Survey of Executives at 30 Major Companies in Distribution, Food, and Other Sectors

Cautious Outlook on Economy and Consumption

Sales and Profitability Seen as "Defensible"

Eight out of ten CEOs of retail and consumer goods companies expect the pace of domestic economic recovery to remain sluggish next year. The strong US dollar, which has weighed on the Korean economy this year, is expected to be reflected in the prices of imported goods and raw materials next year, making household finances tighter and hindering domestic demand. As a result, companies are shifting their management focus from external growth to cost control and profitability protection.

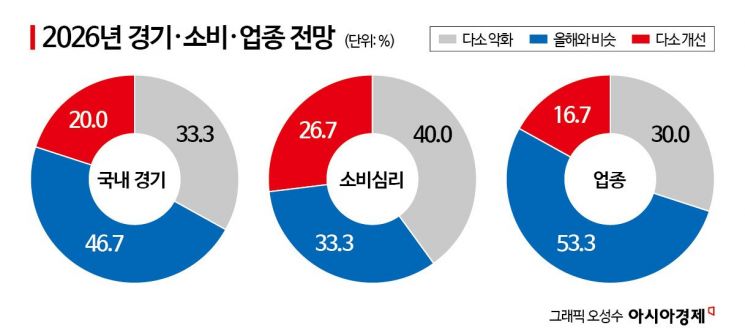

According to a '2026 Economic Outlook Survey' conducted by The Asia Business Daily on December 31 among executives of 30 major companies in the retail, food, cosmetics, and fashion sectors, 80.0% of respondents said that next year's economy would 'deteriorate somewhat or remain similar to this year.' This indicates that the majority of responding companies do not see next year as a period of full-fledged economic rebound. Specifically, 33.3% (10 companies) answered that the economy would 'deteriorate somewhat,' while 46.7% (14 companies) said it would 'remain similar to this year.' In contrast, only 20.0% (6 companies) believed the economy would enter a recovery phase next year.

The outlook for consumer sentiment showed a similar trend. The largest portion, 40.0% (12 companies), responded that it would 'contract somewhat,' while 33.3% (10 companies) said it would 'remain similar to this year.' Only 26.7% (8 companies) expected it to 'recover somewhat.' This reflects the perception that consumer recovery will be gradual rather than rapid.

Industry outlooks were also generally cautious. 53.3% (16 companies) of respondents expected next year's business conditions to remain at a similar level to this year. 30.0% (9 companies) anticipated that conditions would 'deteriorate somewhat,' while 16.7% (5 companies) expected them to 'improve somewhat.' Rather than expecting an overall improvement, most believe that the current trend will likely continue.

These results show an improvement in economic outlook compared to the year-end survey conducted last year. In last year's survey, a total of 20 CEOs expressed a negative outlook, with 14 predicting the economy would 'deteriorate somewhat' and 6 saying it would 'deteriorate significantly.'

This year's domestic market faced headwinds from the outset due to the aftermath of last year's year-end impeachment, but signs of recovery appeared after the presidential election in June, helped by economic stimulus coupons. However, since the second half of this year, the won-dollar exchange rate has soared, driving up the cost of imported raw materials and increasing cost burdens for consumer goods companies such as food, cosmetics, and fashion, leading to a decline in profitability.

The won-dollar exchange rate ended this year at 1,439.0 won, weakening from its peak, but exchange rate volatility remains high. This is why leaders of retail and consumer goods companies have a pessimistic outlook for next year's economy. One department store CEO stated, "There are concerns about weakened consumer sentiment due to high exchange rates, high interest rates, and inflation." A food company CEO also commented, "Exchange rate uncertainty and rising international raw material prices are key management risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)