Price Gap Narrows Amid HBM Generation Shift

Potential Resumption of Nvidia H200 Exports to China

Google and AWS Drive Demand Growth with HBM3E Adoption

Even during the transitional period ahead of mass production of sixth-generation high-bandwidth memory (HBM4) early next year, demand for fifth-generation HBM3E remains strong, leading to an unusual rise in prices. This trend is attributed to the possibility of Nvidia resuming exports of its H200 to China, coupled with increased orders from global big tech companies such as Google and Amazon Web Services (AWS). Both Samsung Electronics and SK Hynix have raised the unit price of HBM3E.

According to the semiconductor industry on December 29, Samsung Electronics and SK Hynix have increased the contract price of HBM3E for next year by about 20% compared to the previous level. There is also speculation in the market that the price of HBM3E could approach that of next-generation products. Recently, the price of HBM3E 8-layer stacks has risen to around $300, while HBM3E 12-layer stacks are reported to have reached between $300 and $500. HBM4 is expected to be priced in the mid-$500 range. It is unusual for the price gap to narrow ahead of a generational shift.

While demand for HBM3E continues to grow due to the development of graphics processing units (GPUs) and application-specific integrated circuits (ASICs), the major memory companies are focusing on HBM4 and standard DRAM production, further strengthening the supplier-dominated market structure. It is rare for the price of a previous-generation product to rise just before the next-generation product enters mass production.

The industry believes that if Nvidia's exports to China ramp up in earnest, the ripple effect will be significant. Recently, U.S. President Donald Trump allowed exports of the H200 to China on the condition of a 25% tariff. The initial shipment volume is estimated at 40,000 to 80,000 units, and Nvidia reportedly plans to handle the initial supply with existing inventory before significantly increasing production of the H200 for export to China starting in the first half of next year. Although the HBM4 market is expected to open and a generational transition is anticipated from next year, the resumption of Nvidia's exports to China is expected to sustain demand for HBM3E for a considerable period.

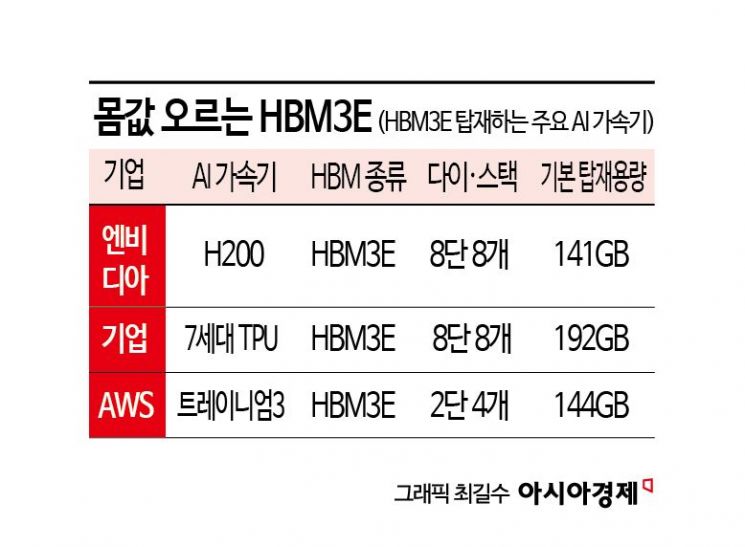

The intensifying AI competition among global big tech companies is also supporting the price increase. Even though Nvidia's share in the AI semiconductor market may decrease slightly compared to previous years, the expanding adoption of HBM by other big tech firms is expected to continue benefiting suppliers. With the exception of Nvidia's "Rubin," which is set to launch next year, most major products have adopted HBM3E. The H200 that Nvidia will export to China is equipped with eight 8-layer HBM3E stacks, and Google's seventh-generation Tensor Processing Unit (TPU) also uses the same configuration. AWS's upcoming Trainium3, expected to go into mass production next year, is projected to feature four 12-layer HBM3E stacks.

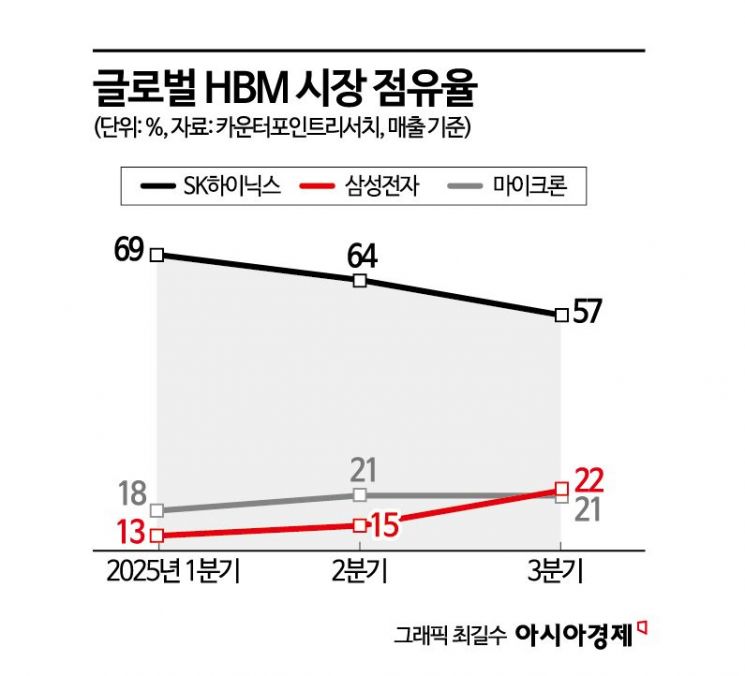

Memory companies are expected to pursue a dual strategy next year: securing initial HBM4 supply centered on Nvidia's Rubin, while boosting profits in the existing HBM3E market through price increases. In the case of Samsung Electronics, delivery was delayed in the early stages of HBM3E mass production due to quality issues, but the company rebounded by securing supply contracts with Nvidia and Broadcom in the third quarter. HBM3E sales volume in the third quarter nearly doubled (1.8 times) compared to the second quarter. According to market research firm Counterpoint Research, Samsung Electronics' global HBM market revenue share in the third quarter was 22%, surpassing Micron to reclaim second place in the industry. SK Hynix has consistently maintained a majority market share.

The HBM market size next year is expected to grow by about 23% compared to this year, reaching 69 trillion won. In terms of revenue, HBM4 is projected to account for 55% and HBM3E for 45%. An industry insider said, "Although China has not yet approved the purchase of the H200, Nvidia's resumption of exports will firmly support HBM3E demand," adding, "If Samsung Electronics and SK Hynix expand their HBM sales base, Samsung-whose supply started later-could see a larger improvement in performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.