FSS Announces March Implementation of "8-Week Rule," Korean Medicine Sector Protests

Korean Medicine Sector: "Violation of Patients' Right to Treatment"

Insurance Industry: "Overtreatment Has Led to Severe Loss Ratios... Reforms Needed"

The amendment to the Enforcement Decree of the Automobile Damage Compensation Guarantee Act, which the Ministry of Land, Infrastructure and Transport and financial authorities announced last year to prevent the abuse of auto insurance, is facing difficulties. This is because the Korean Medicine sector has strongly opposed the introduction of the so-called "8-week rule," which aims to curb indiscriminate long-term treatment for patients with minor injuries. There also appears to be a subtle difference in stance between the Ministry of Land, Infrastructure and Transport and the financial authorities.

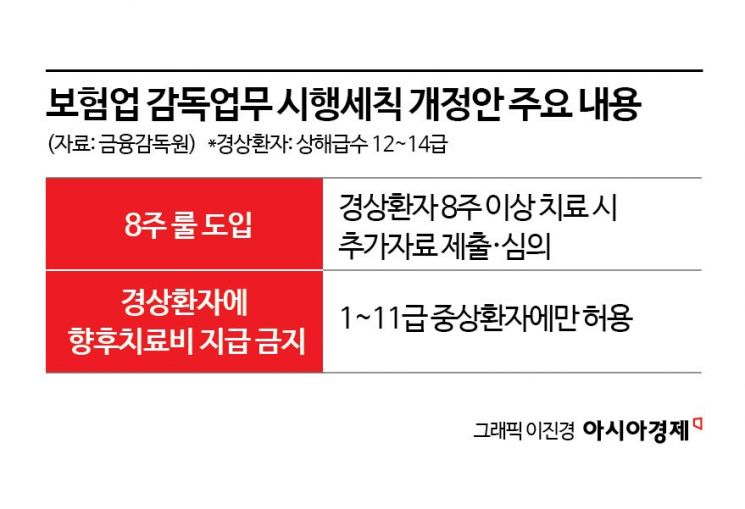

According to the financial sector on January 7, the Financial Supervisory Service issued a prior notice on December 30 regarding the revision of the Detailed Regulations for the Supervision of Insurance Business. The revised regulations prohibit insurance companies from paying future treatment expenses (settlement payments), which have been customarily provided for early settlements, to patients with minor injuries (injury grades 12 to 14). The revision also requires that if a patient with a minor injury wishes to receive treatment for more than 8 weeks, they must submit additional documentation and undergo review. This regulatory change is a follow-up measure after the Ministry of Land, Infrastructure and Transport announced the legislative notice of the amendment to the Enforcement Decree of the Automobile Damage Compensation Guarantee Act in June last year. The Financial Supervisory Service plans to implement the revised regulations starting March 1.

The Korean Medicine sector immediately expressed strong opposition. The Association of Korean Medicine issued a statement the previous day, saying, "The Financial Supervisory Service's revision of the regulations effectively establishes an 8-week treatment limit for traffic accident patients as a fait accompli," and criticized the move as "an act of trading the legitimate right of traffic accident victims to receive treatment for the interests of insurance companies and an act that goes beyond the law."

The main reason for the strong opposition from the Korean Medicine sector is the growing possibility that the number of traffic accident patients, a major source of revenue, will decrease in the future. If the amendment to the Enforcement Decree of the Automobile Damage Compensation Guarantee Act is implemented, the Automobile Damage Compensation Promotion Agency’s Medical Review Committee will determine the appropriateness of treatment exceeding 8 weeks. If the review does not recognize the necessity of long-term treatment, insurance companies may refuse to pay insurance benefits. This would remove the incentive for patients to remain in the hospital longer. According to 2024 statistics from the four major non-life insurance companies (Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, and KB Insurance), 87.2% of minor injury patients who received treatment for more than 8 weeks after a car accident were Korean Medicine patients.

The Korean Medicine sector also claims that the financial authorities are infringing on the authority of the Ministry of Land, Infrastructure and Transport. During a parliamentary audit in October last year, the Ministry stated that it would reconsider the 8-week standard from scratch and that the inclusion of insurance companies in the Medical Review Committee was problematic, promising to come up with alternatives. The Korean Medicine sector argues that while the Ministry is still discussing these issues and has not finalized any plans, the Financial Supervisory Service has already set the implementation for March, moving ahead unilaterally.

The insurance industry believes that the Korean Medicine sector's strong opposition has gone too far. They argue that the Korean Medicine sector, which is most responsible for issues such as medical shopping and overtreatment related to traffic accidents, is only trying to protect its own interests. An industry official said, "The inclusion of insurance companies in the review committee is intended to add objectivity to decisions on long-term treatment by utilizing various data accumulated by insurance companies regarding minor injury cases. The committee also includes the Medical Association and the Association of Korean Medicine, so it is misleading to portray insurance companies as the sole decision-makers on whether treatment exceeding 8 weeks is approved."

Due to overtreatment of minor injury patients, the loss ratio for auto insurance has surged recently. As of November last year, the loss ratio for the four major non-life insurance companies stood at 92.1%. Generally, a loss ratio of 82% is considered the break-even point for large insurers. Non-life insurance companies recorded a loss of 9.7 billion won in the auto insurance sector in 2024, and it is estimated that they recorded a loss of 600 billion won last year. Due to the rising loss ratio, it is highly likely that auto insurance premiums will increase by around 1% this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)