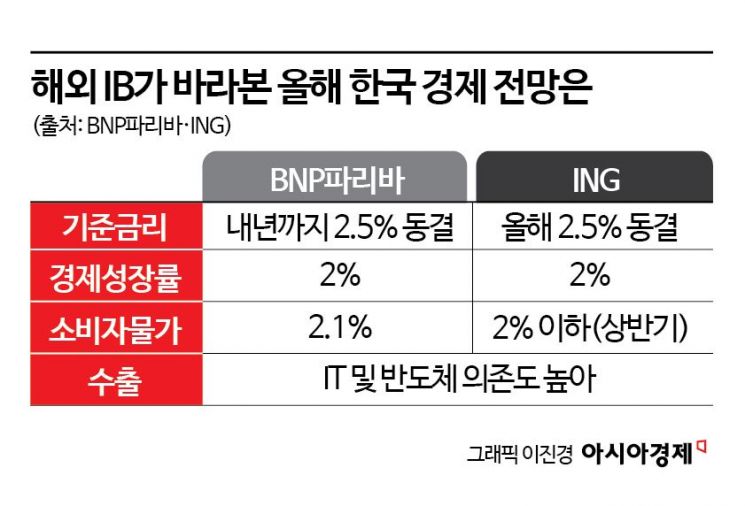

BNP Paribas and ING Macroeconomic Outlook

"Interest Rate Decisions Should Monitor Won Weakness"

2% Economic Growth Forecast... IT and Semiconductors to Drive Expansion

Concerns Over Stagnation in Domestic-Focused Non-Manufacturing Sectors

Major overseas investment banks (IBs) have predicted that the Bank of Korea will keep its benchmark interest rate unchanged at 2.5% this year, citing the weakness of the Korean won. While forecasting an economic growth rate of 2%, they also projected that certain export sectors, such as IT, will drive growth, resulting in a 'K-shaped' economic recovery where the pace and direction of recovery differ by industry.

According to the financial sector on January 8, Yoon Jiho, Senior Economist at BNP Paribas, and Kang Minju, Chief Economist at ING, both released outlook reports on Korea's macroeconomy earlier this month. In his report "2026 Korea and Taiwan Policy Rate Path," Yoon assessed that the Bank of Korea's current policy rate is "in a good place." He stated that there appears to be no need for the Bank of Korea to adjust the policy rate this year.

However, he analyzed that the weakness of the Korean won and the resulting concerns about inflation should be the top factors considered when deciding on any rate adjustments. He forecast the consumer price inflation rate at 2.1%, but noted that if the won's depreciation intensifies, there could be an additional increase of 0.1 to 0.2 percentage points. He explained, "When the won weakens sharply, the exchange rate pass-through effect tends to become stronger." The exchange rate pass-through effect refers to the phenomenon where rising exchange rates lead to higher import prices, and these costs are passed on to companies and consumers. In other words, if the won-dollar exchange rate rises, inflationary pressure increases, and this could prompt discussions about the need for a rate hike to curb inflation.

Yoon forecast Korea's economic growth rate at 2% for this year. He noted, "This is above the average growth rate of 1.8% since 2020 and the recent three-year average of 1.5%," adding, "The IT sector will primarily drive this growth." However, he diagnosed that uneven, K-shaped recovery is inevitable, and projected that the Bank of Korea will use supplementary monetary policy tools, such as the Bank Intermediated Lending Support Facility, to mitigate this. He also predicted that the government's role in fiscal policy would expand, particularly in industries where recovery is sluggish.

Kang also predicted in his recent report, "Why Is Korea Experiencing a K-Shaped Economic Recovery?" that the Bank of Korea will keep the policy rate at 2.5% this year, considering the weakness of the won and concerns over rising housing prices in Seoul. While he agreed with Yoon that the weak won has contributed to inflationary pressure, he differed in projecting that the consumer price inflation rate will fall below 2% in the first half of this year due to the base effect of last year's high inflation.

He also forecast Korea's growth rate at 2% for this year, emphasizing that IT, food, bio-health, cosmetics, and other K-culture-related products will be key drivers of export growth. However, he pointed out that while demand for semiconductors remains strong, recovery in other sectors is minimal. Citing corporate surveys, he explained, "A K-shaped recovery is emerging, with manufacturing improving and non-manufacturing deteriorating."

Since most Korean manufacturers are export-oriented, easing trade tensions and a weaker won could have a positive impact on business sentiment. In fact, the Manufacturing Purchasing Managers' Index (PMI) surveyed by S&P Global rose to 50.1 last month, while the Business Survey Index for manufacturing announced by the Bank of Korea is projected at 93.6 for January this year, up from 91.7 last month. In contrast, the non-manufacturing business sentiment index, which is focused on domestic demand, is expected to fall to 86.6, down from 90.7 last month. Kang analyzed, "This shows that as the effects of fiscal stimulus weaken, domestic demand is slowing."

Kim Jinwook, Citi Economist, also stated in the "January Monetary Policy Committee Preview" released the previous day, "The likelihood of the Bank of Korea raising its policy rate this year is low." He predicted that inflation would stabilize at around 2%, and that the imbalance of 'K-shaped' growth-strong performance in the IT sector alongside sluggishness in non-technology sectors-would persist. However, he added that if both the economic growth rate and consumer price inflation rate exceed 2.5%, a rate hike could be considered between the second half of this year and the first half of next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)