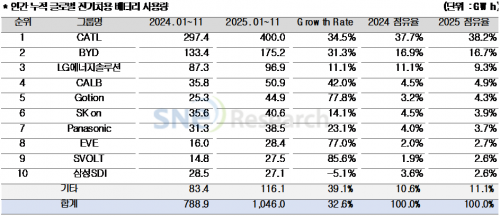

32.6% Growth from January to November 2025

From January to November of last year, the combined market share of the three major Korean battery manufacturers in the electric vehicle battery market decreased by 3.5 percentage points. Samsung SDI's market share dropped to 10th place.

On January 6, battery market research firm SNE Research announced that the total battery usage installed in electric vehicles (including battery electric vehicles, plug-in hybrids, and hybrids) registered worldwide from January to November 2025 reached 1,046 gigawatt-hours (GWh), representing a 32.6% increase compared to the same period the previous year.

During the same period, the global electric vehicle battery usage market share of the three major Korean battery manufacturers-LG Energy Solution, SK On, and Samsung SDI-fell by 3.5 percentage points year-on-year to 15.7%.

LG Energy Solution maintained its third-place market share at 9.3%, growing 11.1% (96.9GWh) year-on-year. SK On recorded a growth rate of 14.1% (40.6GWh), ranking sixth with a 3.9% market share. In contrast, Samsung SDI's supply volume decreased by 5.1% (27.1GWh), causing its market share to drop from eighth to tenth place at 2.6%.

Samsung SDI supplies electric vehicle batteries to BMW, Audi, and Rivian. According to SNE Research, sales of BMW's major electrified models such as the i4, i5, i7, and iX have generally increased. However, sluggish sales of Rivian electric vehicle models equipped with Samsung SDI batteries led to an overall decline in Samsung SDI's supply share. Audi sources batteries not only from Samsung SDI but also from CATL.

SK On supplies batteries to Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. Sales of Hyundai Motor Group's Ioniq 5, EV6, and Volkswagen's ID.4 and ID.7 have remained steady, but sales of the Ford F-150 have slowed.

LG Energy Solution batteries are primarily installed in electric vehicles from Tesla, Chevrolet, Kia, and Volkswagen. Due to sluggish sales of Tesla models equipped with LG Energy Solution batteries, battery usage for Tesla declined by 8.2% year-on-year.

China's CATL grew by 34.5% (400.0GWh) year-on-year, firmly maintaining its position as the global leader with a 38.2% market share. Major Chinese automakers are adopting CATL batteries, and global manufacturers such as Tesla, BMW, Mercedes-Benz, and Volkswagen are also using CATL batteries.

BYD grew by 31.3% (175.2GWh), ranking second globally in electric vehicle battery usage with an 18.7% market share. BYD is expanding its presence not only in the Chinese domestic market but also overseas, with particularly strong growth in the European market. This year, BYD battery usage in Europe reached 12.7GWh, a 206.6% increase compared to the same period last year.

SNE Research stated, "With the increase in power load from AI data centers, demand for energy storage systems (ESS) is surging, accelerating the shift from electric vehicles to ESS applications. However, the cost and time required to convert US-based ternary-focused facilities to prismatic LFP remain variables."

The report added, "After 2026, the competitiveness of battery companies will depend less on global expansion itself and more on redesigning portfolios of products, customers, and production bases to cover both electric vehicles and ESS in line with regulatory changes in each region."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.