Record High for Five Consecutive Years

Greenfield Investment Reaches All-Time Peak

Capital Inflows Driven by the United States and EU

In 2025, annual foreign direct investment (FDI) surpassed USD 36 billion, setting a new all-time high. Despite a contraction in investment during the first half of the year, investment sentiment rebounded in the second half, resulting in year-on-year growth. Notably, greenfield investments-such as the establishment of new factories, which have a substantial impact on the real economy-also reached a record high, marking significant achievements both quantitatively and qualitatively.

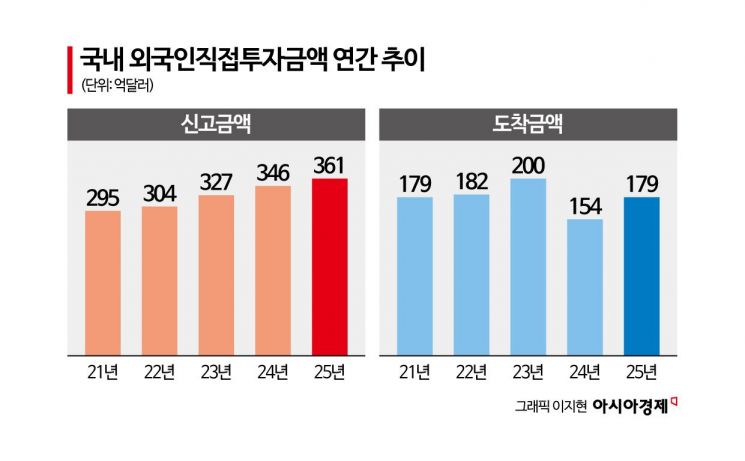

According to the Ministry of Trade, Industry and Energy, the total reported FDI for 2025 amounted to USD 36.05 billion, a 4.3% increase from the previous year. This marks the fourth consecutive year of growth, following USD 30.44 billion in 2022, USD 32.71 billion in 2023, and USD 34.57 billion in 2024. The actual amount of capital inflow, or arrivals, also rose by 16.3% year-on-year to USD 17.95 billion, the third highest level on record.

At the beginning of the year, global monetary tightening and geopolitical uncertainties led to a 14.6% decrease in FDI in the first half compared to the previous year. However, after the inauguration of the new administration in the second half, policy uncertainties eased and external confidence was restored, resulting in a rapid rebound in investment flows. In particular, the government’s industry strategy centered on AI policies and investment promotion activities around the Gyeongju APEC Summit were assessed as positive factors.

By investment type, greenfield investment stood out. Reported greenfield investment in 2025 reached USD 28.59 billion, up 7.1% year-on-year and the highest ever. Greenfield investment accounted for 79.3% of total FDI. In contrast, investment via mergers and acquisitions (M&A) declined by 5.1% to USD 7.46 billion; however, the rate of decline, which had exceeded 50% through the third quarter, narrowed significantly toward the end of the year, indicating a stabilization of the downward trend.

By industry, both manufacturing and services saw increases. Reported investment in manufacturing reached USD 15.77 billion, up 8.8% from the previous year. Investment in high-tech industries and key materials expanded significantly, with chemicals at USD 5.81 billion (up 99.5%) and metals and metal processing at USD 2.74 billion (up 272.2%). However, some sectors saw declines, such as electrical and electronics at USD 3.59 billion (down 31.6%) and machinery, equipment, and precision medical devices at USD 850 million (down 63.7%).

Investment in the service sector also increased by 6.8% to USD 19.05 billion. Investments linked to AI data centers and online platforms grew, driving increases in distribution at USD 2.93 billion (up 71.0%), information and communication at USD 2.34 billion (up 9.2%), and research and development, professional, and scientific technology at USD 1.97 billion (up 43.6%). The finance and insurance sector, however, fell by 10.6% to USD 7.45 billion.

By country, expanded investment from the United States and the European Union (EU) drove overall performance. The United States reported USD 9.77 billion in investment, an 86.6% surge from the previous year, with significant increases in greenfield investment in metals, distribution, and information and communication. The EU also saw a 35.7% increase to USD 6.92 billion, mainly in chemicals and distribution. In contrast, investment from Japan fell by 28.1% to USD 4.4 billion, and investment from China dropped by 38.0% to USD 3.59 billion.

Similar trends were observed in actual capital inflows. In 2025, FDI arrivals totaled USD 17.95 billion, with greenfield investment arrivals reaching USD 13.12 billion-an increase of 41.4% from the previous year. Both manufacturing and services saw increased inflows, and by country, arrivals from the United States surged by 199.1% to USD 5.37 billion.

Regionally, investment amounts increased in both the Seoul metropolitan area and non-metropolitan regions. Reported investment in the metropolitan area rose 9.0% to USD 19.15 billion, while non-metropolitan regions saw a 10.8% increase to USD 6.06 billion. In particular, regions such as Jeonnam, Chungbuk, Gangwon, and Busan saw significant expansion of investments linked to the service sector, raising expectations for revitalization of local economies.

The Ministry of Trade, Industry and Energy plans to continue these achievements in attracting foreign investment by expanding incentives linked to regional development in 2026 and by continuously improving the regulatory environment as experienced by foreign-invested companies. Additionally, the ministry aims to enhance the predictability and stability of the investment environment to strengthen the foundation for sustained medium- to long-term investment inflows.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.