CT and Other Imaging Equipment 1.7 Times OECD Average

Large Hospitals Concentrated in Seoul Maximize Efficiency

Poised to Become a 'One-Stop' Hub from Raw Materials to Clinical Trials

As the radiopharmaceutical therapy (RPT) market continues to grow, attention is turning to the possibility of Korea emerging as a key hub for global clinical trials.

Novotech, a global clinical research organization, recently published a white paper titled "Clinical Research Environment and the Role of CROs in 2025," in which it identified Korea as one of the major countries building infrastructure for radiopharmaceutical therapy clinical trials.

Radiopharmaceutical therapies are treatments that combine radioactive isotopes with drugs to precisely target only cancer cells. This field is considered a next-generation anticancer therapy, with major global pharmaceutical companies engaging in multi-trillion-won mergers and acquisitions. According to the white paper, there were only three global clinical trials for radiopharmaceutical therapies in 2018, but this number surged to 80 between January and August of this year alone.

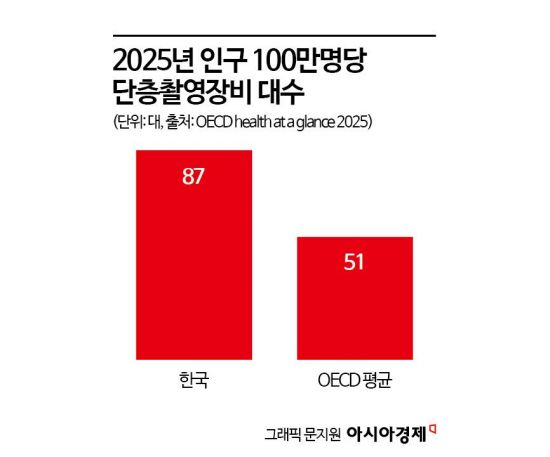

Korea is expected to be well-suited for radiopharmaceutical therapy clinical trials due to its robust infrastructure and rapid trial initiation. As of this year, there are 87 CT (computed tomography), MRI (magnetic resonance imaging), and PET (positron emission tomography) scanners per one million people, exceeding the OECD average of 51.

High population density and a high rate of health insurance coverage also make it easier to recruit patients, which is another positive factor. In particular, the concentration of large hospitals in Seoul maximizes the efficiency of the clinical trial infrastructure. Novotech is currently collaborating with major medical institutions such as Asan Medical Center and Seoul National University Hospital, both of which have the specialized capabilities and infrastructure for conducting clinical trials, to carry out radiopharmaceutical therapy clinical studies.

The short lead time to trial initiation is another advantage. In Korea, clinical trials can generally begin within about five months of submitting a Clinical Trial Application (CTA). In contrast, it can take up to 12 months in countries such as the United States. According to data released by the world’s top 10 pharmaceutical companies, Korea ranked sixth among 16 leading countries, with a period of 112 days from CTA submission to the first clinical trial site visit.

There is also a high possibility that Korea will be able to produce Actinium-225 (Ac-225), which is essential for the development of radiopharmaceutical therapies, domestically. The Korea Institute of Radiological & Medical Sciences has secured Radium-226 (Ra-226), the raw material for producing Actinium-225, since 2021 and obtained domestic production approval this year. Once domestic production capability is established, both raw material supply and clinical trials can be conducted simultaneously.

Jung Yuntaek, head of the Pharmaceutical Industry Strategy Research Institute, stated, "Korea has strong nuclear research capabilities and, centered around the Korea Institute of Radiological & Medical Sciences, possesses competitiveness in radiopharmaceutical therapy clinical trials. High accessibility to pharmaceuticals for patients and the extensive clinical trial experience of medical professionals are also significant advantages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)