Results of February Regular Index Review

"Even if Virtual Assets Exceed 50% of Total Assets,

No Exclusion from the Index"

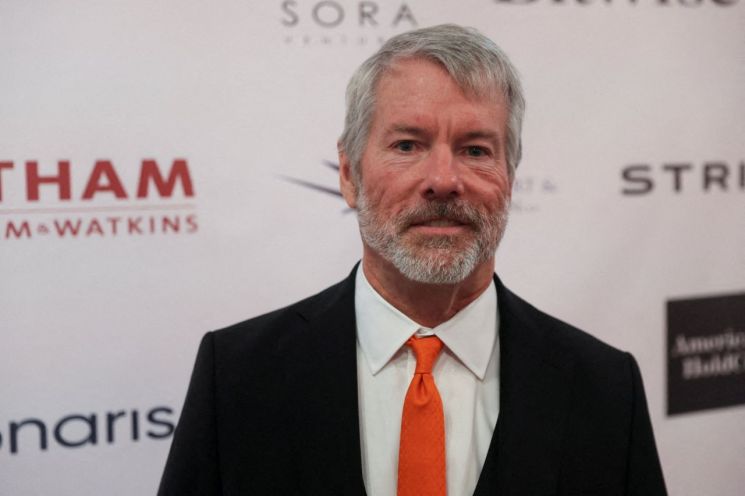

Michael Saylor, Chairman and Founder of Strategy, attending a virtual asset event held in New York, USA, last September. Photo by Reuters Yonhap News

Michael Saylor, Chairman and Founder of Strategy, attending a virtual asset event held in New York, USA, last September. Photo by Reuters Yonhap News

Global index provider Morgan Stanley Capital International (MSCI) announced that it will not exclude companies with virtual asset holdings exceeding 50% of total assets from its indices, leading to a sharp rise in related stocks.

On January 6 (local time), MSCI stated in an official announcement that it would maintain its current index inclusion criteria as part of its regular index review in February. MSCI had previously proposed and reviewed the idea of excluding so-called "Digital Asset Treasury Companies (DATCO)"-those with virtual asset holdings exceeding 50% of total assets-from its indices. However, the company appears to have stepped back from this plan in consideration of opposition from companies.

However, MSCI added a caveat that, going forward, there could be broad regulatory tightening following further research and market consultations targeting all non-operating companies. The company also noted that it may require additional financial statement-based indicators from companies when determining future index inclusion requirements.

Previously, institutional investors had expressed concerns that companies with high proportions of virtual asset investments were sustaining themselves through Bitcoin investments rather than normal business activities. For example, Strategy, led by Michael Saylor, who is widely known as a "Bitcoin evangelist," reportedly holds about $60 billion in Bitcoin, which accounts for more than 99% of the company’s enterprise value. While its main business is developing enterprise data analytics and information management software, its actual profits depend on the performance of virtual asset investments.

Companies that had been concerned about a massive passive fund exodus have also gained some relief. Global investment bank JP Morgan previously estimated that if Strategy were excluded from the index, approximately $2.8 billion in passive funds could flow out. In response, Chairman Saylor has ramped up pressure on MSCI, sending a 12-page protest letter denouncing the move as an arbitrary regulation unfairly targeting digital asset companies.

The market also welcomed the decision. Strategy’s stock price surged more than 6% in after-hours trading. Matt Col, Chairman and CEO of Strive, also praised the decision on the social networking service X (formerly Twitter), calling it "a major victory achieved under adverse conditions."

Nevertheless, the market continues to urge a cautious approach. Christopher Harvey, Head of Equity and Portfolio Strategy at CIBC Capital Markets, told Bloomberg, "For now, they remain, but MSCI has not closed the door completely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.