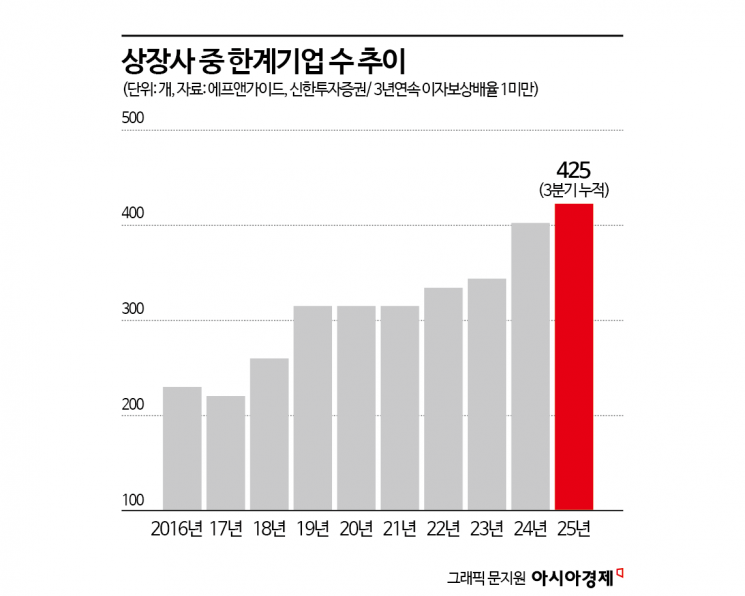

Despite efforts by financial authorities to accelerate the removal of so-called "zombie companies," it has been found that there are still well over 400 listed domestic companies that struggle to pay even their interest expenses with their operating profits.

According to financial information provider FnGuide on January 5, the number of listed non-financial companies with an interest coverage ratio below 1 for three consecutive years totaled 425 as of the third quarter of last year. Among these, 83 companies are listed on the KOSPI, and 342 are listed on the KOSDAQ. The sectors involved are diverse, including bio-pharmaceuticals, components, IT, and chemicals.

The interest coverage ratio is calculated by dividing a company’s annual operating profit by its interest expenses for that year. A ratio below 1 indicates that the company is unable to cover its interest payments with its earnings. In the market, companies that remain in this state for three years or more are typically referred to as zombie companies.

The number and proportion of marginal companies among domestic listed firms continue to rise. After surpassing 300 companies just before the COVID-19 pandemic in 2019, the figure exceeded 400 for the first time in 2024. These marginal companies now account for 21.8% (401 companies) of all listed firms.

The problem with these marginal companies is that their weaknesses can extend beyond their own operations and become a risk to the broader economy. There is a persistent risk of a chain reaction of corporate bankruptcies in the event of external shocks, and the potential for deterioration in the financial sector’s soundness also increases. In addition, as resources within industries are allocated to these marginal firms, the country’s gross domestic product (GDP) and investment figures are being distorted. There are also growing concerns that these companies may engage in accounting fraud, such as inflating sales, to avoid delisting procedures.

Financial authorities also recognize the seriousness of this issue and have been speeding up the timely removal of insolvent companies, for example by announcing the "Improvement Plan for Delisting System" at the start of the year. However, there are still concerns that the zombie company problem remains severe. Kang Jinhyuk, a researcher at Shinhan Investment Corp., pointed out in a report that, "From the perspective of the stock market, the growth rate of new listings over the past five years is about three times higher than that of major countries such as the United States and Japan, but the pace of delisting is much slower in comparison."

However, Kang also noted that most of the institutional reforms for the timely removal of insolvent companies have now been completed, and that, starting early this year, the criteria for market capitalization and sales requirements for delisting will be gradually strengthened. He added that additional institutional measures to improve the efficiency of resource allocation are also expected to be announced.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.