Notice of Proposed Amendments to the “Financial Investment Business Regulations” and the “Detailed Enforcement Rules of the Financial Investment Business Regulations”

Financial authorities have initiated regulatory reforms to ease the concentration of real estate investments by securities firms and to strengthen capital soundness. The risk weight for Net Capital Ratio (NCR) applied to real estate investments will be adjusted to reflect the actual risk level. In addition, the method for calculating the venture capital supply obligation for comprehensive financial investment companies will be revised.

On December 23, the Financial Services Commission and the Financial Supervisory Service announced that they would be issuing a notice of proposed amendments to certain provisions of the “Financial Investment Business Regulations” and the “Detailed Enforcement Rules of the Financial Investment Business Regulations.” The amendments include: ▲ aligning the NCR risk weights for securities firms’ real estate investments with actual risk levels; ▲ setting a maximum recognition limit for the performance of venture capital supply obligations by comprehensive financial investment companies; and ▲ standardizing the requirements for major shareholders in the licensing review for financial investment businesses with those of other financial sectors.

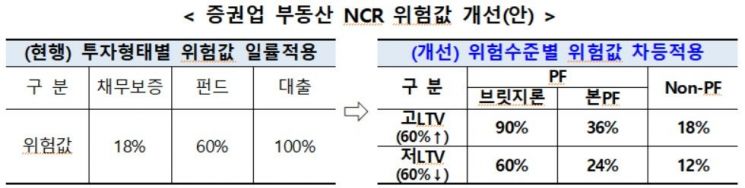

Previously, the securities industry saw a significant expansion of real estate-related exposure, raising concerns that the overall soundness of the sector could be undermined if the real estate market fluctuated. In real estate project financing (PF) investments, the NCR risk weight was uniformly applied regardless of whether the investment took the form of loans, debt guarantees, or other types. As a result, investments tended to concentrate in debt guarantees, which carry relatively lower risk weights.

Accordingly, financial authorities have decided to apply differentiated NCR risk weights to real estate investments based on the project’s stage (bridge loan, main PF, or non-PF) and the loan-to-value (LTV) ratio, rather than by investment type. However, for overseas real estate, where concerns about insolvency persist, a minimum risk weight will be set to ensure it does not fall below the current level of 60%.

Additionally, securities firms will be required to manage their “total real estate investment amount”-including loans, funds, and all forms of real estate investment, not just debt guarantees-within 100% of their equity capital. For firms that exceed this limit at the time of the amendment’s implementation, transitional measures will be applied to gradually reduce the limit from 2026 to 2029. Furthermore, the provisioning rate for normal and precautionary real estate PF exposures in the securities industry will be raised to a level similar to that of other financial sectors.

The method for calculating the venture capital supply obligation for comprehensive financial investment companies will also become more stringent. For investments in A-rated bonds and medium-sized enterprises, which are relatively lower risk, only up to 30% of the obligation can be recognized as fulfilling the venture capital supply requirement, regardless of the investment amount. This standard will be managed through administrative guidance until the regulations are formally implemented.

In addition, to ensure legal consistency and fairness with other financial sectors, the requirements for major shareholders in the licensing review for financial investment businesses will be standardized. Previously, for financial investment business licenses, if the representative of the largest shareholder (a corporate entity) was an individual, authorities reviewed whether the individual met the executive qualification requirements under the “Act on the Corporate Governance of Financial Companies.” However, considering fairness with other sectors, the potential for regulatory arbitrage, and legal consistency, these executive qualification requirements will no longer be applied to representatives of the largest shareholder corporations during future licensing reviews.

These amendments are scheduled to undergo a notice period for regulatory changes from December 24, 2025, to February 2, 2026, after which they will be finalized and implemented following deliberation and resolution by the Securities and Futures Commission and the Financial Services Commission.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.