Bank of Korea's "November 2025 Producer Price Index (Preliminary)"

High Exchange Rate Drives Up Diesel, Gasoline, and Semiconductor Prices

December: Dubai Crude Oil Down 3.1% vs. Exchange Rate and Industrial City Gas Rates Up ? Mixed Factors

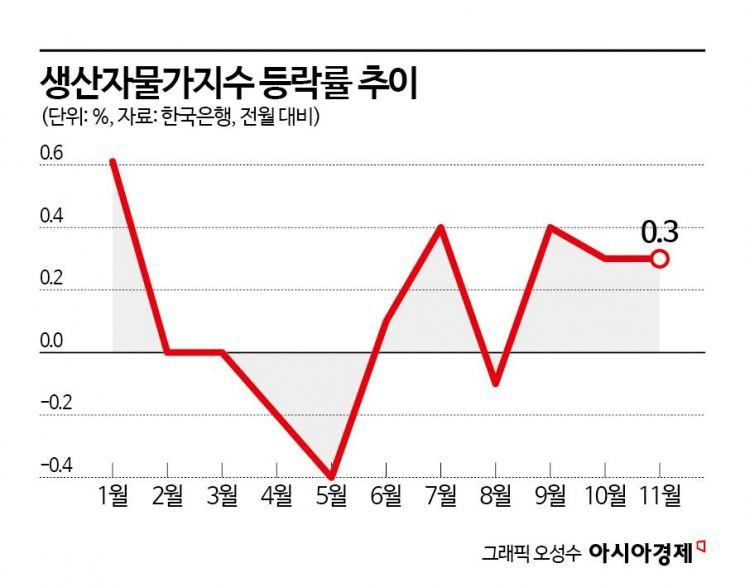

The producer price index has risen for the third consecutive month. Analysts attribute the continued increase in producer prices to higher prices for coal and petroleum products such as diesel and gasoline, as well as for computers, electronic, and optical devices including semiconductors.

According to the "Provisional Producer Price Index for November 2025" released by the Bank of Korea on December 19, last month's producer price index stood at 121.31 (2020=100), up 0.3% from the previous month. Coal and petroleum products, along with computers, electronic, and optical devices, contributed to the third straight month of increases. Compared to the same period last year, the index rose by 1.9%, marking a wider increase.

By item, manufactured goods led the rise in producer prices. Manufactured goods increased by 0.8% from the previous month, driven by coal and petroleum products (5.0%) and computers, electronic, and optical devices (2.3%). Coal and petroleum products recorded their highest growth rate in two years and two months since September 2023 (6.9%). Despite a slight decline in international oil prices in November, the rise in the exchange rate had an impact, and higher refining margins for crude oil due to geopolitical factors such as the Russia-Ukraine war also played a role. As in October, semiconductor prices surged, leading to higher prices for computers, electronic, and optical devices. Services rose by 0.1%. Financial and insurance services jumped by 1.2%, driven by higher brokerage commissions resulting from rising stock prices, and business support services also increased by 0.2%.

In contrast, prices for agricultural, forestry, and fishery products fell by 2.1% from the previous month, as prices for agricultural products (-2.3%) and livestock products (-2.6%) declined. Electricity, gas, water, and waste prices dropped by 0.4% from the previous month due to a 6.4% decrease in industrial city gas rates.

This month, both upward and downward factors are affecting producer prices. Lee Moonhee, Head of the Price Statistics Team at the Economic Statistics Department 1 of the Bank of Korea, stated, "The main factors influencing producer prices include international oil prices, raw material prices, exchange rates, domestic and global economic trends, and adjustments to public utility rates." He added, "Looking at recent conditions, as of December, the price of Dubai crude oil has fallen by 3.1% compared to the previous month's average, while the won-dollar exchange rate has risen by 0.9%, and industrial city gas rates have also been raised this month. Therefore, we need to wait for the December price survey results to see the outcome."

Last month, domestic supply prices rose by 0.7% from the previous month, as both domestic shipments and imports increased. Compared to the same month last year, they rose by 1.6%. The domestic supply price index measures price changes for goods and services supplied domestically (including both domestic shipments and imports) to track the transmission of price fluctuations. By stage of production, raw material prices fell by 0.5%, but intermediate goods rose by 1.1% and final goods by 0.2%.

The total output price index, which measures price changes for goods and services based on total output (including both domestic shipments and exports) to capture overall price changes for domestic products, rose by 1.1% from the previous month as both domestic shipments and exports increased. Both manufactured goods (1.9%) and services (0.1%) rose. Compared to the same month last year, the index jumped by 2.9%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)