Manufacturing: 82.2, Non-manufacturing: 77.9

Financing, Operating Profit, Exports All Show Increases

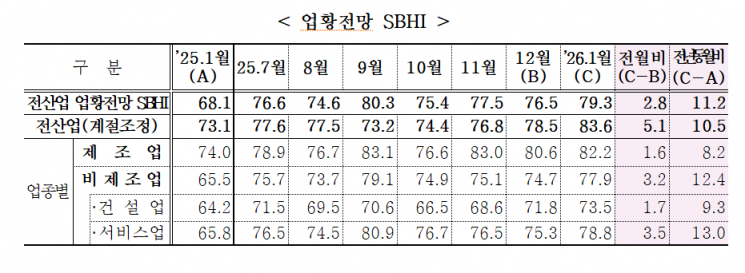

Expectations are high that the business conditions for small and medium-sized enterprises (SMEs) will improve in January next year compared to the previous month. Optimism has risen across manufacturing, non-manufacturing, and service sectors.

On December 30, the Korea Federation of SMEs announced the results of its "Business Outlook Survey for SMEs for January 2026," stating that the Small Business Health Index (SBHI) for January stood at 79.3, up 2.8 points from the previous month. Compared to the same month last year (68.1), it rose by 11.2 points.

The SBHI is an index forecasting SME business conditions. If more companies expect business conditions to improve next month than those who do not, the index exceeds 100. The Federation surveyed 3,136 SMEs from December 11 to 17 regarding their business outlook for January.

The manufacturing and non-manufacturing sectors recorded 82.2 and 77.9, respectively, rising by 1.6 points and 3.2 points from the previous month. During the same period, the construction sector increased by 1.7 points to 73.5, while the service sector rose by 3.5 points to 78.8.

Within manufacturing, 12 industries, led by fabricated metal products and primary metals, saw increases compared to the previous month. Fabricated metal products jumped by 19.6 points to 88.6, and primary metals rose by 11.2 points to 83.3. In contrast, 11 industries declined compared to the previous month, including industrial machinery and equipment repair, which fell by 12.1 points to 68.7, and rubber and plastic products, which dropped by 7.8 points to 73.5.

In the service sector, five industries, including transportation (85.3) and wholesale and retail trade (76.2), rose compared to the previous month. However, five other industries, such as publishing, video, broadcasting, and information services (86.9), as well as accommodation and food services (79.0), declined.

By category, all outlooks improved compared to the previous month: ▲financing conditions (75.8→81.8) ▲operating profit (74.3→77.2) ▲exports (82.2→83.8) ▲domestic sales (76.6→77.6). However, employment, which is a reverse trend indicator (97.4→98.3), is expected to worsen compared to the previous month.

Comparing the SBHI for January next year with the average SBHI for the same month over the past three years by category, all indicators in manufacturing except employment are expected to improve compared to the previous three-year average. In non-manufacturing, all categories except exports and employment are expected to improve compared to the previous three-year average.

The most significant management challenge for SMEs in December this year was "sluggish sales (product sales)" at 52.8%. This was followed by rising labor costs (38.0%), rising raw material prices (31.2%), and intensified competition among companies (25.9%).

The average operating rate of small manufacturers in November this year was 77.9%, up 7.6 percentage points from the previous month and 5.7 percentage points from the same month last year. By company size, small enterprises (74.5%) rose by 7.3 percentage points from the previous month, while medium-sized enterprises (79.9%) increased by 6.1 percentage points from the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)