NHIS: Statutory Copayments Decrease but Offset by Higher Out-of-Pocket Costs for Non-Covered Services

Coverage Rate at Tertiary General Hospitals Rises to 72%

Coverage for Infants and Young Children Up by 3 Percentage Points

Coverage Rates for Four Major Serious Diseases and Long-Term Care Hospitals Decline

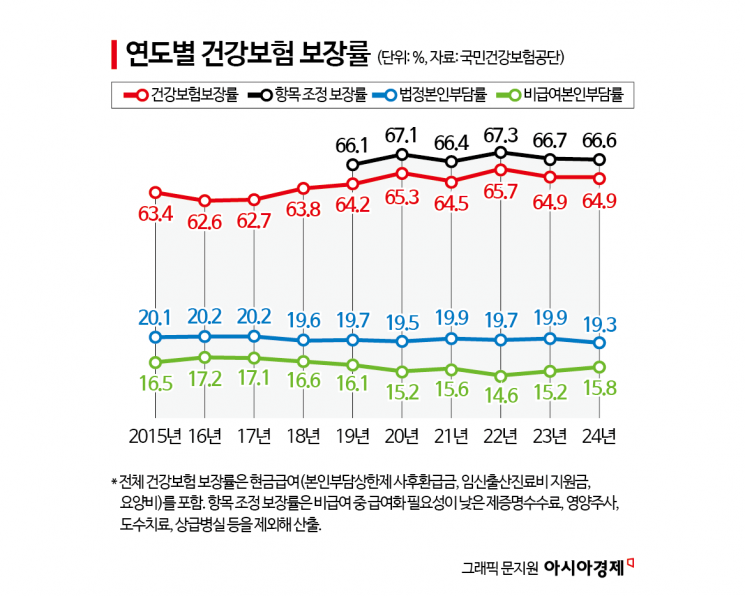

Last year, the health insurance coverage rate stood at 64.9%, maintaining the same level as the previous year. While the statutory copayment rate decreased, the out-of-pocket rate for non-covered services increased.

According to the "Survey on Medical Expenses for Health Insurance Patients" released by the National Health Insurance Service on December 30, 2025, the total medical expenses for health insurance patients in 2024, including non-covered services, amounted to approximately 138.6 trillion won. Of this, the insurer's share was estimated at 90 trillion won, the statutory copayment paid by patients was 26.8 trillion won, and the out-of-pocket expenses for non-covered services directly paid by patients were estimated at 21.8 trillion won.

The health insurance coverage rate was 64.9%, the same as the previous year. Although the statutory copayment rate decreased by 0.6 percentage points year-on-year (to 19.3%), suggesting a reduction in patient burden, the out-of-pocket rate for non-covered services, such as elective treatments and nutritional supplements, increased by 0.6 percentage points (to 15.8%), resulting in the overall coverage rate remaining unchanged from the previous year.

By institution, the coverage rate at tertiary general hospitals rose by 1.4 percentage points to 72.2%, the highest increase, due to factors such as the reduction in statutory copayment rates for consultation fees. General hospitals also saw their coverage rate rise by 0.6 percentage points to 66.7%. For hospitals, the coverage rate increased by 0.9 percentage points to 51.1%, influenced by policy fees in obstetrics and gynecology, while the out-of-pocket rate for non-covered services declined due to a decrease in non-covered test fees. In contrast, coverage rates at long-term care hospitals (67.3%) and pharmacies (69.1%) fell by 1.5 percentage points and 0.3 percentage points, respectively, compared to the previous year, as non-covered medical expenses for cancer-related treatments increased.

By age group, the coverage rate for infants and young children aged 0-5 rose by 3.0 percentage points year-on-year to 70.4%. This is attributed to the government's introduction of new pediatric policy fees, expansion of additional payments for major surgeries, and enhanced support for children's rehabilitation medical institutions. For seniors aged 65 and older, the coverage rate slightly decreased by 0.1 percentage points to 69.8%, as the use of non-covered materials for cataract and musculoskeletal treatments increased.

Meanwhile, the coverage rate for cancer patients and those with serious illnesses declined slightly, and the coverage rate for diseases requiring high-cost or intensive treatment was somewhat lower than the previous year. The coverage rate for the four major serious diseases was 81.0%, down 0.8 percentage points year-on-year, with the cancer coverage rate falling to 75.0% (down 1.3 percentage points), pulling down the overall figure.

In addition, the National Health Insurance Service calculated an adjusted coverage rate that excludes non-essential items with low necessity for insurance coverage, such as cosmetic surgery, physical therapy, and nutritional injections, to better assess the tangible impact of coverage expansion. According to this calculation, the adjusted coverage rate was 66.6%, which is 1.7 percentage points higher than the official indicator.

Looking at the health insurance coverage rate by income group, the coverage rate for lower-income groups remained high due to measures such as the copayment ceiling system for vulnerable populations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.