"2026 Marks the Beginning of the Physical AI Era"

Three Core Value Chains Supporting the Humanoid Industry

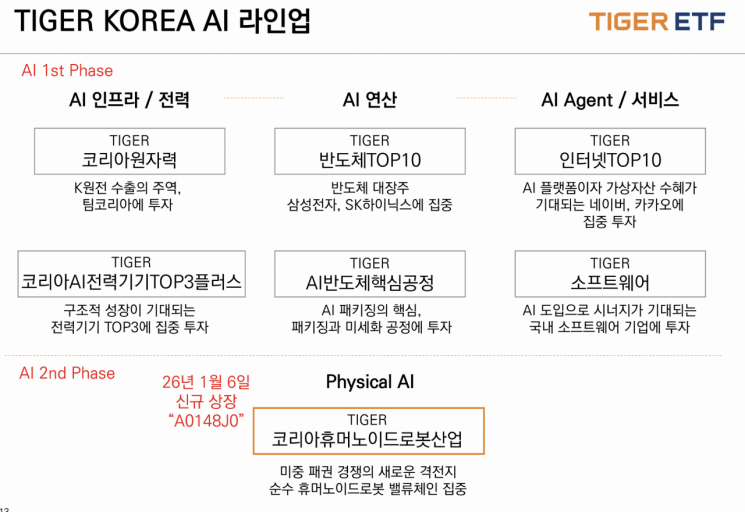

Mirae Asset Global Investments announced on January 5 that it will launch the "TIGER Korea Humanoid Robot Industry ETF."

To commemorate the listing, a webinar was held that morning. Jeong Huihyeon, Head of ETF Management Division, gave a presentation explaining the background and strategy behind the product design, focusing on the advent of the physical AI era and the investment structure of the domestic humanoid robot industry.

Jeong stated, "2025 was the year for AI semiconductors and infrastructure development," and explained, "2026 will be the era of 'physical AI,' when AI directly intervenes in the physical world." He predicted that a global industrial paradigm shift centered on humanoid robots would begin in earnest.

He highlighted the restructuring of the global humanoid supply chain, led by the United States, as a key topic. As the United States seeks to reduce its dependence on China and build an alliance-centric supply chain, he explained that South Korea, which possesses the memory, foundry, battery, robotics, and automotive industries, is emerging as an alternative country.

Jeong added, "Korea is a country with a rare manufacturing infrastructure that covers everything from components to production, software, and smart factories," and said, "Nvidia's AI alliance with Samsung, SK, Hyundai Motor, and Naver, along with its promise of priority GPU supply, is a testament to this 'AI full-stack competitiveness.'"

He also emphasized that government policy support and aggressive investments by major corporations are underpinning the growth of the humanoid industry. The government has made "AI transformation" a core policy to counteract the decline in potential growth rate due to population decrease, and plans to invest more than 32 trillion won in the robotics industry over the next five years.

In line with this, major companies such as Samsung-Rainbow Robotics, Hyundai Motor-Boston Dynamics, and LG-Robotis are expanding investments in humanoids through mergers, acquisitions, and collaborations to reduce labor costs and secure new growth engines.

Three Core Value Chains of the Humanoid Industry

Jeong divided the humanoid industry into three pillars: core components, robot manufacturing, and software & control. He explained that core components such as actuators and reducers, which account for 60-70% of the cost, robot manufacturing that designs and assembles finished products, and software and control systems that create the actual working environment for robots, are key to supporting the industry's growth.

The TIGER Korea Humanoid Robot Industry ETF, scheduled to be listed on January 6, is designed to focus investment on companies representing the three core value chains of humanoid robots, such as Robotis, SPG, Rainbow Robotics, and Hyundai Autoever.

'PURE' Portfolio Directly Linked to Humanoid Revenue

Unlike existing robot ETFs, this ETF minimizes the inclusion of general IT and platform companies with low exposure to the humanoid industry. It focuses on "pure" companies that generate immediate revenue from humanoid robot sales, and applies a maximum weighting of 15% per individual stock and a 6% cap for the software sector to maximize leverage on industry growth.

Jeong introduced, "With the roadmaps for humanoid robot businesses of major domestic companies expected to be released at CES 2026, this ETF will be the most efficient means of investing in the domestic humanoid value chain."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.