K-Ice Cream Captures Global Taste Buds

Surpasses $120 Million in Annual Exports for the First Time

Expanding Presence in North America, Southeast Asia, and Europe

Localization Strategies Drive Record-Breaking Export Growth

Riding the wave of the K-food boom, ice cream exports are reaching record highs every year. This year, the annual export value is expected to surpass $120 million for the first time. Analysts attribute this growth to domestic ice cream companies accelerating their export expansion by strengthening products and distribution strategies tailored to local consumer preferences, particularly in North America, Southeast Asia, and Europe.

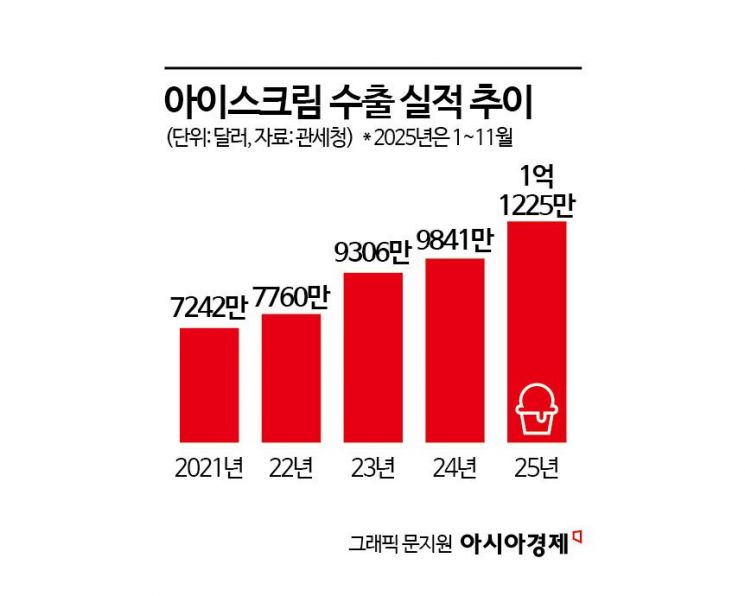

According to the Korea Customs Service as of December 30, Korea’s ice cream export value increased from $72.42 million (103.8 billion won) in 2021 to $77.6 million (111.3 billion won) in 2022, and reached $93.06 million (133.4 billion won) in 2023. Last year, it stood at $98.41 million (141.1 billion won), coming close to the $100 million mark, and this year, the annual total is estimated to have reached $120 million. The cumulative export value from January to November this year was $112.25 million (159.5 billion won). In just four years, the export volume has increased by more than 60%.

By country, North America and Southeast Asia are leading export growth. The United States accounted for the largest share at $34.11 million (4.89 billion won). As distribution channels have expanded beyond Korean supermarkets to major local retailers, K-ice cream is now entering the mainstream dessert market. The next largest markets were the Philippines ($10.09 million, 1.45 billion won), Canada ($8.8 million, 1.26 billion won), Japan ($8.14 million, 1.17 billion won), China ($7.13 million, 1.02 billion won), and Vietnam ($6.05 million, 870 million won).

An industry official stated, "In the past, there was a high dependence on specific countries, but now the export landscape is expanding to North America, Southeast Asia, and Europe. The key factor behind the increase in exports is localization strategies tailored to the consumption tendencies and distribution environments of each country."

At the center of Korea’s ice cream export growth are the two industry giants, Binggrae and Lotte Wellfood. Analysts note that their success is due not only to exporting finished products, but also to meticulously designing flavors, packaging, and distribution strategies that cater to local consumer tastes.

Binggrae exports its flagship brands such as "Melona" and "Bungeoppang Samanco" to more than 30 countries worldwide, including the United States and China. Binggrae’s export value more than doubled from 36.5 billion won in 2020 to 82.9 billion won last year. In just the first three quarters of this year, exports reached 81.7 billion won, and the annual total is expected to approach 100 billion won. The export share rose from 8.5% in 2020 to 13.7% in the first three quarters of this year. Binggrae’s ice cream exports account for over 55% of Korea’s total ice cream exports. In particular, Melona has established itself as an iconic representative of "K-ice cream" in the North American market.

Binggrae is also accelerating its entry into the European market. To lower customs barriers, it launched "Plant-Based Melona," which uses plant-based ingredients instead of dairy, and began exporting to major European countries such as the Netherlands, Germany, the United Kingdom, and France in 2023. As a result, sales in Europe last year increased more than fourfold compared to the previous year. This year, Plant-Based Melona was launched in Carrefour, which operates over 1,300 stores across France.

Expansion is also continuing in the Australian market. Plant-Based Melona is now available at major local retailers such as Woolworths and Coles. In addition, Costco Australia has started selling Melona in packs featuring melon, mango, and coconut flavors. Since 2007, Binggrae has been selling Melona and Bungeoppang Samanco in Thailand, and it plans to accelerate its push into the Southeast Asian market by expanding distribution channels within Thailand.

The other main pillar of Korea’s ice cream export growth is Lotte Wellfood. In addition to exporting domestically produced products, Lotte Wellfood is speeding up its global expansion by developing its overseas ice cream business through its Indian subsidiary, Lotte India.

The main export destinations for Lotte Wellfood’s ice cream are the United States, China, the Philippines, and Taiwan. The company has built its export portfolio around mega brands familiar to Korean consumers, such as Jaws Bar, Screw Bar, Watermelon Bar (locally known as Jokbak), Tico, Seolleim, Bbangppare, and Chalttok Ice. Export value increased from 20.3 billion won in 2022 to 24.8 billion won in 2023, and last year reached 26.4 billion won. In the first half of this year alone, exports amounted to 19.4 billion won, indicating that annual exports are expected to reach an all-time high.

Alongside exports, Lotte Wellfood has achieved particularly notable results in the Indian market. After acquiring the local ice cream company Havmor and restructuring it as Lotte India, the company has been targeting the entire Indian market through local production. Lotte India’s ice cream sales grew from 58.7 billion won in 2020 to 99.4 billion won in 2021, then to 154.4 billion won in 2022, 165.6 billion won in 2023, and 172.9 billion won last year, maintaining steady growth. In the first half of this year alone, sales reached 122.6 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.