"Fed Rate Cuts Signal Start of US 'Money Printing'"

Concerns Over Prolonged Inflation... Preference for Real Assets Rising

"Silver Emphasized as the Most Undervalued Hedge Asset"

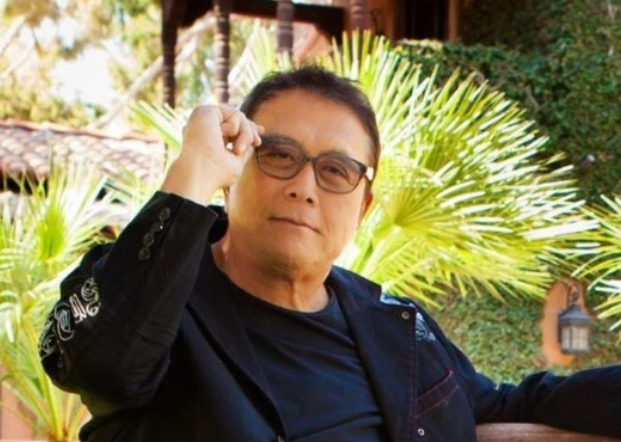

As the US Federal Reserve (Fed) signals a shift toward lowering its benchmark interest rate, attention is increasingly turning to inflation-hedge assets, causing silver prices to soar to unprecedented heights. Against this backdrop, Robert Kiyosaki, author of the global bestseller "Rich Dad Poor Dad," has identified silver as the most promising investment asset, stating that "the price of silver could reach $200 per ounce next year."

"Rate Cuts Could Trigger Severe Inflationary Pressures"

Kiyosaki recently stated on the social media platform X (formerly Twitter) that "the Federal Reserve's interest rate cuts essentially mark the beginning of a new phase of quantitative easing." He argued, "The current global financial system is facing structural limitations," adding that "monetary easing carries a significant risk of fueling long-term inflation in exchange for short-term stability."

Kiyosaki pointed out, "Such policies will continue to increase the cost-of-living burden for those who are unprepared," and stressed, "The market is still underestimating inflation risks." He warned that if currency depreciation becomes prolonged, a shock to overall real purchasing power will be unavoidable.

"Silver Remains Cheap...Could Rise Up to Tenfold Next Year"

Kiyosaki once again emphasized gold, silver, Bitcoin, and Ethereum as core defensive assets. Among these, he singled out silver as the most promising asset for next year, revealing that he recently purchased additional physical silver immediately after the Fed announced further rate cuts.

He stressed, "Despite silver's historical role as a store of value, its current price remains undervalued." He went on to say, "Silver is going to the moon," forecasting that it could climb as high as $200 per ounce by 2026. Given that silver was trading at around $20 per ounce last year, he suggested that, if inflationary pressures intensify, a tenfold increase is possible.

Kiyosaki predicted that silver will be the most promising asset next year. The Asia Business Daily Database

Kiyosaki predicted that silver will be the most promising asset next year. The Asia Business Daily Database

Kiyosaki has consistently argued that precious metals and select cryptocurrencies can serve as a hedge against asset value erosion during periods of monetary expansion and excessive debt growth. With his latest remarks, he once again frames inflation not as a temporary phenomenon but as a structural risk, reiterating his view that central banks' short-term measures are exacerbating long-term instability. However, some in the market believe that Kiyosaki's outlook is excessively optimistic.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.