Earnings Season Kicks Off with Samsung Electronics' Preliminary Results on January 8

KOSPI Q4 Operating Profit Estimated at 78 Trillion Won, Up 5.3% from a Month Ago

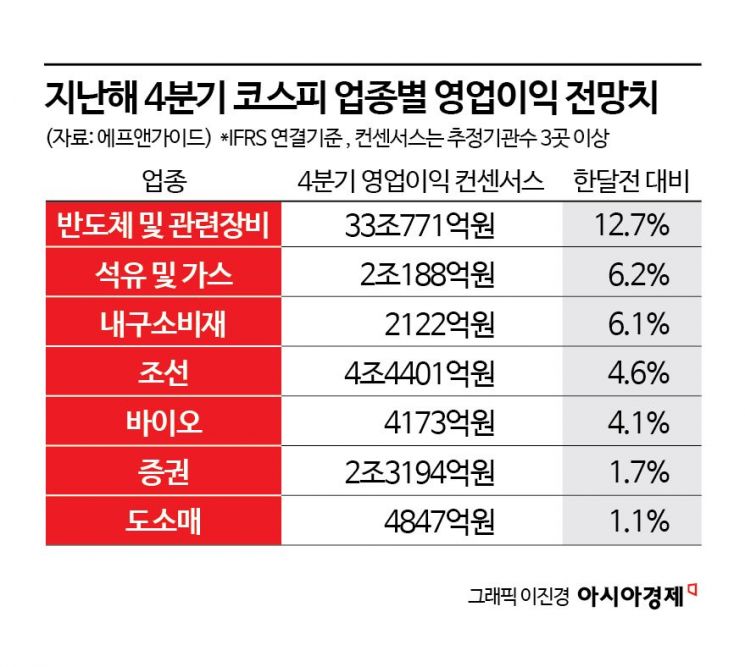

Upward Earnings Revisions Continue, Led by Semiconductors

As the KOSPI continues its record-breaking rally from the start of the year, expectations are rising for the upcoming earnings season. This is because earnings forecasts, especially for semiconductors, have been consistently revised upward, leading to predictions that fourth-quarter results for last year will differ from previous quarters. If fourth-quarter earnings are strong, it is expected to further fuel the KOSPI’s record run.

According to financial information provider FnGuide on January 7, the estimated operating profit for KOSPI-listed companies in the fourth quarter of last year is 78.3892 trillion won, up 76.9% from the same period a year earlier. This figure has been revised upward by 5.3% compared to one month ago.

By sector, semiconductors and related equipment saw the largest increase, with forecasts raised by 12.7%. Other sectors with heightened expectations compared to a month ago include oil and gas (6.2%), consumer durables (6.1%), shipbuilding (4.6%), bio (4.1%), securities (1.7%), and retail (1.1%).

Typically, fourth-quarter earnings tend to fall short of expectations due to large-scale loss recognition, such as big-bath accounting. However, this earnings season is different, as upward revisions are continuing, led by semiconductors. Han Ji-young, a researcher at Kiwoom Securities, said, "Ordinarily, the fourth-quarter earnings season is weaker than the first to third quarters due to one-off issues such as year-end bonus payments, and the market does not attach much importance to it. However, this time, expectations are high for the fourth quarter, especially centered on semiconductors, which is noteworthy."

Seo Taehyun, a researcher at DB Financial Investment, also commented, "Operating profit forecasts for the semiconductor sector have been revised upward by more than 10 trillion won, enhancing overall market confidence in earnings. Typically, there is little interest in fourth-quarter results, and higher annual forecasts tend to weigh on the market at the start of the year. However, this year, robust earnings expectations are continuing."

The fourth-quarter operating profit consensus (average of securities firms’ forecasts) for Samsung Electronics has risen 17.3% to 17.498 trillion won from 14.9229 trillion won a month ago. For SK Hynix, the fourth-quarter operating profit consensus has been revised upward by 7.9% to 15.5599 trillion won over the same period.

In addition, strong exports and favorable exchange rate effects are reinforcing projections that fourth-quarter results will exceed expectations. Lee Kyungmin, a researcher at Daishin Securities, analyzed, "Fourth-quarter export growth last year was 7.71% year-on-year, up from 6.62% in the third quarter, and the export value also improved to 188.7 billion dollars compared to the third quarter. In particular, the exchange rate effect was stronger than in the second and third quarters, which is likely to boost earnings for export-oriented companies." He added, "While the usual cost recognition and big-bath-related fourth-quarter earnings shocks may be inevitable, actual results are expected to be better than investors fear."

While strong fourth-quarter results are expected to create a favorable environment for the KOSPI, some analysts predict that the differentiated rally led by semiconductors will continue. Yeom Dongchan, a researcher at Korea Investment & Securities, noted, "Unlike in the past, the overall fourth-quarter earnings outlook for listed companies is at a favorable level, but this is due to the significant contribution of Samsung Electronics and SK Hynix, which account for a large share of profits. Other companies may still experience the usual seasonal downturn. As strong results are concentrated in major semiconductor firms, the differentiated trend between semiconductor and non-semiconductor companies is expected to persist throughout the earnings season."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.